USDCHF: While the pair’s three-week uptrend may be intact, corrective pullback risk continues to develop. With USDCHF closing flat the past week, we think a correction of the mentioned uptrend could be building up further. In such a case, the 0.8932 level comes in as the next downside objective. A turn below here will expose … “USDCHF: Looks To Trigger More Corrective Weakness.”

Month: May 2014

Euro Had Decent Trading Week, Terrible Month

The euro had rather decent week, falling initially but rescued by the weekend by poor data from the United States. The monthly performance, on the other hand, was nothing but disastrous for the currency. The euro was rather soft for the most part of the week, mainly due to speculations about stimulus from the European Central Bank, but managed to bounce by the end of the week with help of poor macroeconomic reports from the USA, which hurt the dollar. … “Euro Had Decent Trading Week, Terrible Month”

Australian Dollar Moves Inversely to Fundamental Data

The Australian dollar fell today versus the euro and the Japanese yen, staying flat against its US counterpart at the same time. It is a puzzling behavior as today’s economic report was good, while yesterday’s data was bad but did not prevent the Aussie’s rally. Today’s data about private sector borrowing showed an increase by 0.5 percent in April, while analysts expected a 0.4 percent increase — the same as in March. … “Australian Dollar Moves Inversely to Fundamental Data”

Canadian Dollar Drops as Economic Data Disappoints

The Canadian dollar edged today as economic data from Canada, including a very important report about economic growth, was rather poor, meaning that it is unlikely for the Bank of Canada to tighten its monetary policy in the near future. Canada’s gross domestic product expanded 0.1 percent in March, in line with expectations, slowing from February’s growth of 0.2 percent. GDP grew 0.3 percent in the first quarter of 2014 … “Canadian Dollar Drops as Economic Data Disappoints”

US Dollar Slips on Consumer Spending News

The US dollar is slipping today, heading mostly lower as the latest economic data disappoints. Concerns about the still-slow economic recovery continue are holding the greenback down right now. Consumer spending in the United States fell for the first time in a year, with the US Commerce Department reporting that spending slipped 0.1 per cent last month. This news comes on the heels of an adjusted GDP report for the first quarter of 2014 … “US Dollar Slips on Consumer Spending News”

Euro Gains Some Ground Against the US Dollar

Even with deflation worries increasing in the eurozone, the 18-nation currency is gaining some ground against the US dollar right now. US data is a bit disappointing, and that is giving euro a bit of an edge right now. The latest inflation data is in from Spain and Ireland, and it appears that those countries are well below the mark. This news means that the eurozone’s continued battle against deflation … “Euro Gains Some Ground Against the US Dollar”

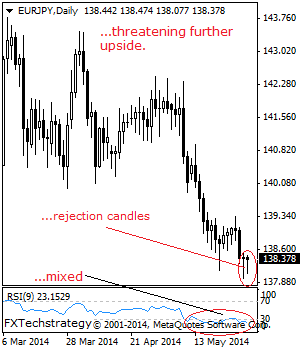

EURJPY: Recovery Risk Builds Up

EURJPY- The cross may continue to face downside vulnerability but now faces recovery risk with a rejection candle printed on Thursday. It will have to follow through on that recovery to open the door for more upside. Resistance resides at 139.35 level where a break will aim at the 140.00 level and then the 140.94. … “EURJPY: Recovery Risk Builds Up”

GBP Gains on USD as UK Consumer Sentiment & House Prices Rise

The Great Britain pound rallied against the US dollar today as the UK consumer sentiment improved and house prices were rising. The sterling trimmed its gains against the greenback by now and trades virtually flat versus the Japanese yen. The GfK UK Consumer Confidence Index rose from -3 in April to 0 in May. The report commented on the result: A rise of three points in the Index in a month is itself a significant change, but what matters … “GBP Gains on USD as UK Consumer Sentiment & House Prices Rise”

Yen Rises with Inflation, Has Troubles Keeping Gains

The Japanese yen rallied today as nation’s consumer inflation accelerated, reducing chances for additional stimulating measures from the central bank. The currency has troubles keeping gains, trimming its rally versus the US dollar and erasing it completely against the euro. Japan’s core Consumer Price Index rose 3.2 percent in April after rising 1.3 percent in March. Tokyo core CPI was up 2.8 percent in May following … “Yen Rises with Inflation, Has Troubles Keeping Gains”

David Cooney of MahiFX inducted into Profit & Loss Hall

David Cooney, which founded MahiFX and MFX Compass was inducted into the Profit and Loss Hall of Fame for his contributions to the forex industry. MahiFX recently launched its institutional solution MFX Compass. For more about the introduction of Cooney, here is the official press release: NEW YORK and LONDON, 30 May 2014 – MahiFX Ltd, … “David Cooney of MahiFX inducted into Profit & Loss Hall”