Fundamentals looked extremely grim to the Australian dollar today. An interest rate cut by Australia’s central bank, unfavorable domestic economic reports, persisting risk aversion on markets — all those factors should have driven the currency down. But instead, the Aussie jumped against almost all of its major rivals, except for the Japanese yen. The Reserve Bank of Australia cut its main interest rate by 25 basis points to 0.5% at Tuesday’s … “Australian Dollar Jumps After RBA Cuts Interest Rates”

US Dollar Slumps As Federal Reserve Cuts Interest Rates

The US dollar is slumping on Tuesday as the Federal Reserve announced an emergency cut to interest rates. With financial markets tanking and plenty of economic uncertainty surrounding the coronavirus, the central bank cut its benchmark rate by 50 basis points. Stocks fell after an initial bump, but the greenback was largely unaffected by the … “US Dollar Slumps As Federal Reserve Cuts Interest Rates”

Japanese Yen Strengthens As BoJ Plans to Help Fight COVID-19 Crisis

The Japanese yen is accelerating against several currencies on Tuesday as the central bank announced that it plans to help stabilize financial markets that have been decimated by the coronavirus. With an already fragile economy on the brink of a recession, the Bank of Japan (BoJ) aims to offer liquidity to ensure Covid-19 does not do any more damage to a country that is scheduled to host the Olympic Games in Tokyo. The announcement was not enough … “Japanese Yen Strengthens As BoJ Plans to Help Fight COVID-19 Crisis”

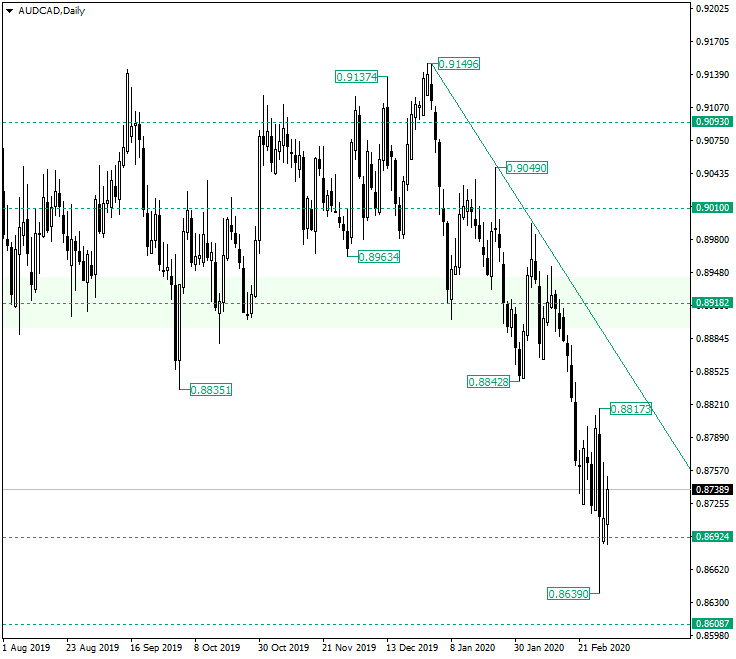

AUD/CAD Is Facing the 0.8692 Support

The Australian dollar versus the Canadian dollar currency pair consolidates at 0.8692. Will the bulls take their chance? Long-term perspective After the flat — lined up by the resistance of 0.9093 and the support of 0.8918 — ended, the price dropped, reaching the level of 0.8692. This fall seems to be an impulsive swing which is part, of course, of a descending trend, the resistance of which is the line obtained by joining the highs of 0.9149 with 0.9049, respectively. The strong drop … “AUD/CAD Is Facing the 0.8692 Support”

Chinese Yuan Sinks As Purchasing Indexes Crash to Record Lows

The Chinese yuan is sliding against most major currencies to kick off the trading week as the latest economic data highlighted just how damaging the fallout of the coronavirus has been to Beijing. It may be some time until China fully recovers from Covid-19, especially with hundreds of new cases being reported. Plus, the outbreak appears to have spread worldwide, causing consternation about global supply chains and the near-term … “Chinese Yuan Sinks As Purchasing Indexes Crash to Record Lows”

