The euro today traded at multi-year lows against the US dollar despite the release of positive German macro reports in the early European session. The EUR/USD currency pair fell to lows last witnessed in April 2017 after the results of the last French election were announced. The EUR/USD currency pair today traded between a high … “Euro Trades at April 2017 Lows Despite Upbeat German Macro Prints”

Chinese Yuan Slides Breaches 7 As PBoC Injects More Stimulus

The Chinese yuan has tumbled past the crucial 7 mark against the US dollar again as the central bank injected additional stimulus to contain the economic fallout from the coronavirus. This is the second time in less than a year that the yuan has fallen to this level, and many experts anticipate further weakening of the currency until Covid-19 has been subsided. On Thursday, the Peopleâs Bank of China (PBoC) reduced the loan prime rate … “Chinese Yuan Slides Breaches 7 As PBoC Injects More Stimulus”

Australian Dollar Drops After Unemployment Rate Rises

The Australian dollar fell against almost all most-traded currencies today (with the exception of the New Zealand dollar) after the release of an employment report. While the employment figures were not that bad, the bigger-than-expected increase of unemployment made the currency unappealing to traders. The Australian Bureau of Statistics reported that the seasonally adjusted number of employed Australians increased by 13,500 in January. That was a bigger increase than 10,000 predicted by experts. The increase was … “Australian Dollar Drops After Unemployment Rate Rises”

Three things to watch in the ECB Meeting Minutes – EUR/USD vulnerable

The ECB’s meeting minutes may reveal the bank’s thinking amid worsening conditions. The hawk-dove divide may also be exposed as it faces new challenges. EUR/USD is at a critical spot and may move in both directions. Is the European Central Bank ready to get off the fence and act to stimulate the economy? That is the question that … “Three things to watch in the ECB Meeting Minutes – EUR/USD vulnerable”

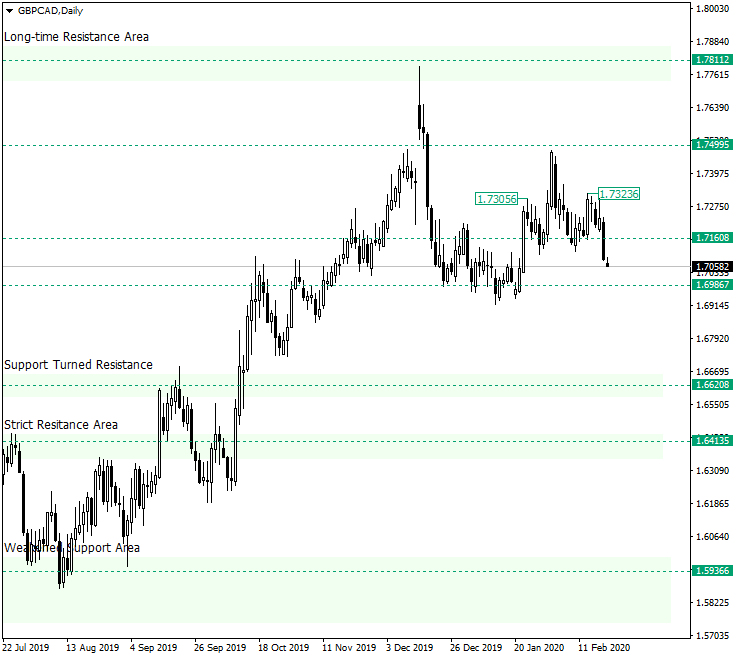

Head and Shoulders Look-Alike on NZD/CAD: Complete

The Great Britain pound versus the Canadian dollar currency pair set the depreciation into motion. Do the bulls still have any chances? Long-term perspective The confirmation of the 1.5936 support level started a strong bullish movement, one that extended until the level of 1.7811. After almost reaching the level, the price retraced under 1.7499 and confirmed it, at the start of February, as resistance. This confirmation, alongside with the highs of 1.7305 and 1.7323, respectively, … “Head and Shoulders Look-Alike on NZD/CAD: Complete”

