Guest post by Kris Matthews tradeforexfundamentally.com

Have you ever put a trade on after seeing the market run nicely in one direction only to see the market immediately move in the opposite direction? Have you ever waited for a pair to come down to a specific price level that you were certain would hold, only to see the market blast right down through your entry without even caring?

Chances are you’ve done your research and have a strategy for identifying turning points or trends, so that’s not the issue. You’ve been selecting good currency pairs to trade with so that’s not the issue. So what is it? Entries.

I want to show you how to make optimal entries for forex profits, but first we need to get clear on two things:

- Direction: You need to align yourself to the overall direction of the market. Price action is very random, especially on the smaller time frames, and you can’t afford to chase every up and down move. Instead, analyze sentiment through your forex price chart or by looking at fundamental news. Once you figure out the direction, only make trades in that direction.

- Objective: What are you trying to get out of this trade? Are you trying to catch a bounce at a specific level, or to get into the market to ride a trend from the beginning?

Entries for trading the trend

The objective here is to get in, not so much at the right price level, but the right time. You want to find the setup on your price chart or in the news that most often leads to the beginning of a new trend. Here are some suggestions for entries to achieve maximal forex profits:

- Look for rejection of price from a key support/resistance level. I define a key level as a level that has marked many significant previous highs/lows in the past or are marked by round numbers (e.g. 1.20 as opposed to 1.1917). I define rejection as price trying to move through it but quickly bounces back and away.

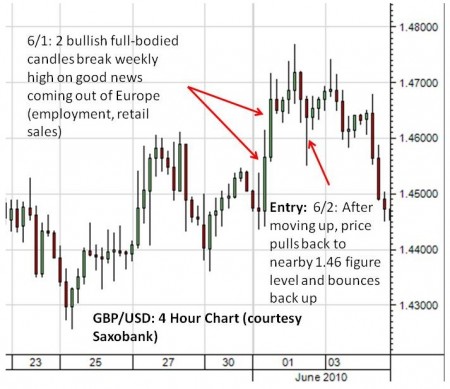

- After spotting that price is unwilling to move past a certain level and reverses direction, look for a continuation of that reversal via large full-bodied candles on the price chart, preferably supported by a surprise economic data release.

- Look for price to break the week’s high or low after the big move described in (2).

- Enter on a slight pullback (10-20%). Often you will see that after price breaks through a weekly high/low with strong volume, it doesn’t pull back much. This is where most traders fail because they want to get in at a “good” price level (a.k.a a “discount”) and wait for price to pull back 50-80% only to realize that the market was done making it’s move and is now moving in the opposite direction and ready to blow right past their stop losses. Here’s a question: Why would you want to wait for price to pull back if you know that price is going to keep going in a particular direction?

Entries for catching bounces

Now the strategy for bounces is a little different because we often have smaller profit targets and are trying to catch really quick moves. In this case, we often desire to wait for pullbacks. Here’s a brief entry strategy:

- Look for price to convincingly clear new weekly highs/lows with full bodied candles (indicating large volume and conviction of the market), preferably supported by a market reaction to surprising economic data (i.e. strong sentiment).

- After breaking a level strongly, wait for price to come back and retest that level OR a nearby key level. As I mentioned above, price doesn’t always pull back a great deal, especially after strong movement. For this reason, you might want to expect a shallow pullback to a nearby key level if price breaks very far away from the previous high/low.

There you have it. Two types of entries for two different types of objectives. I hope you find the value in combining fundamentals and technicals together to spot high probability trades in the forex market rather than getting mixed up by the randomness of price action.