The Chinese yuan is mixed against its currency competitors to finish the trading week as investors weigh Chinaâs near-term economic recovery. With the latest bearish numbers suggesting Beijingâs COVID-19 devastation, analysts are hoping that the worst is over and that the nationâs reboot will lead to better results. According to the National Bureau of Statistics (NBS), the gross domestic product (GDP) plummeted 6.8% in the first quarter, worse than the market … “Chinese Yuan Mixed As Economy Contracts 6.8% in Q1, Retail Sales Crash”

Loonie Sinks As Crude Oil Trades at 18-Year Lows Despite Supply Cuts

The Canadian dollar today extended its losing streak against the US dollar for the second day in a row despite yesterday’s hawkish rate decision by the Bank of Canada. The USD/CAD currency pair surged higher as the loonie remained under pressure due to falling crude oil prices despite recent output cust by OPEC+ and some US producers. The USD/CAD currency pair today rallied from a low of 1.4063 in the early American session to a high of 1.4182 … “Loonie Sinks As Crude Oil Trades at 18-Year Lows Despite Supply Cuts”

Euro Extends Decline Amid Fears of a Looming Recession in the EU

The euro today fell against the US dollar as market sentiment remained decisively risk-averse amid fears that the eurozone was facing an imminent recession. The EUR/USD currency pair fell for the second consecutive session despite the release of upbeat data from Germany and the euro area, which did little for the pair. The EUR/USD currency pair today fell from an opening high of 1.0907 to a … “Euro Extends Decline Amid Fears of a Looming Recession in the EU”

US Dollar Mixed As 22 Million Americans Lose Jobs in Four Weeks

The US dollar is mixed against its G7 currency rivals on Thursday after the US government reported a slightly worse-than-expected jobs report that brought the total number of Americans who lost their jobs to about 22 million. A flurry of other economic data weighed on the greenback and US equities, leaving everyone wondering just how long the coronavirus pandemic will affect the world’s largest economy. According to the Department of Labor, initial … “US Dollar Mixed As 22 Million Americans Lose Jobs in Four Weeks”

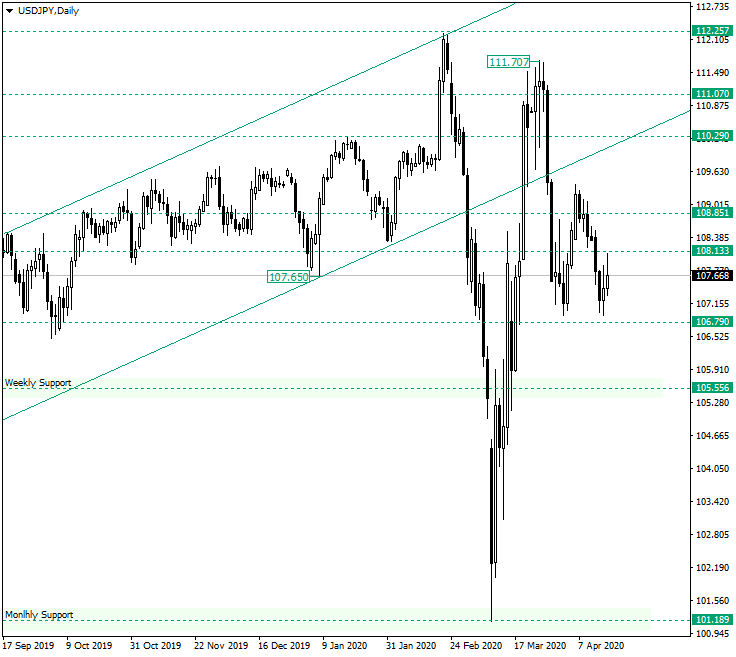

Bulls on USD/JPY Not Confident Enough

The US dollar versus the Japanese yen currency pair seems to be willing to go towards the north. However, something keeps the bulls from making their next move. Long-term perspective The depreciation that started from the peak of 111.70 and after the 111.07 level was confirmed as resistance extended to just a little above to the 106.79 support level. From there, the bulls tried to regain 108.85, but their endeavor ended with another … “Bulls on USD/JPY Not Confident Enough”

Australian Dollar Falls, Ignoring Shockingly Good Employment Data, but Rebounds Later

The Australian dollar fell today, largely ignoring the shockingly good employment report. While the currency spiked immediately after the release, it retreated almost immediately. By now, though, the Aussie has managed to trim losses and even trades flat against a number of most-traded peers. The Australian Bureau of Statistics reported that the seasonally adjusted number of employed people increased by 5,900 in March. Experts totally missed the mark with their forecasts of a big … “Australian Dollar Falls, Ignoring Shockingly Good Employment Data, but Rebounds Later”

Pound Falls Amid Speculation That COVID-19 Deaths Are Much Higher

The Sterling pound today fell against the much stronger US dollar amid fears that the global economy was sliding into a significant recession due to the coronavirus pandemic. The GBP/USD currency pair recouped some of its losses in the American session as the greenback gave up some of its gains, allowing riskier currencies to post … “Pound Falls Amid Speculation That COVID-19 Deaths Are Much Higher”

Canadian Dollar Plunges As GDP Contracts 9% in March, BoC Unveils New QE

The Canadian dollar hit the pause button on its recent rally after the federal government released its gross domestic product (GDP) reading early for the first time ever. The loonie is slumping on news that economic activity suffered the biggest monthly decline in history. With falling energy prices and accommodating central bank, it could be a downward trend for the Canadian dollar in the near-term. According to Statistics Canadaâs flash reading, the economy … “Canadian Dollar Plunges As GDP Contracts 9% in March, BoC Unveils New QE”

US Dollar Surges Despite Crashing Retail Sales, Industrial Output

The US dollar is surging against its G7 currency rivals, despite a plethora of disastrous economic reports. With global financial markets deep in the red midweek over concerns of the coronavirus pandemic, investors are pouring into the greenback for shelter. Could the US economy reverse these losses if the nation reopens next month? Or will the country endure a second wave and erase any potential gains? According to the Census Bureau, retail … “US Dollar Surges Despite Crashing Retail Sales, Industrial Output”

Australian Consumer Sentiment Collapses, Aussie Reverses Gains

The Australian dollar declined against all other most-traded currencies today, including its riskier commodity-related counterparts. The possible reasons for the decline were the worsening market sentiment and bad domestic macroeconomic data. The Aussie was rising yesterday but halted its rally shortly after Wednesday’s Asian session started. After trading sideways for a short while, the currency started to move lower. While it does not look that the extremely … “Australian Consumer Sentiment Collapses, Aussie Reverses Gains”