The euro fell against the US dollar and was trading flat or lower versus other most-traded rivals. Market analysts thought that the euro’s weakness was mostly a result of the dollar’s strength as speculators continue to bet that US politicians will approve fiscal stimulus before the presidential election at the beginning of November. German macroeconomic data was worse than expected but did not have a material impact on the euro, though it … “German Consumer Climate Deteriorates, Euro Weaker as Traders Expect Fiscal Stimulus in USA”

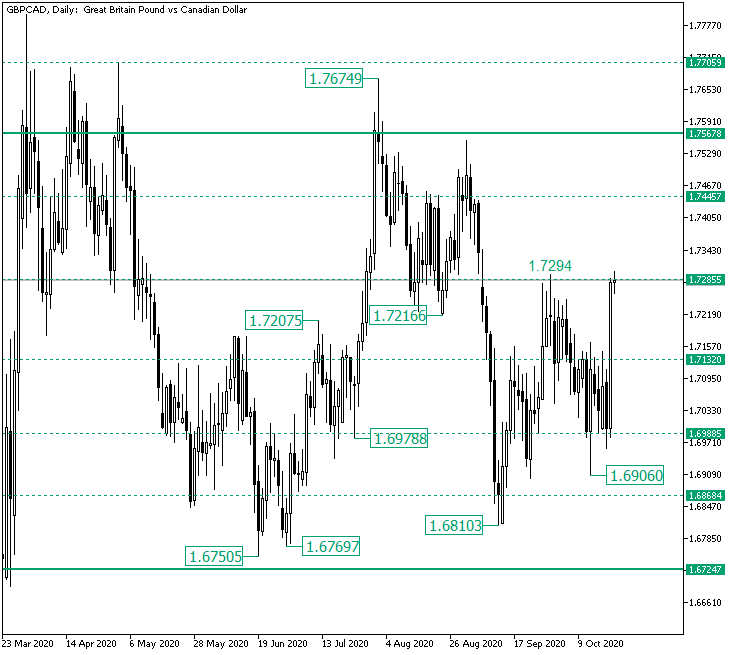

Chances for Bulls to Validate 1.7285 as Support on GBP/CAD?

After the rally to 1.7285, would the level cede in front of the bullish momentum or serve as the perfect spot for the bears to short the market at a very good price? Long-term perspective After the price validated the major level of 1.6724 as support, it managed to rise until the important 1.7567 area. But as the intermediary level of 1.7705 limited further bullish advancement, the result was a decline well under 1.7567. As a result, the price almost retouched the 1.6724 level. However, … “Chances for Bulls to Validate 1.7285 as Support on GBP/CAD?”

Turkish Lira Strengthens to Two-Week High as Markets Bet on Rate Hike

The Turkish lira is strengthening to its best level in two weeks against the US dollar. The lira, which recently crashed to a fresh all-time low, is finding support on widespread expectations that the central bank will raise interest rates to prevent further currency depreciation and to support the economy. On Thursday, central bank officials will hold their October policy meeting. Analysts believe that Ankara will vote to continue tightening … “Turkish Lira Strengthens to Two-Week High as Markets Bet on Rate Hike”

2020 Elections: Trump is is showing signs of a comeback, will the dollar follow?

National polls have been showing that President Trump has narrowed his deficit. Surveys in the critical battleground states of Pennsylvania and Florida are also tentatively showing Biden has peaked. The chances of a contested election are rising and could lead to a stock sell-off and a dollar rise. “It ain’t over till the fat lady … “2020 Elections: Trump is is showing signs of a comeback, will the dollar follow?”

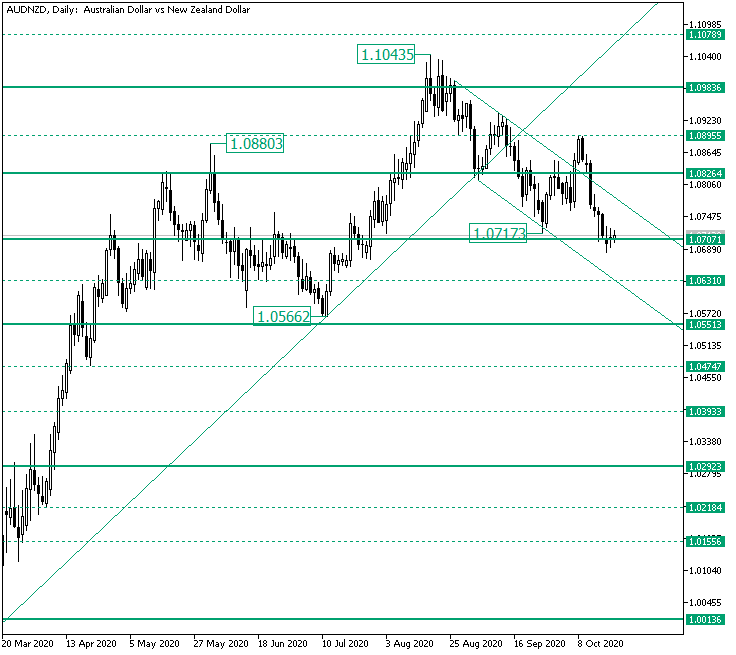

Bulls Searching for Support at 1.0707 on AUD/NZD?

The Australian versus New Zealand dollar currency pair retraced until the 1.0707 level. Are the bulls able to pull off another rise? Long-term perspective After validating 1.0013 as support, the price printed a rally that extended until the 1.0880 high. From the 1.0880 high, which is part of the false piercing of the 1.0826 firm resistance area, the price passed 1.0707 — also a steady level — only to stop near the next one, … “Bulls Searching for Support at 1.0707 on AUD/NZD?”

