UK inflation has likely extended its fall to 0.5% yearly in May. Coming 24 hours ahead of the BOE, the size of QE and tone on negative rates may move. GBP/USD is sensitive to any developments amid ongoing Brexit and coronavirus uncertainty. The rush to buy toilet paper is over – and even the bounce … “UK Inflation Preview: Sterling needs Goldilocks CPI to rise ahead of the BOE”

GBP/USD Weekly Forecast: Will Bailey bail out the pound after Powell’s punch? Brexit, coronavirus eyed

GBP/USD has climbed down from the peak following the Fed’s pessimism. The Bank of England’s rate decision, Brexit, and coronavirus developments are eyed. Mid-June’s daily chart is showing a mixed picture. The FX Poll is pointing to a short-term correction and a fall afterward. Has cable begun its climbdown? The Fed’s commitment to low rates, … “GBP/USD Weekly Forecast: Will Bailey bail out the pound after Powell’s punch? Brexit, coronavirus eyed”

AUD/USD Weekly Forecast: Finally turning down under? Australian jobs, US coronavirus data eyed

AUD/USD tumbled down as the market mood soured on several fronts. Australia’s jobs report, US coronavirus figures, and Chinese data are eyed. Mid-June’s daily chart is painting a bullish picture. The FX Poll is pointing to short term gains before a downfall afterward. The tables have turned – a mix of Fed pessimism, rising US … “AUD/USD Weekly Forecast: Finally turning down under? Australian jobs, US coronavirus data eyed”

UK GDP Preview: A 20% plunge could serve as a third blow to sterling, three scenarios

Economists estimate that the UK economy has lost 18.4% of its output in April. Data for the first full month of lockdown may provide certainty, but also gloom. Concerns about coronavirus and Brexit may be compounded by GDP figures. How are you coping with the lockdown? That is often the first question asked when Brits … “UK GDP Preview: A 20% plunge could serve as a third blow to sterling, three scenarios”

Fed Preview: Fear fueling a greenback comeback or another dollar downer? Five things to watch

The Federal Reserve is set to leave its rates unchanged in June. The first growth and employment forecasts since December will be of high interest. Chair Powell’s comments on supporting the economy, stocks, rates, and fiscal stimulus will likely rock markets. Stocks up, dollar down – that has been the recurring story on most days … “Fed Preview: Fear fueling a greenback comeback or another dollar downer? Five things to watch”

NFP: Shocker surge in jobs may trigger a much needed dollar bounce, regardless of stocks

The US gained 2.509 million jobs in May, beating all estimates, lowering the chances for further Fed support. Government support may be behind the move. The urge for the Federal Reserve to act is lower and may strengthen the dollar. Shocker – but a positive one – America is getting back to work, or at … “NFP: Shocker surge in jobs may trigger a much needed dollar bounce, regardless of stocks”

Chinese Yuan Slips as US Threatens Sanctions on China Over Hong Kong

The Chinese yuan is extending its losses to jumpstart the holiday-shortened trading week. The currency is falling against its rivals on Monday after the White House threatened to slap sanctions on China over the governmentâs proposed implementation of national security laws on Hong Kong that reportedly threaten its autonomy. The heightened tensions come as the worldâs two largest economies escalate their war of words over trade. Whether this is a new … “Chinese Yuan Slips as US Threatens Sanctions on China Over Hong Kong”

AUD/USD depends on relations with China

AUD/USD has hit new highs over vaccine hopes but lost ground amid geopolitical concerns. Sino-American relations, China’s rate decision, the RBA’s minutes, and coronavirus statistics stand out. Late May’s daily chart is painting a mildly bullish picture for the pair. The FX Poll is pointing to the downside. Worsening relations between China with both the … “AUD/USD depends on relations with China”

AUD/USD Slipped Under the 0.6600 Mark

The Australian dollar versus the US dollar currency pair seems to have failed to profit from the fact the price went above the 0.6600 psychological level. Do the bulls still have a chance? Long-term perspective The rise that followed the confirmation of 0.5516 as support recovered a big part of the depreciation that started from the 0.7034 high. In doing so, the price consolidated the support area inscribed by the 0.6386 level and the descending trendline that originates from … “AUD/USD Slipped Under the 0.6600 Mark”

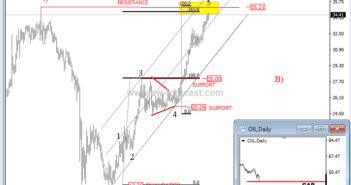

Crude Oil on the Way Towards March 09 Gap – Elliott wave analysis

Hello traders, Crude oil is bullish since the end of April and is currently trading very strongly towards $35 per barrel. This can be now a temporary resistance, ideally for wave 5 of A), therefore traders should be aware of a potential wave B setback, before the trend resumes even higher. This pullback is anticipated … “Crude Oil on the Way Towards March 09 Gap – Elliott wave analysis”