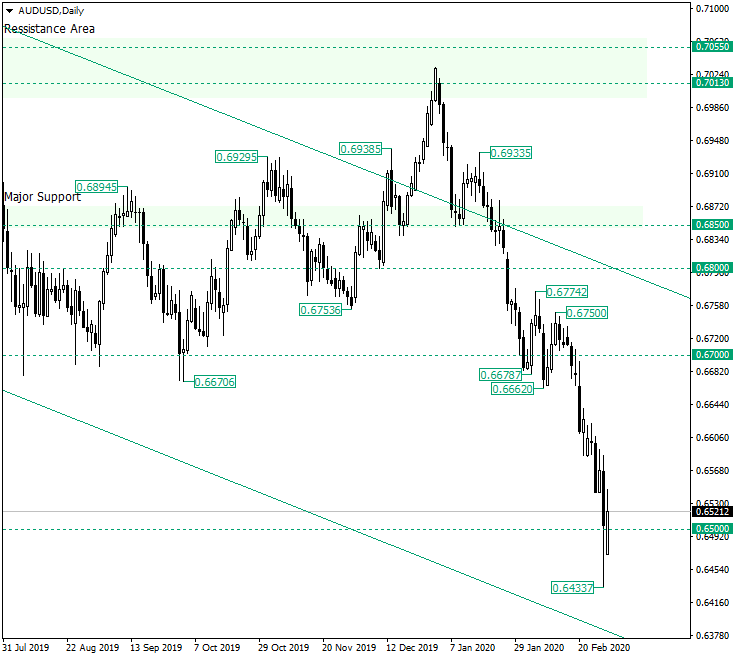

AUD/USD Still to Fall from 0.6500?

The Australian dollar versus the US dollar currency pair extended to as low as 0.6433. Is this the end of the road for this depreciation? Long-term perspective After confirming the resistance area defined by 0.7055 and 0.7013, the price started to fall towards the major support of 0.6850. As the price reached the support, the head and shoulders — shoulders marked by the highs of 0.6938 and 0.6933, respectively — was ready to let its message print on the chart. The 0.6850 support — which also served … “AUD/USD Still to Fall from 0.6500?”

US Dollar Rallies As Market Turmoil Spurs Safe-Haven Demand

The US dollar is rallying against several major currency rivals at the end of the trading week, driven by the financial market turmoil that has spurred safe-haven demand for the greenback. While the global coronavirus outbreak has dominated the business headlines, positive economic data is adding to the buckâs gains on Friday. In January, personal income rose 0.6%, up from the 0.1% gain in December. Personal spending slipped 0.2% last month, down … “US Dollar Rallies As Market Turmoil Spurs Safe-Haven Demand”

Canadian Dollar Falls on Weak Oil Prices, Spikes On In-Line GDP Data

The Canadian dollar today extended its losses against the US dollar for the third consecutive day as global crude oil prices fell to lows last seen in December 2018. The Commodity-linked loonie’s performance was boosted slightly by the Canadian GDP data, but the risk-off market sentiment created by the Chinese coronavirus headlines hindered its rally. … “Canadian Dollar Falls on Weak Oil Prices, Spikes On In-Line GDP Data”

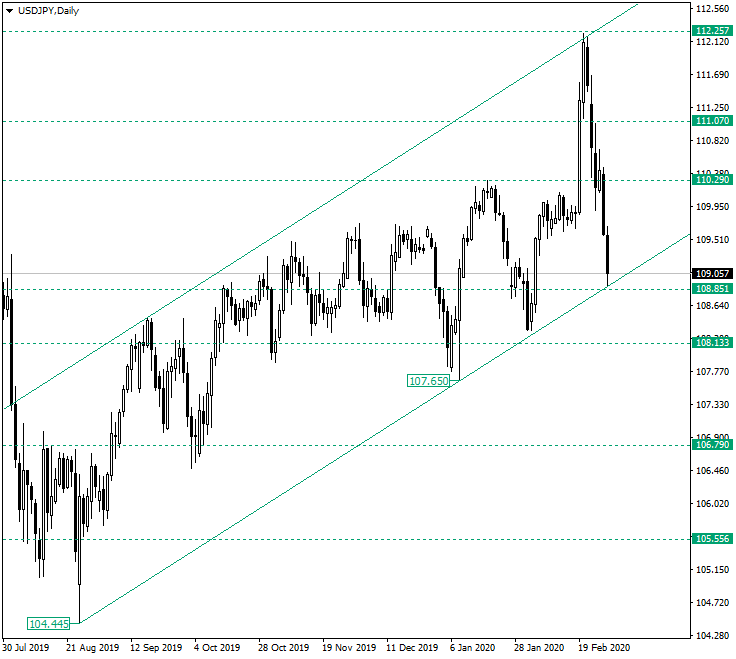

Strong Correction on USD/JPY from 112.25

The US dollar versus the Japanese yen currency pair retraced drastically. Are the bulls in danger in the long term? Long-term perspective After printing the low of 104.44, the price went above the 105.55 support level and from there all the way to the 110.29 resistance. But before reaching 110.29, the bulls were challenged, as the bears tried to establish the price under the 108.13 level. Their victory is marked by the low of 107.65. Joining the two aforementioned … “Strong Correction on USD/JPY from 112.25”

Euro Hits 3-Month High as Dollar Crumbles on Coronavirus Fears

The euro today to new highs as the dollar crumbled in the face of mounting coronavirus fears amid and falling US Treasury yields dampened demand for the greenback. The EUR/USD currency pair today rallied above the crucial 1.10 level as investors flocked to the single currency boosted by positive euro area fundamental releases. The EUR/USD … “Euro Hits 3-Month High as Dollar Crumbles on Coronavirus Fears”