EUR/USD may ride on a blue wave and surge. A victory for Biden with a Republican-controlled Senate could trigger a moderate downfall. Euro/dollar has room to rise if Trump is re-elected. The nightmare scenario is that the results of the elections are contested. The second wave of coronavirus is locking the euro to the downside – … “How three US election outcomes (and a contested result) could rock the dollar”

Canadian Dollar Slides As BoC Leaves Rates Unchanged, Crude Oil Crashes

The Canadian dollar is sliding against its US peer on Wednesday as the Bank of Canada (BoC) left interest rates unchanged during its November policy meeting. The loonie was also falling on plummeting crude oil prices amid escalating COVID-19 cases around the world that traders bet would continue to weigh on global demand. With Canada witnessing a second wave of the highly infectious respiratory illness, will the economic recovery … “Canadian Dollar Slides As BoC Leaves Rates Unchanged, Crude Oil Crashes”

US Dollar & Japanese Yen Climb amid Risk Aversion

Safe-haven currencies, like the US dollar and the Japanese yen, jumped today as risk aversion was ruling markets. The main themes were the rising number of coronavirus cases in Europe and the upcoming presidential election in the United States. According to reports, the French government is considering a month-long nationwide lockdown to curb the rising number of coronavirus cases. French President Emmanuel Macron will address the issue on television later today. The European Commission announced that … “US Dollar & Japanese Yen Climb amid Risk Aversion”

Australian Dollar Retreats After Rising on Good Inflation Report

The Australian dollar rose on Wednesday after a positive inflation report released in Australia. But as of now, the currency has lost its gains due to risk aversion that prevailed on markets. The Australian Bureau of Statistics reported that the Consumer Price Index rose by 1.6% in the September quarter (1.5% with seasonal adjustments). The increase followed the 1.9% drop in the previous three months. Year-on-year, the index increased by 0.7%. The trimmed mean CPI (which is … “Australian Dollar Retreats After Rising on Good Inflation Report”

Gold has three ways go in response to the 2020 Presidential Elections

Gold prices heavily depend on the fate of fiscal stimulus. A blue wave could unleash a golden age for the precious metal. If Trump remains is reelected, the reaction could be mixed. President Biden with a Republican Senate would cause a meltdown. Gold could power up if the government prints more money – that is the … “Gold has three ways go in response to the 2020 Presidential Elections”

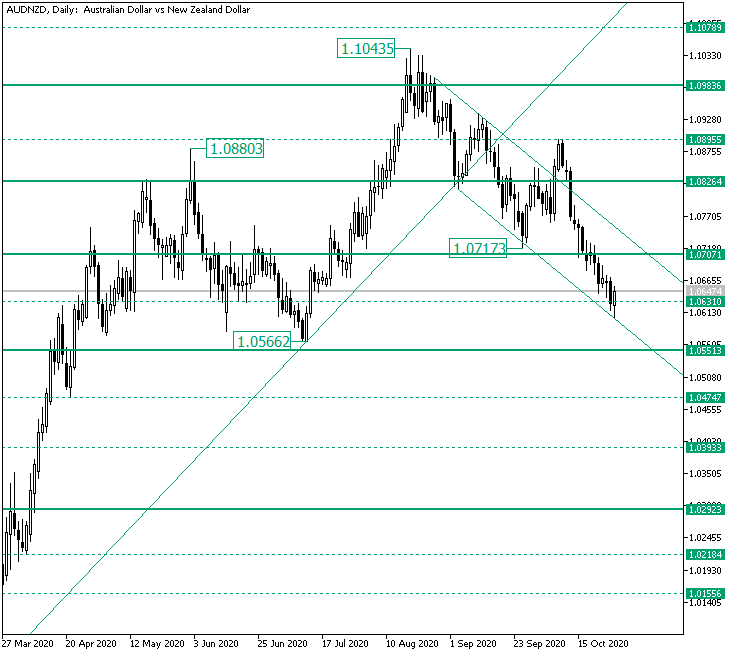

Can the Bears Still Push on AUD/NZD After Reaching 1.0631?

