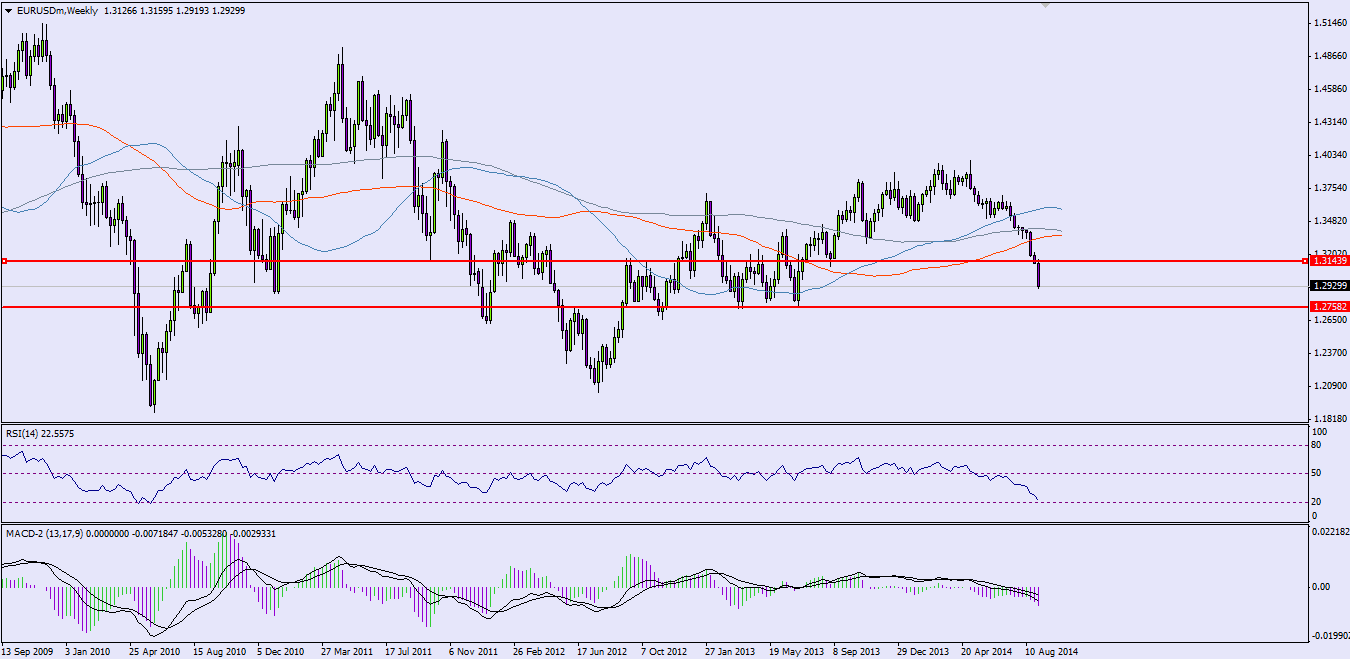

US Non-Farm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Update: Non-Farm Payrolls disappoint with only 142K – USD falling Here are the details and 5 possible outcomes for … “EUR/USD: Trading the US NFP Sep 2014”

Month: September 2014

Loonie Trades Mixed as This Week’s Dust Settles

Canadian dollar is trading mixed today, looking for solid direction as the dust from this week settles. The Bank of Canada kept things steady, but elsewhere, there is plenty of turmoil. Many are still waiting for the Bank of Canada to start raising rates again. After all, the Canadian economy continues to hold up admirably, and some are getting concerned about inflation. However, BOC Governor Stephen Poloz has … “Loonie Trades Mixed as This Week’s Dust Settles”

Euro Makes Small Gains

Euro is eking out some small gains today, following yesterday’s huge drop against all major counterparts. Forex traders aren’t expecting much, though. The big shocker from the ECB is likely to result in general euro weakness for a while. For months, Forex traders and other have been speculating about what the ECB would do to help boost the eurozone economy. Any move would, of course, weaken the euro, … “Euro Makes Small Gains”

Euro Nosedives as ECB surprises with a rate cut

The Euro crashed yesterday against all major currencies, including the US dollar, the British pound and the Australian dollar. The reason behind the fall was the ECB interest rate decision. The European central bank decided to cut the key interest rates to new record lows at the September meeting. This came as a shock to the investors, as the … “Euro Nosedives as ECB surprises with a rate cut”

Dollar Holds onto Massive Gains

The US dollar demonstrated huge gains today, mostly with help from the European Central Bank policy decision, but also due to the string of positive domestic economic indicators that supported the outlook for monetary tightening from the Federal Reserve. The major driver for the Forex market today was the ECB decision. While all major currencies rallied against the euro, the dollar profited the most from the resulting risk aversion. News from … “Dollar Holds onto Massive Gains”

Sterling Attempts to Gain Ground After BoE

The Great Britain pound experienced weakness today but halted its decline and attempted to gain ground after the Bank of England decided to keep its monetary policy unchanged. The BoE announced today: The Bank of Englandâs Monetary Policy Committee at its meeting today voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion. Such decision was … “Sterling Attempts to Gain Ground After BoE”

Yen Recovers After BoJ, Remains Soft vs. Dollar

The Japanese yen recovered a bit after earlier losses today after the Bank of Japan announced no changes to its monetary policy. While the currency remained soft versus the US dollar, it pared losses against some other majors. Japanese policy makers decided in an unanimous vote to keep interest rates close to zero and the size of asset purchases at ¥60–70 trillion. The yen was weak ahead of the meeting as traders were somewhat … “Yen Recovers After BoJ, Remains Soft vs. Dollar”

Big Shock: ECB Cuts Interest Rates to Record Lows

The European Central Bank provided a big surprise to the Forex market today, cutting interest rates to new lows, sending some of them deeper into a negative territory. What was not surprising was the reaction of the euro to the news — the currency sank, falling to the lowest rate in more than a year against the US dollar. The ECB announced today that it cut the benchmark interest rate on the main refinancing operations by 10 basis points … “Big Shock: ECB Cuts Interest Rates to Record Lows”

Fundamental Currency Analysis for September 4th 2014

USD: The U.S. Dollar opened lower overall this morning in Asia, with the U.S. Dollar Index trading as low as 82.8360 before rallying back to its current level of 82.8720. U.S. Factory Orders came in at +10.5 percent, missing analyst expectations of +10.9 percent. The Fed’s Beige Book showed economic improvement in all twelve Federal … “Fundamental Currency Analysis for September 4th 2014”

Policy Expectations Boost US Dollar Index

US dollar is mostly higher today, thanks in large part to policy expectations. Many expect the Federal Reserve to start tightening soon, and that is leading to gains for the greenback. The latest economic data out of the United States continues to indicate that an economic recovery is underway. This recent recovery has been somewhat slow, but it is nonetheless moving in a positive direction, and that is helping the greenback. US … “Policy Expectations Boost US Dollar Index”