Canadian Dollar Rallies on Chinese Stimulus, Higher Crude Prices

The Canadian dollar is rallying midweek on Chinaâs latest announcements of fiscal and monetary stimulus to combat the negative economic effects of the Wuhan coronavirus, also officially known as Covid-19. The loonie also benefited from soaring crude oil prices on Wednesday, but gains were capped on warnings that the rail blockade by protesters will affect the national economy. This week, Beijing unveiled a series of measures to shield the worldâs second-largest economy from the coronavirus’ … “Canadian Dollar Rallies on Chinese Stimulus, Higher Crude Prices”

Pound Falls Despite Upbeat UK Inflation Data and Positive US Prints

The Sterling pound today fell against the US dollar despite the release of upbeat UK inflation data in the early London session. The GBP/USD currency pair fell at a crucial support level, which has been cited by most analysts as the main reason for the pair’s decline. The GBP/USD currency pair today fell from an … “Pound Falls Despite Upbeat UK Inflation Data and Positive US Prints”

UK CPI data may be the straw that breaks cable’s back

UK inflation figures for January are set to show a rebound to 1.6%. GBP/USD has shown resilience to weak wage figures and worrying Brexit headlines. Downbeat CPI figures may be a breaking point for the pound. Sterling is strong – but for how long? GBP/USD has shown remarkable prowess in shrugging off adverse developments. It managed … “UK CPI data may be the straw that breaks cable’s back”

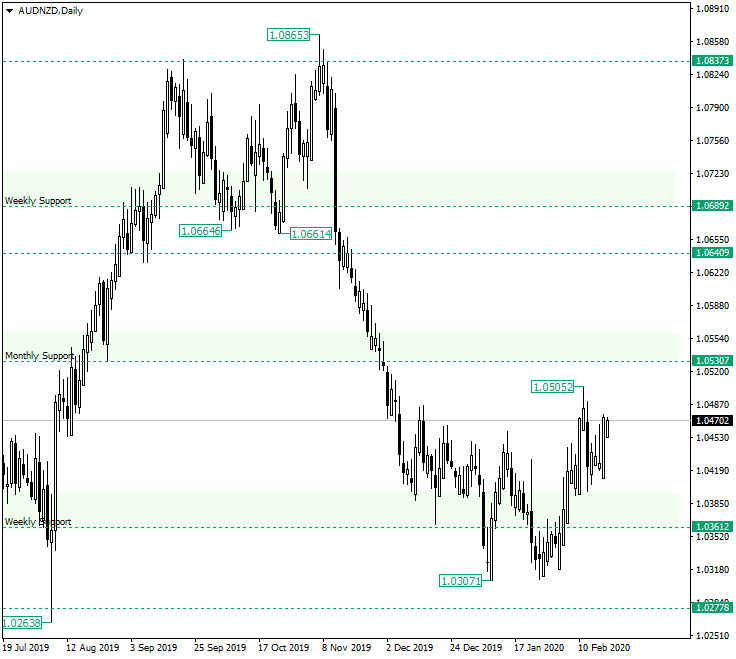

Looks like AUD/NZD Targets 1.0530

The Australian dollar versus the New Zealand dollar currency pair appears to be in bullish hands, even if the bears did all they could to send it towards the south. Long-term perspective After the confirmation of 1.0837 as resistance, the price started a strong depreciation that reached the area of 1.0361. Along this way, two important levels gave way: the weekly support of 1.0689 and the monthly support of 1.0640, respectively. But the next support, … “Looks like AUD/NZD Targets 1.0530”

Japanese Yen Rebounds Despite Heightened Recession Fears

The Japanese yen is rebounding on Tuesday after the safe-haven currency struggled to hold ground to kick off the trading week due to a disappointing gross domestic product reading. The yenâs jump, despite heightened recession fears, is being driven by decent industrial production in December. All eyes will now be on January trade data and machinery orders in December. According to government numbers, industrial production rose 1.2% in December, up from … “Japanese Yen Rebounds Despite Heightened Recession Fears”