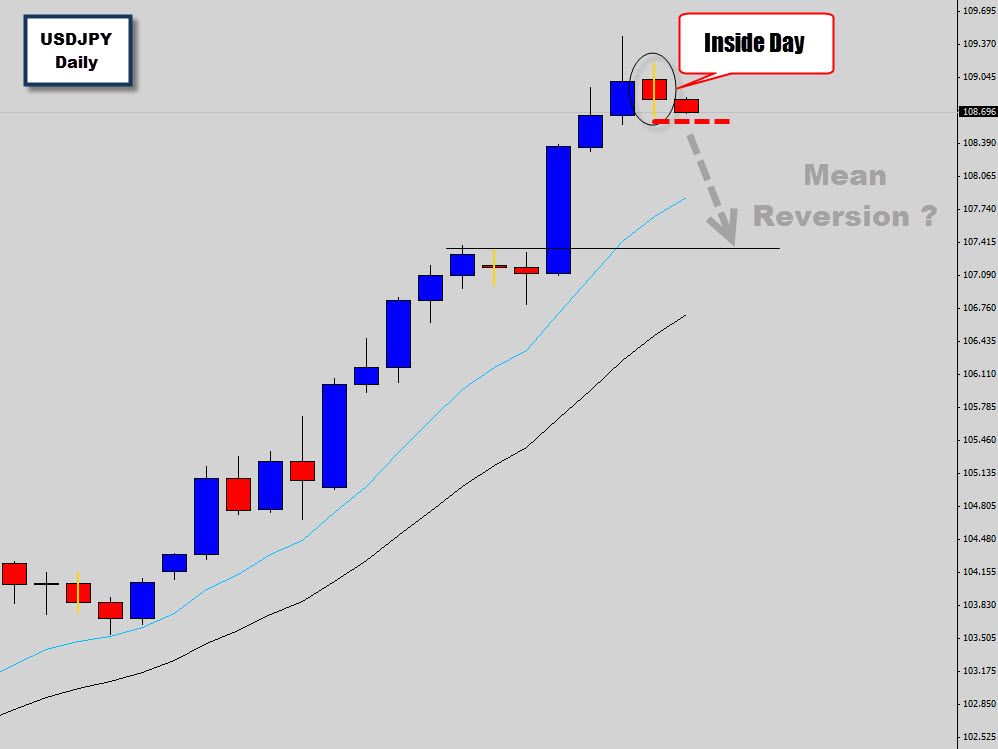

The USDJPY has rallied aggressively higher after breaking out of the long term consolidation pattern we witnessed for the first half of the year. It’s no surprise the breakout out of such a long term churning pattern has been so explosive. The bullish momentum has now pushed price to an extended point relative to its … “USDJPY Upward Momentum Stalls – Getting Ready to Catch a”

Month: September 2014

Fears of China’s Slowdown Push Aussie Lower

The Australian dollar dipped today together with other growth-related currencies due to concerns about potential slowdown of economic expansion in China. Fears of slowing growth hurt the Aussie both directly and indirectly, pushing prices for commodities lower. Prospects for slower growth in China bode ill for the Australian economy, as the Asian nation is the biggest importer of Australia’s goods. Additionally, prices for raw materials declined due to fears of lower demand from China. … “Fears of China’s Slowdown Push Aussie Lower”

AUD/USD: Trading the Chinese Flash PMI Sep 2014

Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible … “AUD/USD: Trading the Chinese Flash PMI Sep 2014”

Fundamentals Prevent NZD from Rallying

The New Zealand dollar attempted to rally today but failed and slid below the opening level. Economic data from New Zealand was not particularly supportive for the currency, and concerns about tomorrow’s manufacturing report from China further eroded bullishness of the kiwi. The New Zealand currency rallied after the National Party of Prime Minister John Key secured majority in the parliament, giving it power to introduce reforms that are necessary … “Fundamentals Prevent NZD from Rallying”

