Direct Market Access (DMA) gives traders direct access to the global stock exchanges that speed up your transactions and reduces your costs. With DMA, you place your order online and it immediately undergoes a direct execution in the market. This means that your broker is essentially facilitating access directly to the market liquidity providers. Take … “What is DMA Direct Market Access?”

Chinese Yuan Weakens As Government Abandons 2020 GDP Target

The Chinese yuan is weakening against its major currency competitors to end the trading week, driven by officials announcing that they are abandoning their gross domestic product (GDP) target for 2020. The yuan is also coming under pressure on US-China tensions regarding trade and Hong Kong. While the worldâs second-largest economy has hit the reboot button, outside factors may pause its reopening. For the first time, China … “Chinese Yuan Weakens As Government Abandons 2020 GDP Target”

Pound Falls on Weak UK Retail Sales Data and Risk-Off Sentiment

The Sterling pound today fell against the US dollar following the release of disappointing UK retail sales data in the early London session. The GBP/USD currency pair’s decline was further fueled by the risk-off market sentiment as investors priced-in various global risks. The GBP/USD currency pair today fell from a high of 1.2233 in the Asian session to a low of … “Pound Falls on Weak UK Retail Sales Data and Risk-Off Sentiment”

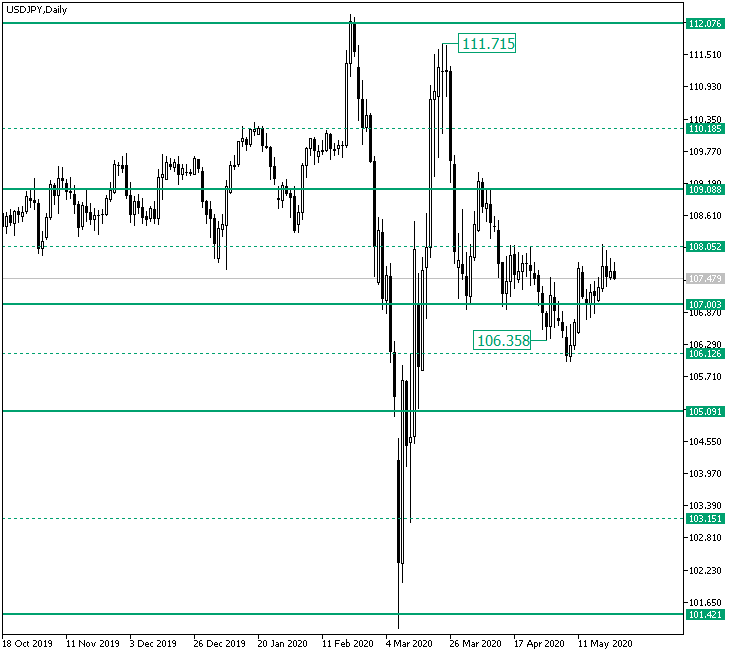

USD/JPY Bounces off the 108 Psychological Level

The US dollar versus the Japanese yen currency pair is still to decide about the overall direction. Long-term perspective The fall from 111.71 found support in the stable 107.00 level, but even so, the bulls slowly lost their determination, culminating with the confirmation of 108.05 as resistance. This lead to the price breaking the 107.00 support, extending until the low of 106.35, making a throwback, and departing again from the 107.00 level. However, this … “USD/JPY Bounces off the 108 Psychological Level”

Euro Rallies on Upbeat Euro Area PMIs, Falls on Strong US PMIs

The euro today rallied higher against the US dollar earlier today lifted by positive PMI reports from across the euro area released by Markit Economics. The EUR/USD currency pair later fell after the release of positive PMI data from the US amid rising Sino-US tensions. The EUR/USD currency pair today rallied to a high of 1.1008 in the mid-European session … “Euro Rallies on Upbeat Euro Area PMIs, Falls on Strong US PMIs”

