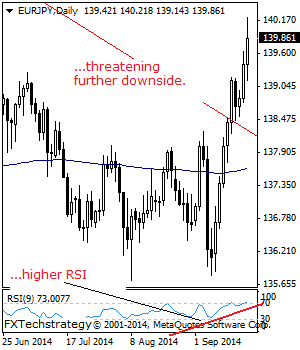

EURJPY- With the cross reversing its one-day correction, further upside is now expected. On the upside, resistance resides at the 140.50 level where a break if seen will threaten further upside towards the 141.00. Further out, resistance resides at the 141.50 level where a break will aim at the 142.00. Support comes in at the … “EURJPY: Bullish, Threatens Further Upside”

Month: September 2014

Global Business & Finance Review award FXTM

Cyprus based broker FXTM won two awards in Asia: the Fastest Growing ECN Broker Asia 2014 and the Best Partner Program Asia 2014. FXTM recently won a “Best Newcomer” award by World Finance. For more, here is the official press release: International forex broker Forex Time (FXTM) has once again been recognized as an influential player in … “Global Business & Finance Review award FXTM”

Global Business & Finance Review award FXTM

Cyprus based broker FXTM won two awards in Asia: the Fastest Growing ECN Broker Asia 2014 and the Best Partner Program Asia 2014. FXTM recently won a “Best Newcomer” award by World Finance. For more, here is the official press release: International forex broker Forex Time (FXTM) has once again been recognized as an influential player in … “Global Business & Finance Review award FXTM”

New Zealand Economic Growth Lifts NZD

The New Zealand dollar advanced today with the help of a positive report about nation’s economic growth. The kiwi managed to reverse earlier losses and rally versus its US counterpart but is far from erasing yesterday’s huge drop. New Zealand gross domestic product expanded 0.7 percent in the second quarter of this year. While the growth was slower than the first quarter’s 1.0 percent, the actual value was … “New Zealand Economic Growth Lifts NZD”

Dollar Rallies After Fed Meeting, Keeps Gains

The major event this week was the monetary policy meeting of the Federal Reserve that ended yesterday. While the Fed did not present clear timing for a start of monetary tightening and the tone of the statement was not much more hawkish than it has been before, the US dollar rallied nevertheless and continued to rise today. The Fed trimmed its bond-purchasing program by another $10 billion and central bank’s chief Janet Yellen … “Dollar Rallies After Fed Meeting, Keeps Gains”

Yellen is cautious, but markets want to buy dollars –

The Federal Reserve did not change its language regarding the rate hike: the word “considerable” remained in the text. In addition, the labor market is still seen as “underutilized”. However, we are in a bullish USD market and markets found not-so-important changes to get hung upon: a second hawkish dissenter, a marginal rise in the … “Yellen is cautious, but markets want to buy dollars –”

Fed Quick Preview: Considerable chance of dollar slide

The Fed is expected to taper its bond buys for the 7th time to $15 billion, in the last taper before QE end in October. Without a change in rate hike expectations, Yellen is expected to maintain the dovish approach and to disappoint USD bulls. Some are expecting Yellen and her colleagues to alter the … “Fed Quick Preview: Considerable chance of dollar slide”

Investing in exotics: how long will the dollar’s rise

One of the prevailing stories in August was the strength of USD, spurred by positive news from US economic figures. After a long period where the relative state of the recovery in the UK and US appeared to be tied, the US economy appeared to be making major strides ahead. In September, despite a brief … “Investing in exotics: how long will the dollar’s rise”

The case for Yes – 5 reasons why the polls

The latest polls show a stronger convergence towards a No vote in the Scotland referendum vote, and one betting firm is already paying out on some of the No bets. There is a growing notion that a No vote is 90% priced in. This makes a Yes vote an even wilder outcome for the markets. But … “The case for Yes – 5 reasons why the polls”

GBPUSD: Maintains Recovery Bias

GBPUSD: With GBP following through on the back of its recovery during early trading today, it faces risk of continuation of that strength. Resistance resides at the 1.6350 level with a break aiming at the 1.6400 level. A violation will aim at the 1.6450 level and possibly higher towards the 1.6500 level. Its daily RSI … “GBPUSD: Maintains Recovery Bias”