The Australian versus the New Zealand dollar currency pair ebbed until the 1.0631 level. Could this level be the one that starts a correction? Long-term perspective After validating the support of 1.0013 — not highlighted on the chart — the price climbed until the 1.1043 high. In doing so, towards the end of the movement, it pierced two significant levels. The first one is 1.0826, which previously — see the 1.0880 high — served as a firm resistance, … “Can the Bears Still Push on AUD/NZD After Reaching 1.0631?”

USD/KRW Declines As South Korea Exits Recession in Q3

The South Korean won is recording modest gains against multiple currency rivals on Tuesday as the nation’s economy returned to growth in the third quarter. After enduring the sharpest economic downturn in more than a decade, Seoul was able to resuscitate the economy through a series of COVID-19 stimulus measures and surging exports. During the July-to-September period, the gross domestic product (GDP) advanced 1.9%, following a 3.2% slide in the second quarter. The market had penciled … “USD/KRW Declines As South Korea Exits Recession in Q3”

ECB Preview: Three charts show why Lagarde could send EUR/USD tumbling

The ECB is set to leave rates unchanged but hint of additional stimulus due to the virus. Forward-looking indicators are already pointing to a significant slowdown. Recent inflation figures paint a worrying picture for the bank. All eyes are on Europe again – and for the wrong reason. COVID-19 cases are surging in the old continent … “ECB Preview: Three charts show why Lagarde could send EUR/USD tumbling”

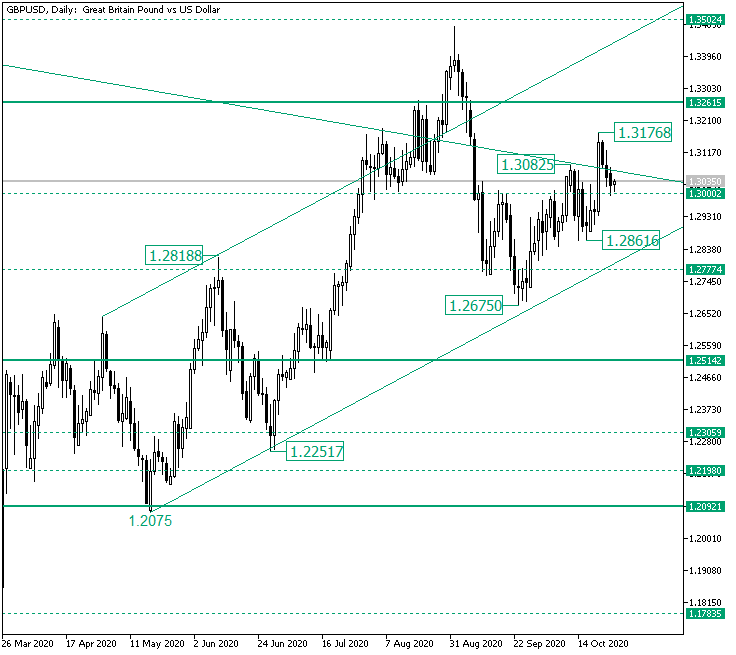

Bears Testing the 1.3000 Level on GBP/USD

The Great Britain pound versus the United States dollar currency pair has to make a decision: above or beneath 1.3000? Long-term perspective After validating the firm level of 1.2092 as support, the price started an ascending trend, one that came very close to the 1.3502 intermediary level. However, reaching 1.3502 meant passing a triple resistance area made up of the 1.3261 level, the upper line of the ascending channel, and the descending line. But as the retracement … “Bears Testing the 1.3000 Level on GBP/USD”

Euro Falls on Rising Eurozone COVID-19 Cases, Risk-Off Sentiment

The euro today fell against the US dollar as investors sold the single currency amid rising coronavirus cases within the euro area dampening investor sentiment. The EUR/USD currency pair’s decline was further fueled by the stalemate in the US stimulus talks ahead of next week’s Presidential election as equity markets sold off. The EUR/USD currency … “Euro Falls on Rising Eurozone COVID-19 Cases, Risk-Off Sentiment”