The Australian dollar versus the New Zealand dollar currency pair is about to test the major support of 1.0707. Is there any way to grasp the direction? Long-term perspective The rally that began from the low of 1.0476, after the market confirmed the pivotal 1.0013 support, extended all the way to the 1.0830 high. However, reaching the 1.0830 level involved passing the 1.0707 mark. As a consequence, the bulls could have felt confident that they … “AUD/NZD at the Important Support of 1.0707”

Pound Rallies Higher on Mixed Jobs Data and Upbeat Investor Sentiment

The British pound today rallied higher against the US dollar extending yesterday’s gains driven by positive investor sentiment and the mixed UK jobs data. The GBP/USD currency pair today posted gains after the release of the latest jobs data showing a better than expected unemployment rate. The GBP/USD currency pair today rallied from a daily low of 1.2184 in the Asian session to a … “Pound Rallies Higher on Mixed Jobs Data and Upbeat Investor Sentiment”

Turkish Lira Strengthens Ahead of Interest Rate Decision

The Turkish lira is strengthening against several major currency competitors on Tuesday as investors anticipate the central bank to cut interest rates. Forex markets are also optimistic that Ankara can establish swap lines with foreign central banks to mitigate its currency crisis. The lira has been rebounding since it crashed to a record low against the US dollar earlier this month. According to a Reuters poll of economists, … “Turkish Lira Strengthens Ahead of Interest Rate Decision”

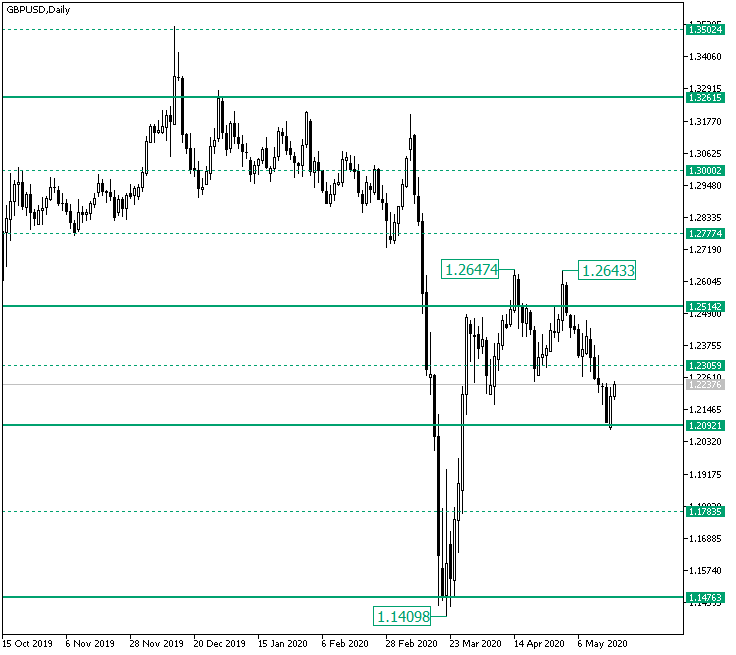

GBP/USD Bounced from 1.2092

The Great Britain pound versus the US dollar currency pair corrected from the 1.2100 area. Is this a simple correction of the downwards movement, or is it a bullish comeback? Long-term perspective The rally that commenced from the low of 1.1409, after the significant support level of 1.1476 was validated, lost its steam just under the 1.2514 mark. From there, a consolidative phase took shape, one that was limited by the 1.2514 … “GBP/USD Bounced from 1.2092”

Chinese Yuan Weakens on PBoC Expansion, Poor Data

The Chinese yuan is weakening against its primary currency competitors to start the trading week. Trading patterns appear to reveal that investors are uncertain regarding the yuanâs near-term performance due to weak economic data and expansionary monetary policy. With 100 million people under a renewed lockdown over a potential second wave of the coronavirus pandemic, is the economic restart in jeopardy? Over the last three months, the Peopleâs Bank of China … “Chinese Yuan Weakens on PBoC Expansion, Poor Data”

Could AUD/USD Be in Bearish Hands from 0.6400?

The Australian dollar versus the US dollar seems not to be profiting from the appreciation opportunities. Is this a sign that the bears are preparing the next movement? Long-term perspective The rally that started from the 0.5701 low, after the confirmation of 0.5516 as support, pierced the descending trendline that starts from 0.7034, and extended all the way to 0.6616. Subsequently, the price entered a consolidative phase, limited by the important level of 0.6386 and the intermediary level … “Could AUD/USD Be in Bearish Hands from 0.6400?”

Euro Spikes Then Falls Against Dollar on Day Full of Macro Releases

The euro today rallied to new daily highs against the US dollar after the release of weak US data, but the single currency later gave up its gains. The EUR/USD currency pair fell after the release of upbeat US consumer sentiment data, which surprised investors causing the pair to sell-off. The EUR/USD currency pair today … “Euro Spikes Then Falls Against Dollar on Day Full of Macro Releases”

NZ Dollar Weakest Among Brewing US-China Trade War

The New Zealand dollar was the weakest among the most-traded currencies on the Forex market today. While domestic macroeconomic data could have played a part in the decline, market analysts speculated that the major reason for the drop was the brewing trade war between the United States and China. The Trump administration made a move to block shipments of semiconductors to China’s tech giant and the world’s second biggest smartphone maker Huawei Technologies. It will likely … “NZ Dollar Weakest Among Brewing US-China Trade War”

US Dollar Holds Steady As Retail Sales Crash Worse Than Expected in April

The US dollar is holding steady to finish the trading week as investors comb through the worse-than-expected retail sales report for April. The greenbackâs endurance was further tested on bleak industrial and manufacturing numbers, lending credence to the Federal Reserveâs gloomy assessment that the US economyâs road to recovery will be a long and slow one. So, why is the buck not plummeting on Friday? According to the US Census Bureau, April retail sales … “US Dollar Holds Steady As Retail Sales Crash Worse Than Expected in April”

Aussie Soft Despite Rebound in Chinese Industrial Production

The Australian dollar was soft today despite a rebound of industrial production in China — Australia’s biggest trading partner. Other indicators released in China today were not good, though. There were no economic releases in Australia today, and yesterday’s employment data was mixed. The National Bureau of Statistics of China released a report containing a bunch of important macroeconomic indicators for April. The report started with a very optimistic preamble: In April, under … “Aussie Soft Despite Rebound in Chinese Industrial Production”