The Sterling pound today launched a major rally against the US dollar on news that Boris Johnson was thinking of extending the Brexit talks deadline past tomorrow. The GBP/USD currency pair had initially sunk to new weekly lows before the announcement triggered a shift in investor sentiment to very bullish fueling the rally. The GBP/USD currency pair today fell to a low … “Pound Rallies on Brexit Extension Hopes Ahead of Crunch Meeting”

USD/TRY Recovers After Crashing to Fresh Record Low As Turkey Unveils Three-Year Plan

The Turkish lira is recovering after crashing to a fresh record low in the middle of the trading week. The lira, which has been one of the worst-performing currencies in 2020, has repeatedly recorded all-time lows. Depleted foreign exchange reserves, slumping economic data, and geopolitical tensions â Ankara is facing pressure on many fronts, and … “USD/TRY Recovers After Crashing to Fresh Record Low As Turkey Unveils Three-Year Plan”

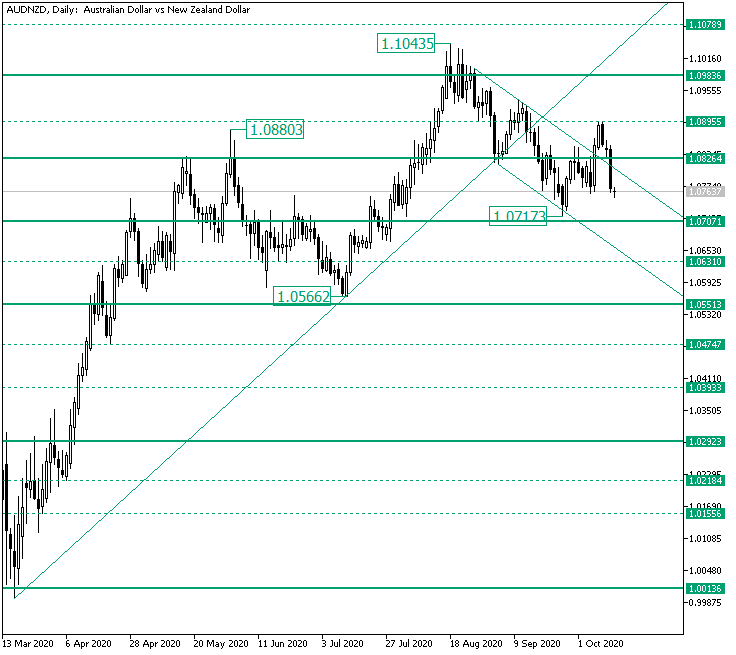

AUD/NZD Falls Beneath 1.0826. What Next?

The Australian versus the New Zealand dollar currency pair made a surprise shift in direction. Is this only a temporary development? Long-term perspective The rise that started after the validation of 1.0013 as support extended until the 1.0880 high. From that peak, the price retraced under the 1.0826 level, rendering it as a false piercing. After the bulls regained their strength, they started a new surge from the 1.0566 low, not only … “AUD/NZD Falls Beneath 1.0826. What Next?”

Euro Falls Against Dollar on Risk-Off Sentiment As Investors Flee

The euro today fell against the dollar driven by the risk-off market sentiment as investors fled the riskier assets in favour of fo safe-haven instruments such as the dollar. The EUR/USD currency pair fell over 80 pips as markets reacted to news that Johnson & Johnson was pausing its COVID-19 vaccine trial due to unexplained … “Euro Falls Against Dollar on Risk-Off Sentiment As Investors Flee”

Chinese Yuan Extends Losing Streak on PBoC Move, Exports

The Chinese yuan is extending its losing streak against a basket of major currency rivals on Tuesday. The yuan, which recently suffered its worst one-day drop in seven months, slumped on slightly lower-than-expected trade data. With more economic data being released this week, the yuan could come under a lot of pressure and reverse its significant 2020 rally. According to the General Administration of Customs, China’s trade surplus slipped … “Chinese Yuan Extends Losing Streak on PBoC Move, Exports”

