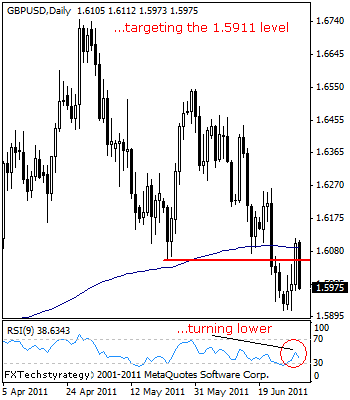

GBPUSD: Reverses Gains, Set For 1.5911 Level

GBPUSD: The pair has failed to follow through higher on the back of its Wednesday gains and tumbled lower wiping out those gains early trading today.

With GBP dominated by its bearishness triggered from the 1.6745 level, its 2011 high, a return to the 1.5911 level, its Jun 26’2011 low could be developing.

A break of that level will resume its short term downtrend towards the 1.5749 level, its Jan 25’2011 low and then the 1.5700 level, its psycho level.

Guest post by www.fxtechstrategy.com

Its daily RSI has turned lower suggesting further weakness. Alternatively, a convincing break above the 1.6076/56 zone follow with a loss of the 1.6112 level will have to occur to prevent a return to the 1.5911 level.

However, the ultimate test will be a return above the 1.6546 level, its May 31’2011 high. This if seen will target the 1.6743 level, its 2011 high and then the 1.6877 level, its Nov’2009 high.

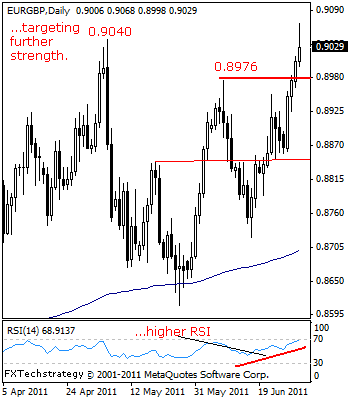

EURGBP: Bullish, Surges Higher.

EURGBP- With a firm hold above the 0.8976 levels, its Jun 08’2011 high seen and a test of the 0.9040 level, its May 05’2011 high now occurring, further bullish offensive looks to continue.

The caveat though is to watch closely how the price plays out at the 0.9040 level, which the cross needs to break and hold above to target additional gains.

However, a convincing break (0.9040) will trigger further strength towards the 0.9150 level, its Feb’2010 high and then the 0.9200 level, its psycho level.

Its daily and weekly RSI are bullish and pointing higher supporting this view. On the other hand, the risk to our analysis will be a return below the 0.8976 level, its Jun 08’2011 high violated on Wednesday.

If this is seen, further downside risk will build up towards the 0.8720 level, its Jun 16’2011 low. A breather may occur here but on any failure, further declines will shape up towards the 0.8610 level, its May 26’2011 low.