The US dollar is consolidating right now, moving slightly lower ahead of today’s expected Federal Reserve announcement. For the most part, Forex traders are in wait and see mode, waiting to see what Fed Chair Janet Yellen has to say about US monetary policy. Many traders are interested to learn whether or not she will provide any new hints about when interest rates might rise. … “Dollar Consolidating Ahead of FOMC”

Month: September 2014

Thai Baht Unable to Maintain Rally After Central Bank’s Decision

The Bank of Thailand decided to keep its main interest rate unchanged during today’s policy meeting. The Thai baht attempted to rally after the decision but failed and currently is trading below the opening level. The central bank stayed put, leaving the policy rate at 2 percent. While policy makers said in the statement that “global economy recovered at a moderate pace”, they had a mixed view on the domestic economy. As a result, the members … “Thai Baht Unable to Maintain Rally After Central Bank’s Decision”

Aussie Unable to Profit from China’s Stimulus

The Australian dollar fell today with despite news from China that was supportive for the currency. Domestic fundamentals were not in favor of the Aussie and it is likely that poor economic data played a part in the currency’s decline. The People’s Bank of China injected CNY 500 billion of liquidity by providing money to five major state-owned banks. It was a surprise for traders and good news to growth-related currencies, but the Australian dollar … “Aussie Unable to Profit from China’s Stimulus”

NZ Dollar Reverses Gains as Current-Account Deficit Widens

The New Zealand dollar dipped, reversing yesterday’s rally, as a report released today revealed that the nation’s current account deficit widened last quarter. It was the first decline this week after two sessions of gains. New Zealand’s current account balance demonstrated a gap of NZ$2.0 billion in the June quarter, up from NZ$$1.4 billion in the March quarter. On an annual basis, the deficit shrank from 2.7 percent to 2.5 percent … “NZ Dollar Reverses Gains as Current-Account Deficit Widens”

Canadian Dollar Keeps Huge Gains

The Canadian dollar was little changed today following yesterday’s big jump. The rally was caused by both domestic fundamentals and developments on the global markets that were largely beneficial for the loonie. Canadian manufacturing sales jumped 2.5 percent in July to a new record. Bank of Canada Governor Stephen Poloz voiced hope for revival of exports, particularly energy products. As an echo of such outlook, prices for crude oil, the major Canada’s export commodity, … “Canadian Dollar Keeps Huge Gains”

Brazilian Real Strengthens Ahead of Election Month

The Brazilian real rose today as investors wait for an outcome of the presidential elections that will occur next month and a monetary policy decision of the Federal Reserve that will be announced tomorrow. According to polls, the current president Dilma Rousseff and opposition candidate Marina Silva have roughly the same amount of votes. The resulting political uncertainty could have resulted in excessive volatility for the real if not for the fact that traders are reluctant … “Brazilian Real Strengthens Ahead of Election Month”

Russian Ruble Drops to Record Lows on Sanction Fears

The Russian ruble dropped to all-time lows today due to concerns about potential impact of sanctions from the United States and the European Union on Russia’s economy. The Bank of Russia left its interest rates unchanged at its meeting last week even though inflation spiked as the currency crashed. The central bank said that monetary tightening is unlikely in the future even though the sanctions will have “a prolonged impact” on the economy. Still, there … “Russian Ruble Drops to Record Lows on Sanction Fears”

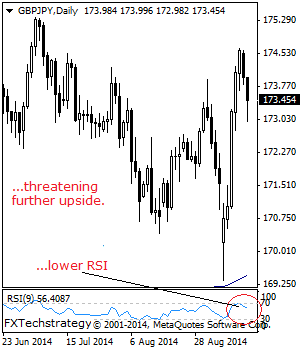

GBPJPY: Declines On Corrective Weakness

GBPJPY – With GBPJPY seen weakening on corrective pullback, more downside is envisaged. On the downside, support comes in at the 173.00 level where a violation will aim at the 172.50 level. A break below here will target the 172.00 level followed by the 171.50 level. Further down, support lies at the 171.00 level. Resistance … “GBPJPY: Declines On Corrective Weakness”

Euro Mostly Steady Following ZEW

Euro remains mostly steady following the latest ZEW report. Even though the ZEW showed a drop, the 18-nation currency didn’t follow suit. For now, it looks as though Forex traders are settling in to the current state of things. The latest reading of the German ZEW showed a drop to 6.9 this month, from 8.6 last month. The drop, according to analysts, is due in large part to concerns about Russia. The European Union has … “Euro Mostly Steady Following ZEW”

Pound Continues to Struggle as Independence Vote Looms

The vote on Scottish independence is coming up on Thursday, and the pound continues to struggle on uncertainty surrounding the outcome of the vote, as well as speculation about what might happen if the Scots really do vote to split off from the United Kingdom. On September 18, the residents of Scotland will head to the polls to determine whether or not they want to remain part of the United Kingdom. The United Kingdom has been existence for more than 300 years, … “Pound Continues to Struggle as Independence Vote Looms”