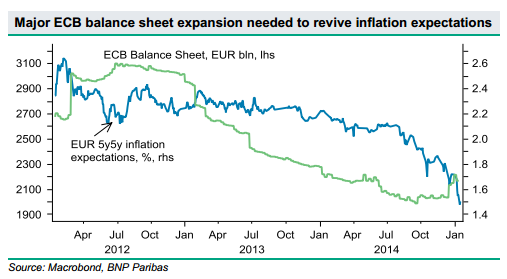

A lot of details are pouring in regarding the size and the details of the ECB’s QE program, which is set to be announced on Thursday, January 22nd. But is such an announcement already baked into the price of the euro? Not necessarily so. The team at BNP Paribas explain why they remain EUR bears: … “The ECB’s time to shine: how to position with EUR?”

Month: January 2015

SNBomb, ECB Preview, US wages, Saudi costs and the

Our weekly podcast came just in time after the shocking removal of the EUR/CHF floor. We begin with this and move on the very correlated upcoming event: the upcoming ECB meeting in which QE is on the cards. We then look at the state of the states, especially wages, before questioning how cheap Saudi oil really … “SNBomb, ECB Preview, US wages, Saudi costs and the”

EUR/USD: Trading the UOM January 2015

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US Consumer Sentiment jumps to 98.2 – better than expected Here are all the details, and 5 possible … “EUR/USD: Trading the UOM January 2015”

MahiFX reports business as usual

New Zealand and UK based forex broker MahiFX reports “business as usual” after the SNB shocker. The broker states that client funds are fully protected in segregated accounts. They join a long list of brokers to release statements following the surprising removal of the 1.20 floor under EUR/CHF. Not all brokers did well. Here is the … “MahiFX reports business as usual”

Japanese Yen Mostly Lower After Yesterday’s Gains

Yesterday, the Japanese yen saw gains as jitters sent Forex traders to safe havens, and as reports came in about a reduction in trade deficit. Today, though, many majors have recovered against the yen, and the currency is mostly lower. Yen got a boost against many of its major counterparts yesterday, thanks in large part to market concerns. US economic data didn’t come out as well as expected, and that provided the yen gains … “Japanese Yen Mostly Lower After Yesterday’s Gains”

Bearish EUR; Bullish Gold – Levels & Targets – BofA

Gold managed to emerge as one of the winners from the recent market turmoil. On the other side of the equation, the euro suffered from the removal of the Swiss bid. The team at Bank of America Merrill Lynch analyzes the charts and sets targets: Here is their view, courtesy of eFXnews: Gold in Euros ( XAU/EUR) … “Bearish EUR; Bullish Gold – Levels & Targets – BofA”

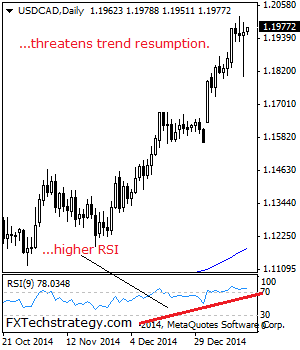

USDCAD: Looks To Resume Broader Uptrend.

USDCAD: USDCAD continues to build up on more upside pressure medium term though it was seen backing off higher prices on Tuesday. On the upside, resistance is seen at the 1.2000 level followed by the 1.2050 level. Further out, resistance comes in at the 1.2100 level where a turn lower may occur. But if further … “USDCAD: Looks To Resume Broader Uptrend.”

Swiss Shock – A test for forex brokers

The move by the Swiss National Bank was undoubtedly a huge surprise that caught markets unprepared. This kind of “Black Swan” event is not too common and has special implications. With scarce liquidity and fast moving markets, it certainly makes sense for spreads to widen and for brokers to decide on the suspension of trading … “Swiss Shock – A test for forex brokers”

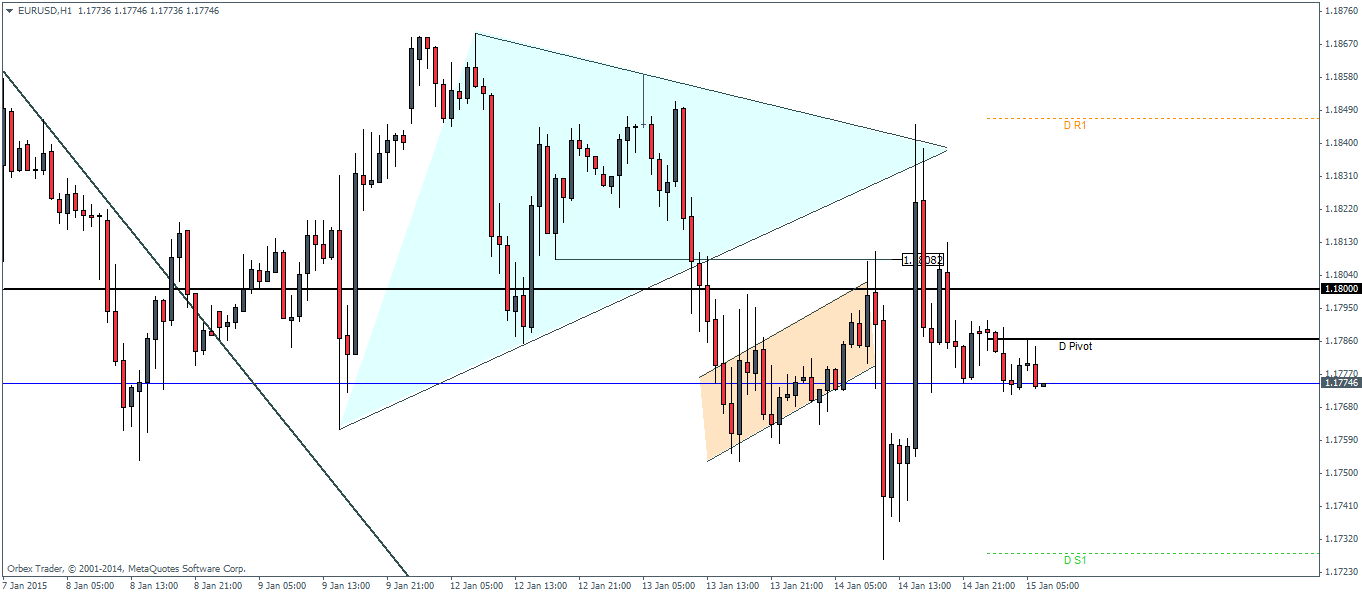

EURUSD, GBPUSD, USDJPY Pivot Points, TA – Jan. 15 2015

EURUSD Daily Pivots R3 1.1965 R2 1.1905 R1 1.1846 Pivot 1.1786 S1 1.1728 S2 1.1667 S3 1.1609 EURUSD was marked by very choppy price action yesterday. But failure to stay above 1.18 levels is indicative that we could see the resumption of the bearish declines. We would need to see a close below 1.175 … “EURUSD, GBPUSD, USDJPY Pivot Points, TA – Jan. 15 2015”

3 hints from the SNB that ECB QE is going

The Swiss National Bank shocked the markets with removing the 3 year+ old peg on EUR/CHF just one week before the ECB decision. That alone may be enough to show that they just cannot stay alone on the euro bid in the face of a massive downturn. Actions speak strong and are already felt in the markets. In … “3 hints from the SNB that ECB QE is going”