The euro today initially fell against the US dollar despite the release of positive eurozone GDP data and other GDP reports from across the euro area. The EUR/USD currency pair later rallied higher moving into positive territory boosted by the investor sentiment and the weaker greenback as the US markets opened. The EUR/USD currency pair … “Euro Trades Sideways Despite Upbeat Euro Area GDP Reports”

Australian Dollar Rises on Decent Domestic Economic Reports

The Australian dollar was trading flat against major currencies today. While domestic macroeconomic data released in Australia on Friday was decent, worries and uncertainty made investors reluctant to buy riskier commodity-linked currencies, like the Aussie. Yet currently, the Australian currency has managed to regain upward momentum and is trading above the opening level versus majors. The Australian Bureau of Statistics reported that the Producer Price Index rose by 0.4% … “Australian Dollar Rises on Decent Domestic Economic Reports”

Japanese Yen Fails to Keep Gains

The Japanese yen rallied during Friday’s trading session. Market analysts explained the rally by risk aversion ahead of the US presidential election as well as by mostly positive macroeconomic reports released in Japan over the trading session. Currently, though, the currency has trimmed its gains, losing them outright against some of its rivals. Japan’s Ministry of Economy, Health, and Industry reported that industrial production climbed by 4.0% in September from a year … “Japanese Yen Fails to Keep Gains”

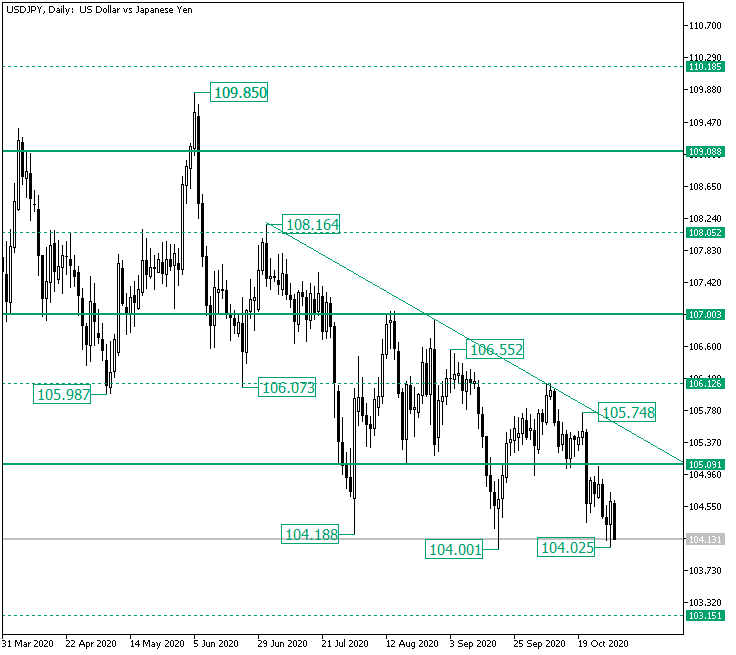

Correction or Change from the 104.02 Low on USD/JPY?

The United States dollar versus the Japanese yen currency pair bounced off the 104.00 psychological level. Who will steer the price from here? Long-term perspective The fall from the 109.85 high, which came after the bulls failed to keep their gains above the 109.08 level, extended beyond the next firm support, 107.00. However, from there, the bulls were able to bring it back above 107.00, but only … “Correction or Change from the 104.02 Low on USD/JPY?”