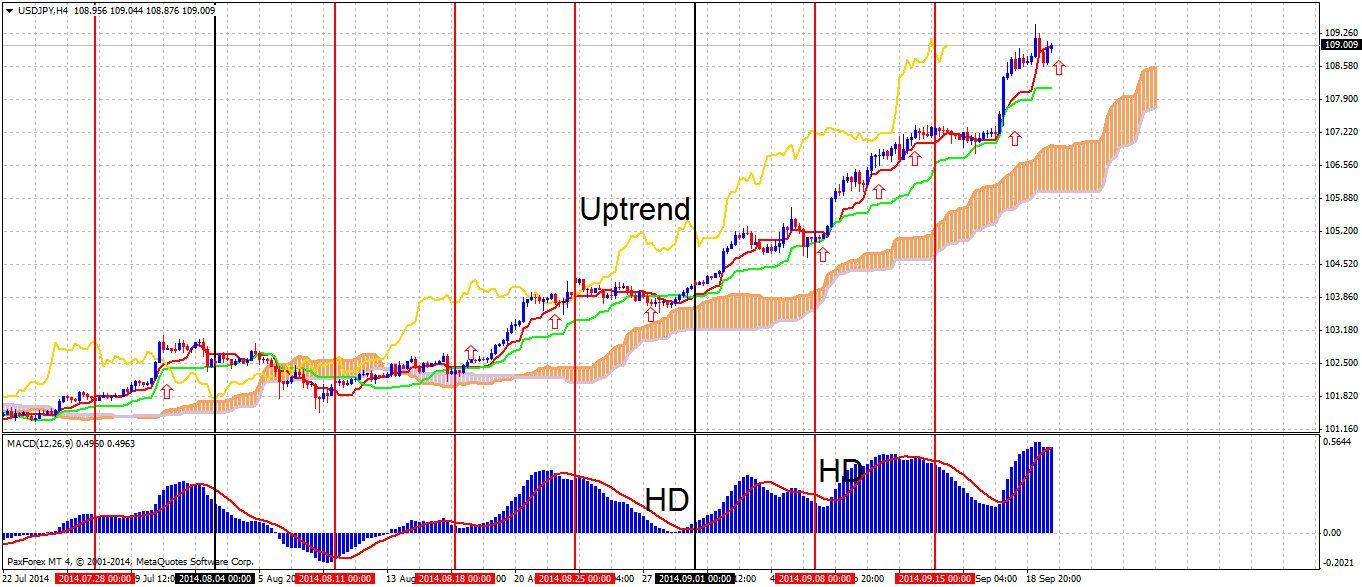

How to Catch the Ichimoku Trend

This strategy is based on an amazing Japanese indicator – Ichimoku Kinko Hyo. The system is used to catch the trend as its name suggests. It uses only one indicator though it can be combined with MACD to find better trade setups or conditions to close position. The system uses both Clouds and its 2 … “How to Catch the Ichimoku Trend”

Why You Need To Change How You Think About Forex Trading

Why You Need To Change How You Think About Trading Improve Your Trading by Knowing this One Fact I get a lot of emails from traders asking me various trading-related questions. Upon reading these emails, probably about 95% of the time I can tell that the trader emailing me is not even aware of the … “Why You Need To Change How You Think About Forex Trading”

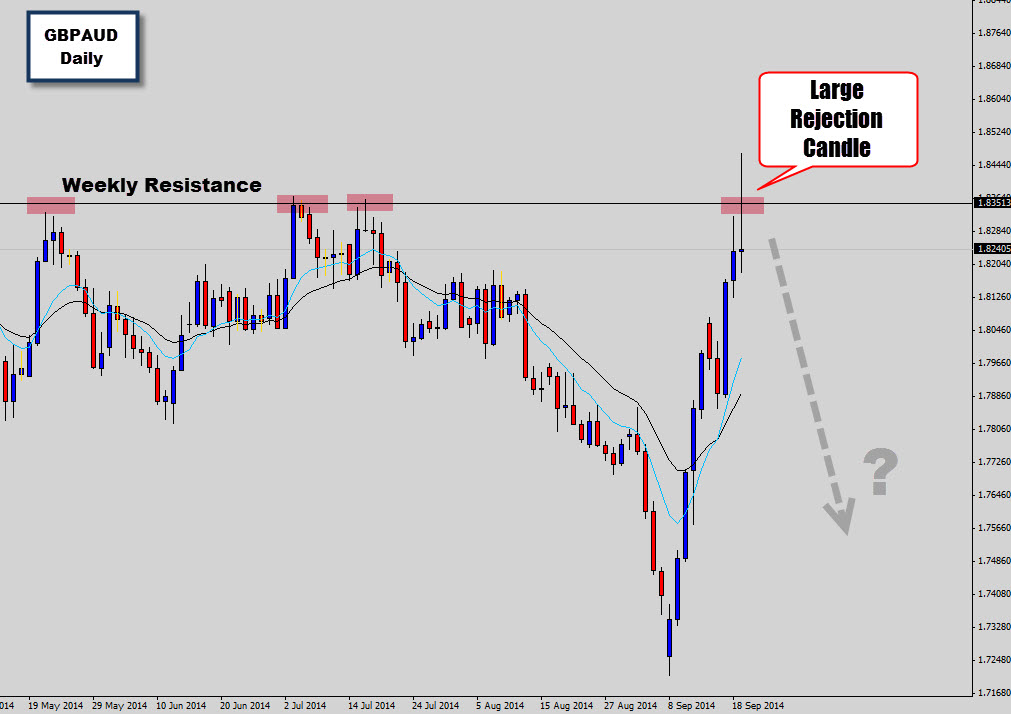

GBPAUD Prints Massive Reversal Signal at Weekly Resistance

The news about the Scottish independence has been ‘the’ hot topic amongst Forex traders this week causing heavily volatility on the GBP markets. As most of you know, I don’t follow the news or fundamentals too heavily. One of the benefits of price action trading is letting the charts communicate how the market ‘feels’ about … “GBPAUD Prints Massive Reversal Signal at Weekly Resistance”

Referendum Week Turns Positive for Sterling

The Great Britain pound demonstrated solid performance this week as traders were betting on Scotland staying in the United Kingdom after the referendum about independence. Another important event this week was the Federal Reserve policy meeting that gave boost to the US dollar. While there were concerns that Scotland may break away from Great Britain, the prevailing view this week was that the UK will remain … “Referendum Week Turns Positive for Sterling”

Orbex launches “Upgrade Forex” social media contest for traders

Here is the official press release: International forex broker, Orbex, has recently launched their social contest ‘’Upgrade Forex’’ for traders to compete for the number of shares on social networks. Orbex, formerly known as AFBFX, has once again shown their focus on a social network side of forex by introducing the Orbex-Man in their fun … “Orbex launches “Upgrade Forex” social media contest for traders”

Malaysian Central Bank Keeps Rates on Hold, Ringgit Drops

The Malaysian ringgit fell today, heading to the biggest weekly drop since August, after the nation’s central bank refrained from changing its monetary policy and kept the benchmark Overnight Policy Rate unchanged. The Bank Negara Malaysia left its key interest rate at 3.25 percent today. Regarding the outlook for monetary policy in future, the central bank commented: Further adjustment to the degree of monetary accommodation may be taken depending on how … “Malaysian Central Bank Keeps Rates on Hold, Ringgit Drops”