US Dollar Flat As Initial Jobless Claims Show Steady Decline

The US dollar is trading flat on Thursday as the number of Americans filing for unemployment benefits continues its downward pattern, suggesting the job-loss trend peaked at the end of March. US financial markets were flat across the board, so there was not a huge push into the traditional safe-haven asset toward the end of the trading week. According to the Department of Labor, the initial jobless claims hit 2.438 million for the week ending May 16, … “US Dollar Flat As Initial Jobless Claims Show Steady Decline”

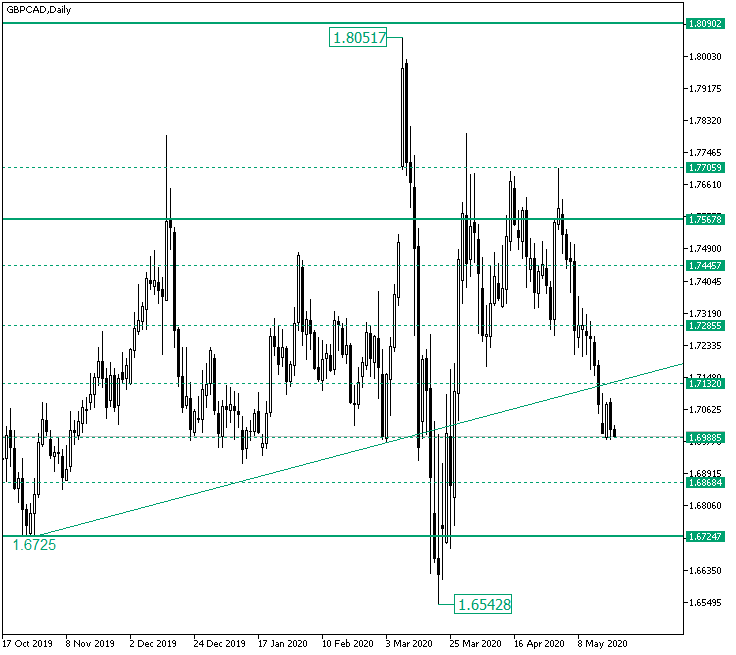

Price Sent by the Bears at 1.7000 on GBP/CAD

The Great Britain pound versus the Canadian dollar currency pair is at the 1.7000 psychological level. Is there a chance for the bulls to stop the bears in their tracks? Long-term perspective The rally that started from the 1.6542 low, after the price stalled from the 1.8051 peak, ended as a consolidative phase limited by the 1.7705 resistance and the 1.7285 support. But after the attempts to conquer the 1.7567 level failed altogether, as the bullish efforts were hindered by the 1.7705 … “Price Sent by the Bears at 1.7000 on GBP/CAD”

Euro Rallies on Bullish Sentiment, Mixed Eurozone Inflation Data

The euro today rallied higher against the US dollar driven by positive investor sentiment even as the greenback registered losses across the board. The EUR/USD currency pair rallied higher ignoring the weak eurozone inflation data released earlier today as investors bid up riskier assets. The EUR/USD currency pair today rallied from an opening low of … “Euro Rallies on Bullish Sentiment, Mixed Eurozone Inflation Data”

Canadian Dollar Rallies on High Oil Prices and Mixed Macro Data

The Canadian dollar today rallied higher against its US peer driven by high crude oil prices before the release of multiple fundamental reports from the Canadian docket. The USD/CAD currency pair today fell as the loonie rallied higher against the much weaker greenback amid a risk-on market environment as investors remain hopeful about the future. The USD/CAD currency pair today fell from a high of … “Canadian Dollar Rallies on High Oil Prices and Mixed Macro Data”

British Pound Mixed on Sliding Inflation, First-Ever Negative-Yielding Bond

The British pound is trading mixed against its G10 currency competitors midweek as investors comb through the influx of April inflation data. For the first time in the nationâs history, the United Kingdom sold a negative-yielding bond, meaning that the government is being paid to borrow. In the post-Coronavirus economy, this might be the new norm for a myriad of nations around the world. According to the Office for National Statistics (ONS), the consumer price index (CPI) tumbled … “British Pound Mixed on Sliding Inflation, First-Ever Negative-Yielding Bond”