The Australian dollar advanced today, rising for the second trading session, after the release of central bank’s policy minutes. The currency managed to bounce to Friday’s closing level against the US dollar and the euro after opening sharply lower on Monday but struggled to rise against the Japanese yen. The minutes revealed a mixed picture of Australia’s economic performance, saying that “exports had declined” and “labour market conditions had remained subdued” but mentioning … “Aussie Extends Rally After RBA Minutes”

Month: September 2014

EUR/USD: Trading The German ZEW Sep 2014

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 9:00 GMT. Indicator Background … “EUR/USD: Trading The German ZEW Sep 2014”

Dollar Backs Off After Mixed Data

The US dollar backed off today against its major peers, but the losses for the most part were not as big as yesterday’s gains. As an exception, the greenback closed flat versus the Japanese yen on Monday and sank today. Monday’s data from the United States was mixed, and it perhaps played a role in the halt of the dollar’s rally. While the Empire State Manufacturing Survey was very good, saying that “business activity expanded … “Dollar Backs Off After Mixed Data”

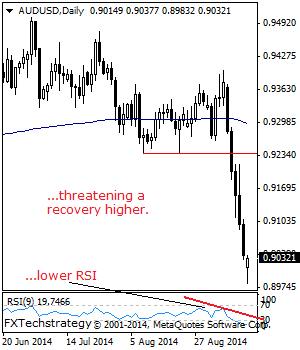

AUDUSD: Halts Weakness, Looks To Recover Higher

AUDUSD: With the pair halting its past week sell off, we envisaging a corrective recovery higher in the days ahead. Support lies at the 0.8983 level. A cut through here will turn attention to the 0.8950 level and then the 0.8900 level where a violation will set the stage for a retarget of the 0.8850 … “AUDUSD: Halts Weakness, Looks To Recover Higher”

Swiss Franc Weakened by Negative Interest Rates Speculations

The Swiss franc dropped today on speculations that the Swiss National Bank will implement negative interest rates as a measure to keep the currency weak and to help the nation’s economy overcome its problems. The SNB set a cap on the franc back in 2011, effectively pegging it to the euro. With the European Central Bank implementing negative interest rates, the SNB may be forced to take the same route in order to maintain the ceiling. Today’s data from … “Swiss Franc Weakened by Negative Interest Rates Speculations”

Yen Higher Now, but Will It Last?

Yen is higher today, thanks in large part to the fact that China’s weak data is prompting strong risk aversion. Even though the yen is higher now, though, there are many who think that the yen will move lower in the future, due to the fact that the Japanese government is running out of options. Right now, the yen seems to be correcting a little bit from its huge … “Yen Higher Now, but Will It Last?”

Weak Chinese Data Hits the Euro

Euro would have been weakening anyway, thanks to recent efforts from the ECB, but weak Chinese data is weighing on risk appetite, and the euro is down across the board. Euro is down today, thanks in large part to the fact that there are a lot of factors weighing on the 18-nation currency. The fact that the ECB continues to take steps to stimulate the economy is sending the euro lower, as are concerns about … “Weak Chinese Data Hits the Euro”

Aussie Opens Sharply Lower After China’s Data

The Australian dollar opened sharply lower today due to worse-than-expected economic data from China released over the weekend. While the currency bounced from daily lows, it is still far below the Friday’s closing rate. Several reports from China were released over the weekend, and they all were disappointing. Among them was industrial production data that showed annual growth of 6.9 percent in August, which … “Aussie Opens Sharply Lower After China’s Data”

The World MoneyShow Toronto–October 16-18

US and Canadian equity markets trading near all-time highs amid record-low volatility has many pointing to a sense of “complacency” in the markets, like it’s possible that the “easy money” has already been made. That’s why 40+ leading investing and trading experts will be speaking LIVE and in-person at The World MoneyShow Toronto, and will reveal their latest … “The World MoneyShow Toronto–October 16-18”

Market Movers Episode #15: About Gold and Inflation, Scotland

Is gold really a hedge against inflation? In this episode we run down the correlation between the precious metal, inflation and QE. We then continue with the Scottish referendum that grabbed the headlines and finish up with a preview of the FOMC September meeting. Will this give the greenback the next push higher? Welcome to a new … “Market Movers Episode #15: About Gold and Inflation, Scotland”