Pound Falls to 10-Day Lows on UK COVID-19 Cases, Risk-Off Mood

The Sterling pound today fell to new 10-day lows against the US dollar driven by the risk-off market sentiment amid rising UK coronavirus cases and the ongoing Brexit talks. The GBP/USD currency pair’s decline was also fueled by the resurgent greenback, which benefitted as a safe-haven asset ahead of next week’s US Presidential election. The … “Pound Falls to 10-Day Lows on UK COVID-19 Cases, Risk-Off Mood”

Euro Falls to 5-Week Lows As ECB’s Lagarde Promises More Stimulus

The euro today fell to 5-week lows against the US dollar after the European Central Bank Governor promised to introduce new stimulus measures next month. The EUR/USD currency pair’s decline was also fueled by the introduction of new lockdown measures in many European countries to curb rising COVID-19 cases. The EUR/USD currency today fell from … “Euro Falls to 5-Week Lows As ECB’s Lagarde Promises More Stimulus”

ECB: Gloomy Lagarde lays ground for stimulus, next euro moves depend on covid

ECB President Lagarde has laid down a gloomy picture of the economy under the second covid wave. She committed to providing additional stimulus measures in the December meeting. EUR/USD is set to remain under pressure and focused on coronavirus statistics. “We are not going to stand still” – the words of Christine Lagarde, President of … “ECB: Gloomy Lagarde lays ground for stimulus, next euro moves depend on covid”

US Dollar Gets Direction on Better-Than-Expected GDP, Initial Jobless Claims

The US dollar is looking to extend its gains against several major currency rivals on Thursday after a plethora of data pointed to a strengthening economy for the world’s second-largest market. The greenback, which has come under pressure this month, is benefiting from both safe-haven demand and positive macroeconomic economic developments, including first-time jobless claims and the gross domestic product. According to the Bureau of Economic Analysis (BEA), the US economy expanded … “US Dollar Gets Direction on Better-Than-Expected GDP, Initial Jobless Claims”

US GDP Analysis: No V-shaped recovery despite 33.1% leap, covid looms over markets

The US economy leaped by an annualized rate of 33.1% in the third quarter of 2020. The output is roughly 3% below pre-pandemic levels. Investors are worried about the impact of coronavirus in the fourth quarter. The best quarter in history – following the worst one. Gross Domestic Product jumped by an annualized rate of … “US GDP Analysis: No V-shaped recovery despite 33.1% leap, covid looms over markets”

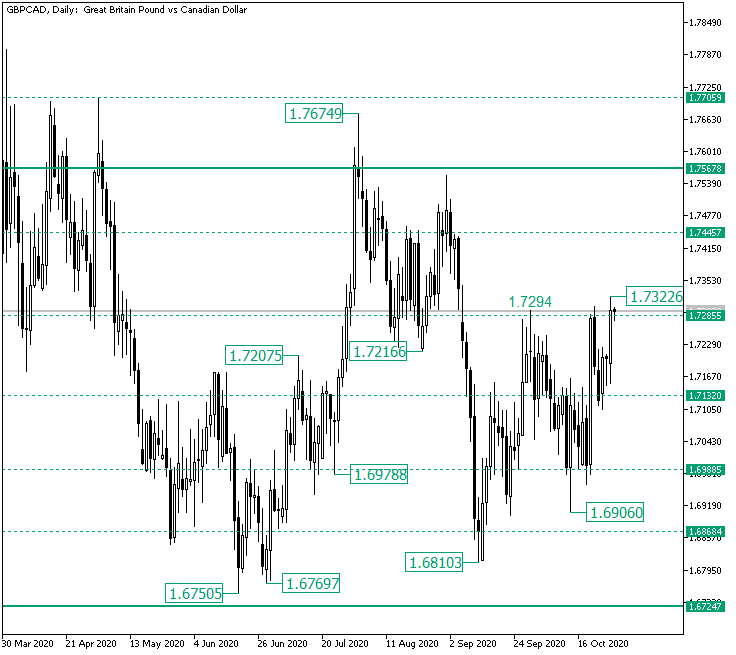

Bulls Targeting 1.7445 on GBP/CAD?

The Great Britain pound versus the Canadian dollar currency pair seems to be willing to go higher. Will the bears let it do so? Long-term perspective After the double bottom defined by the 1.6750 and 1.6769 lows, respectively, the price started an ascending movement that managed not only to touch the firm level of 1.7567 but also to pierce it. To the bullish disappointment, the pierce ended as being a false one, as the price retraced under … “Bulls Targeting 1.7445 on GBP/CAD?”