US Dollar Erases Gains As Nancy Pelosi Says Stimulus Deal Possible by Dayâs End

The US dollar erased its gains on Tuesday and deepened into negative territory after House Speaker Nancy Pelosi revealed that a coronavirus stimulus and relief package could be done by the dayâs end. This sent stocks and other asset classes rallying as investors were confident that the White House and the Democratic leadership could reach an agreement over a $2 trillion bill. One day after telling President Donald Trump … “US Dollar Erases Gains As Nancy Pelosi Says Stimulus Deal Possible by Dayâs End”

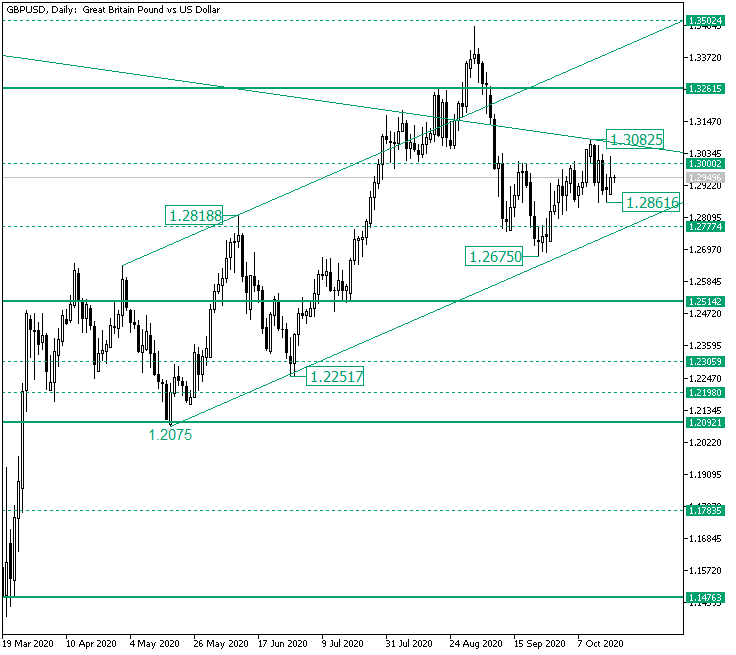

GBP/USD Encountering Bearish Resistance at 1.3000?

The Great Britain pound versus the United States dollar currency pair seems to limit the bullish efforts. Are the bulls out of steam? Long-term perspective The rally that started from the 1.1476 firm support level extended above 1.2092 but was stopped by 1.2514, leading to a consolidative phase. This phase printed the low of 1.2075 before validating 1.2092 as support and thrusting to the 1.2818 high. The retracement that came about from 1.2818, … “GBP/USD Encountering Bearish Resistance at 1.3000?”

Chinese Yuan Strengthens Against USD on Upbeat GDP, Retail Sales

The Chinese yuan reversed its recent downward trend against the US dollar to kick off the trading week, breaking below 6.7 on positive economic data. The latest figures show that the post-coronavirus recovery is doing well, from growth to retail sales. This has Beijing anticipating that the worldâs second-largest economy will be one of the few Asian countries to report growth in 2020. How will this benefit the currency? … “Chinese Yuan Strengthens Against USD on Upbeat GDP, Retail Sales”

2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate

President Trump is trailing Biden by a wide margin but skeptics point to 2016. There are seven reasons why this time is different. The Senate race is much closer and could be more consequential for markets. Polls dismissed then-candidate Donald Trump in 2016, and are off the mark also in 2020 – that is the … “2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate”

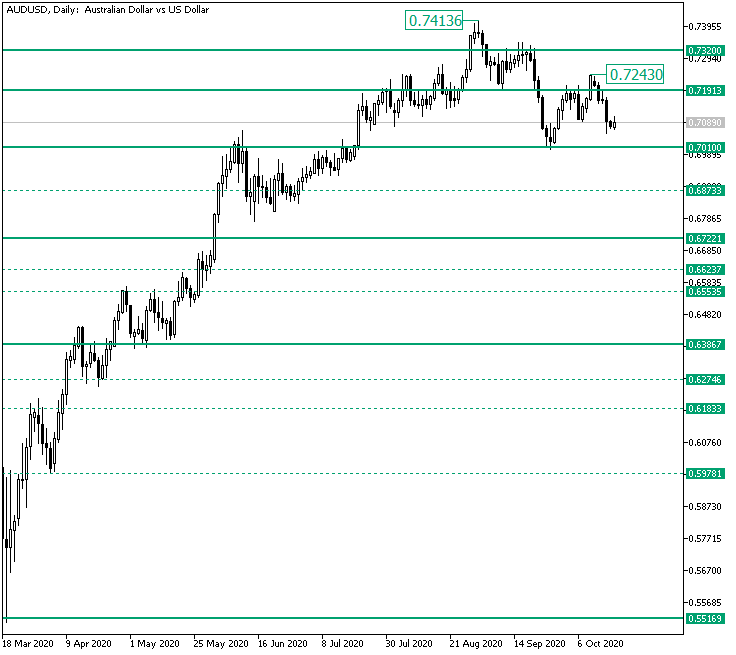

Safety Net at 0.7010 on AUD/USD for the Pressured Bulls?

The Australian versus the US dollar currency pair seems to have a hard time resuming the upward movement. It is the trend approaching the end of its evolution? Long-term perspective After the rise that started following the validation as support of the 0.5516 firm area, the price started an ascending trend. The first part of this unfolding was under strict bullish control, as they conquered 0.6386 fairly quickly. Their next objective, 0.7010, required … “Safety Net at 0.7010 on AUD/USD for the Pressured Bulls?”