The Chinese yuan is rebounding on Thursday as reports suggest that the central bank will unleash additional stimulus to contain the Wuhan coronavirusâ impact on the worldâs second-largest economy. While the death toll and number of confirmed cases have risen in China, global financial markets believe that the outbreak is waning. These reports come as Beijing is set to cut tariffs on US goods and report crucial trade data on Friday. According to Reuters, … “Chinese Yuan Rebounds on Expected Stimulus, Cut in Tariffs”

Euro Flat-to-Higher Despite Slump of German Manufacturing Orders

The euro was flat today and even gained on some of its rivals despite the slump of German manufacturing orders. The likely reason for the decent performance was the positive market sentiment. The Federal Statistical Office reported the German manufacturing orders dropped by 2.1% in December from the previous month. The actual reading was far worse than an increase of 0.6% predicted by analysts. On a more positive note, the previous month’s decline got a revision from 1.3% … “Euro Flat-to-Higher Despite Slump of German Manufacturing Orders”

NZ Dollar Little Changed After Mixed Employment Data

The New Zealand dollar was little changed today as local markets were closed for a holiday. The currency did not show a clear trend yesterday either after the release of mixed employment data in New Zealand. Statistics New Zealand reported that the number of employed people remained unchanged in the December quarter of 2019 versus expectations of a 0.3% increase. Employment grew by 0.2% in the previous three months. The unemployment rate fell from 4.1% … “NZ Dollar Little Changed After Mixed Employment Data”

Australian Dollar Strongest, Rising for Fourth Session

The Australian dollar was the strongest currency on the Forex market today, rallying for the fourth consecutive day thanks to the improving investors’ sentiment. The currency managed to rally even though domestic macroeconomic data failed to meet expectations for the most part. The Wuhan coronavirus continues to spread as the number of confirmed cases in China climbed by 3694 to 28018, while the death toll increased by 73 to 563. Yet it looks like investors hope that the measures to contain … “Australian Dollar Strongest, Rising for Fourth Session”

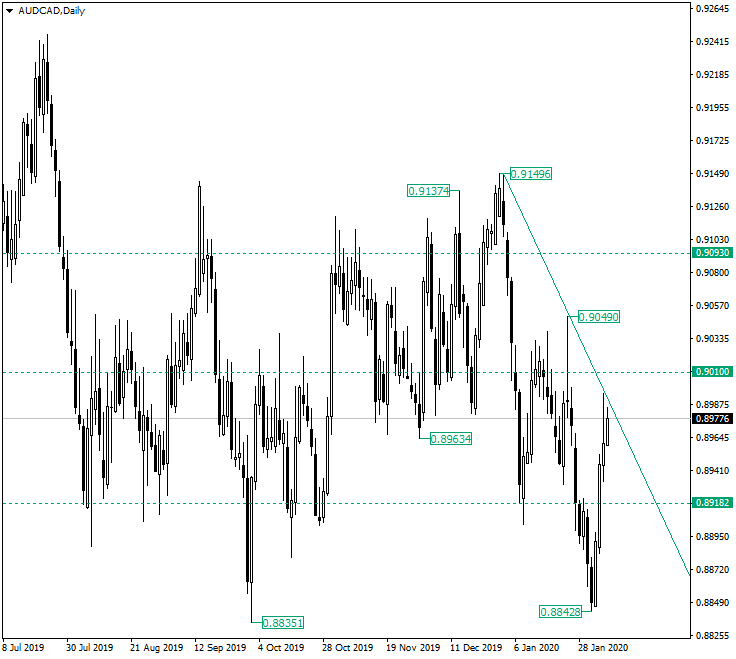

Trendline on AUD/CAD May Send It to 0.8918

The Australian dollar versus the Canadian dollar currency pair is at a very interesting spot. Long-term perspective After printing the high of 0.9149, the price retraced under the 0.9093 resistance level and continued a descent that pierced the potential support of 0.9010 and extended all the way to 0.8918. From 0.8918 an appreciation commenced, one that tried to conquer 0.9010, but ended up confirming it as resistance. In the process, a false piercing of the 0.9010 level took … “Trendline on AUD/CAD May Send It to 0.8918”

