The euro today rallied higher against the US dollar driven by positive investor sentiment as European countries cautiously move forward with the reopening of their economies. The EUR/USD currency pair today benefitted from the greenback’s overall weakness recouping yesterday’s losses and printing new weekly highs. The EUR/USD currency pair today rallied from a low of 1.0784 to a high of 1.0885 in a 100 pip move before giving up some of its gains … “Euro Rallies on Investor Sentiment Amid European Reopening Efforts”

NZ Dollar Strong Ahead of RBNZ Monetary Policy Decision

The New Zealand dollar was among the strongest currencies today amid the mildly positive market sentiment. The currency waits for tomorrow’s monetary policy decision from the Reserve Bank of New Zealand. No economic reports were released in New Zealand today while yesterday’s data was not bad but not particularly good either. The RBNZ will announce its decision on monetary policy at 2:00 GMT tomorrow. While the vast … “NZ Dollar Strong Ahead of RBNZ Monetary Policy Decision”

US Dollar Mixed As Fed Triggers Corporate Bond-Buying

The US dollar is trading mixed against multiple G10 currencies on Tuesday as the Federal Reserve begins its historic corporate bond-buying initiative. Investors were also concentrating on core consumer prices sliding and economies reopening across the country. On Tuesday, the US central bank will start purchasing corporate bond exchange-traded funds (ETFs) as part of its new $2.3 trillion Main Street Lending Facility. The New York Fed Bank … “US Dollar Mixed As Fed Triggers Corporate Bond-Buying”

Aussie Rebounds After Falling on Tensions Between China & Australia

The Australian dollar fell intraday but has rebounded by now. The drop was a result of growing political tensions between China and Australia as well as poor macroeconomic data in both Australia and China. China banned imports of red meat from four Australian abattoirs. Analysts speculated that the move was a response to Australia’s demands of inquiry into the handling of the coronavirus pandemic by China. With China being the major destination of Australian exports, the conflict … “Aussie Rebounds After Falling on Tensions Between China & Australia”

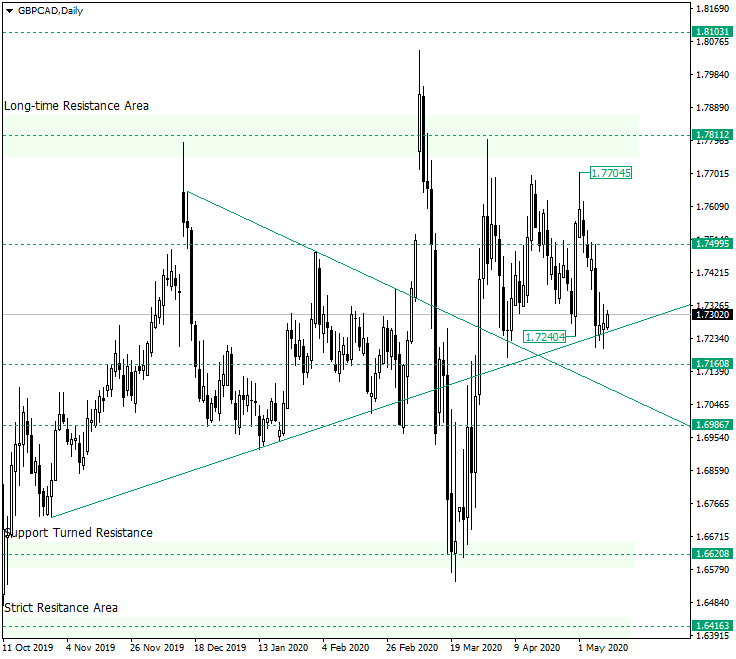

Bears Joining Forces on GBP/CAD to Send Price Under 1.7200?

The Great Britain pound versus the Canadian dollar currency pair is back at the ascending trendline. Could the bears spell further movement to the downside? Long-term perspective After the appreciation that started from 1.6620, the bulls met the long-time resistance area of 0.7811. The price retraced drastically from this area, ingraining a high that would serve as a reference point for the next — at least for now — two confirmations, and that matches to the 0.7700 psychological level — … “Bears Joining Forces on GBP/CAD to Send Price Under 1.7200?”