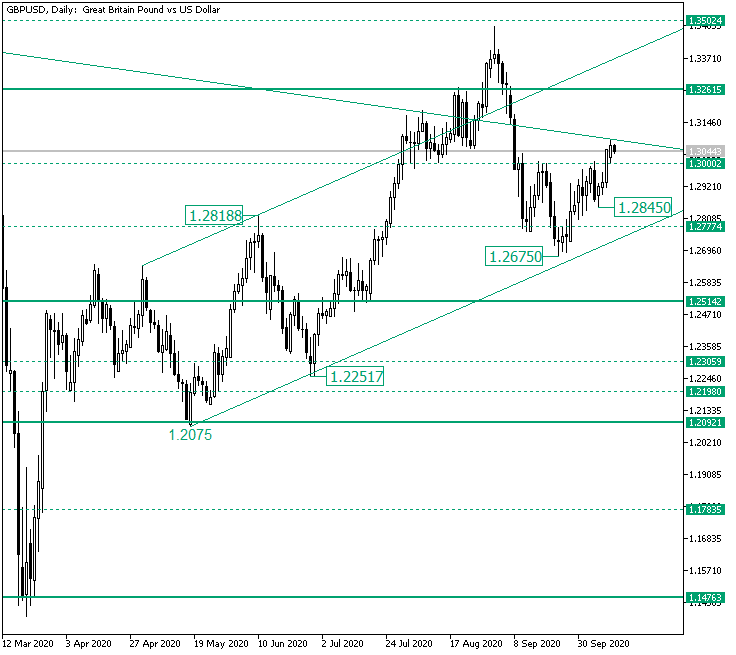

1.3000 On GBP/USD, Conquered by the Bulls?

The Great Britain pound versus the United States dollar currency pair seems to be willing to head north. Do the bulls have enough steam for that? Long-term perspective After the appreciation that came about following the confirmation of 1.1476 as support, the price started an ascending trend. The first impulsive swing, which started after a relative range trading phase, extended from the 1.2075 low to the 1.2818 high. After the correction that joins … “1.3000 On GBP/USD, Conquered by the Bulls?”

Swiss Franc Mixed After Positive Revision of Economic Forecasts

The Swiss franc was mixed today following the release of an updated economic forecast from Switzerland’s government. The State Secretariat for Economic Affairs released an updated economic forecast for 2020 and 2021. The updated forecast predicts that gross domestic product adjusted for sports events will fall by 3.8% this year, which is better than the July forecast of a 6.2% drop. The Consumer Price Index is expected to fall by 0.7%, whereas the previous … “Swiss Franc Mixed After Positive Revision of Economic Forecasts”

US Dollar Flat As Investors Weigh Fiscal Stimulus Talks, Wait for Inflation Data

The US dollar is kick off the trading week relatively flat, hovering at its lowest level in three weeks. With not much economic data to work with, investors are weighing fiscal stimulus in Washington and the 2020 presidential election in a couple of weeks. Will traders adopt a wait-and-see approach to the greenback for the remainder of October? On Sunday, President Donald Trump urged Congress to approve a stripped-down version of the fiscal stimulus and relief package. The White … “US Dollar Flat As Investors Weigh Fiscal Stimulus Talks, Wait for Inflation Data”

Japanese Yen Gains During Monday’s Quiet Trading

The Japanese yen gained, rising against all other most-traded currencies, during Monday’s quiet trading. Today’s calendar is light in terms of macroeconomic releases, and trading is expected to be quieter than usual due to holidays in the United States and Canada. As for today’s economic reports in Japan itself, they were mixed. The Bank of Japan reported that the Producer Price Index fell by 0.8% in September, year-on-year, after declining by 0.6% in August. … “Japanese Yen Gains During Monday’s Quiet Trading”

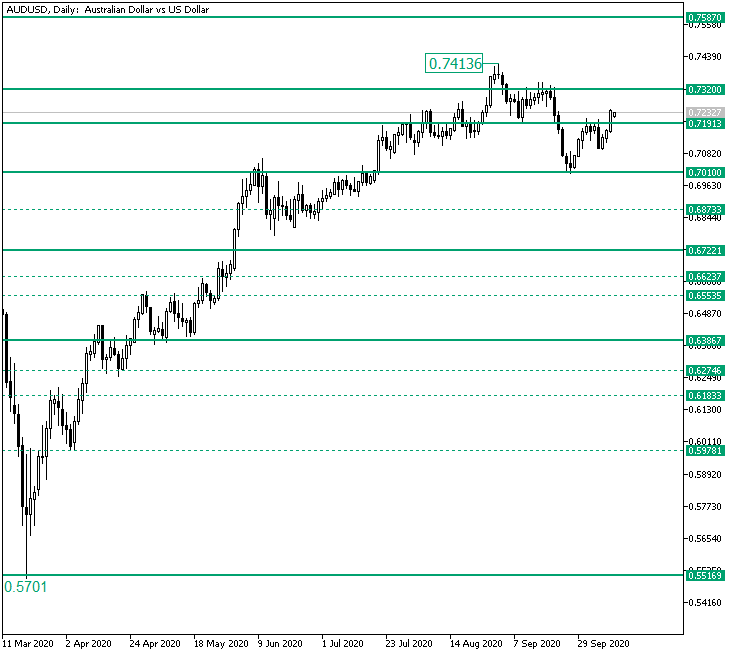

Bulls Set for 0.7320 on AUD/USD?

The Australian versus the United States dollar currency pair seems to be determined to reach for 0.7320. Long-term perspective The rise that took place from the 0.5701 low extended all the way to the 0.7413 high. From there, the price slipped under the 0.7320 level, which had just been pierced. The resulting drop reached the next support area, 0.7191. From 0.7191, the bulls attempted a recovery, but their efforts were limited … “Bulls Set for 0.7320 on AUD/USD?”