US Dollar Rises on Decline in Trade Deficit, Jobs Data

The US dollar is rising midweek on strong economic data and the rebound in global financial markets. Despite the Wuhan coronavirus significantly affecting China and spreading to other countries, traders are confident that the outbreak will be contained. The greenback is mirroring its performance from early last year as it is already up close to 2% so far in 2020. According to the Bureau of Economic Analysis (BEA), the trade deficit jumped … “US Dollar Rises on Decline in Trade Deficit, Jobs Data”

Pound Crashes Against US Dollar on Upbeat US PMI Data

The Sterling pound today attempted to rally against the US dollar, but the rally was shortlived as the greenback reversed course and drove the pound lower. The GBP/USD currency pair today rallied to its daily highs before heading lower as investor appetite for the pound waned amid a rejuvenated dollar. The GBP/USD currency pair today … “Pound Crashes Against US Dollar on Upbeat US PMI Data”

Scandinavian Capital Markets launches new Foreign Exchange trading service for Institutional Traders

Scandinavian Capital Markets, based in Stockholm, is announcing launching a new service aimed at institutional traders, in collaboration with Currenex. Here are all the details: Scandinavian Capital Markets’ new service powered by the award-winning Currenex platform STOCKHOLM, February 5, 2020 – Scandinavian Capital Markets announced today it has entered into a new partnership with Currenex … “Scandinavian Capital Markets launches new Foreign Exchange trading service for Institutional Traders”

Top five assets to run to in coronavirus times

The coronavirus outbreak has triggered demand for safe-haven assets. A similar pattern has been seen with the Iran crisis and may reoccur throughout 2020. Five financial assets stand out in these times of trouble. Whether it originates in Wuhan or Iran, financial markets always have something to worry about – but the demand for safe-haven … “Top five assets to run to in coronavirus times”

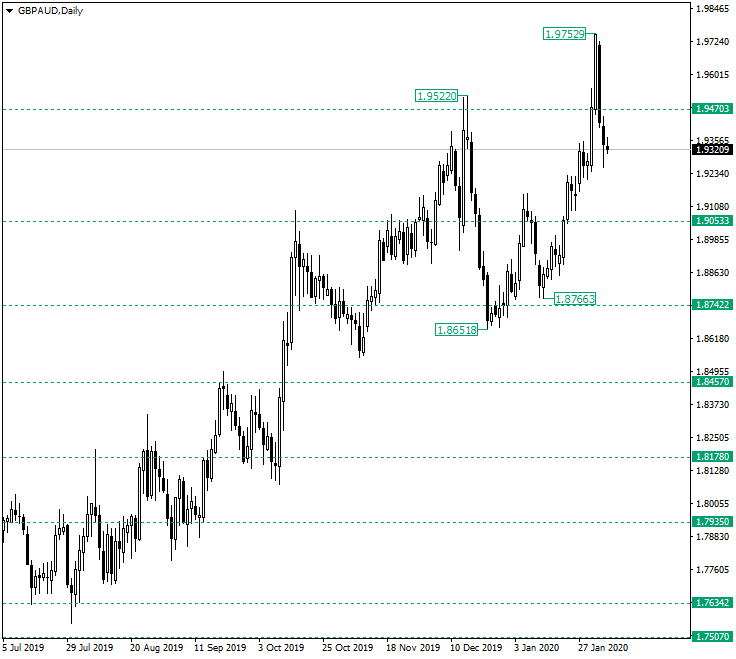

GBP/AUD Could Head for 1.9053 After Bearish Engulfing

The Great Britain pound versus the Australian dollar currency pair seems to lack the power to drive prices higher. Is this actually true or are the bulls just waiting for the right moment? Long-term perspective The ascending movement that started after 1.7634 was confirmed as support managed to conquer every level with relative ease and, thus, was able to extend until the high of 1.9752. Even if the bulls seem to be … “GBP/AUD Could Head for 1.9053 After Bearish Engulfing”