Chinese Yuan Slumps Despite Surprising Gain in Auto Sales

The Chinese yuan is slumping to kick off the trading week, despite a surprise gain in new motor vehicle sales last month. Investors are potentially keeping an eye on internal financing struggles and concerns over a renewed trade war between the two largest economies. Despite the coronavirus pandemic shutting down China, the yuan has only recorded modest losses against the US dollar. If the data improves, could the currency test … “Chinese Yuan Slumps Despite Surprising Gain in Auto Sales”

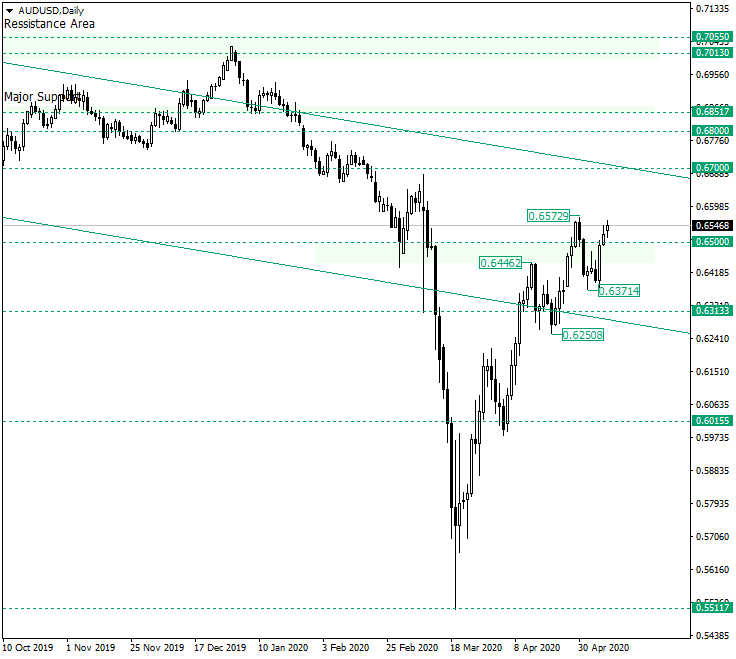

AUD/USD Above the 0.6500 Handle

The Australian dollar versus the US dollar currency pair is, yet again, above the 0.6500 psychological level. It’s the bulls that won, or is the bears that are preparing their final push? Long-term perspective After confirming the support level of 0.5511, the price started an upwards movement that, against the bearish odds, accomplished to pierce major resistances and establish them as support areas. And it looks like the 0.6500 psychological level … “AUD/USD Above the 0.6500 Handle”

AUD/USD: More upside? Global gloom could overwhelm even robust Australian figures

AUD/USD has held up yet failed to reach new highs amid global concerns. Sino-American relations, Australia’s jobs report and US retail sales stand out. Mid-May’s daily chart is showing bears are gaining ground. The FX Poll is pointing to falls on all timeframes, yet with upgraded targets. The Australian dollar benefited from the encouraging coronavirus … “AUD/USD: More upside? Global gloom could overwhelm even robust Australian figures”

Canadian Dollar Rallies Against US Peer on US/Canadian Jobs Data

The Canadian dollar today rallied against its Southern neighbour after the release of jobs data from both countries with some prints beating analysts’ estimates. The USD/CAD currency pair today printed news lows as US non-farm payrolls disappointed causing the greenback to lose ground against the loonie amid higher oil prices. The USD/CAD currency pair today fell from a high of … “Canadian Dollar Rallies Against US Peer on US/Canadian Jobs Data”

US Dollar Weakens As Economy Lost Historic 20.5 Million Jobs in April

The US dollar is weakening against most of its G10 currency counterparts at the end of the trading week. All eyes were focused on the April jobs report as the national economy lost more than 20 million jobs last month. Is the worst over, or is the US bracing for the real economic storm? According to the Bureau of Labor Statistics (BLS), the US lost 20.5 million jobs, which was lower than the median estimate … “US Dollar Weakens As Economy Lost Historic 20.5 Million Jobs in April”