Some currency pairs slow down when they approach a strong line of support or resistance, and follow by bouncing back within the range. If momentum is significant, these type of currency pairs will make the break without looking back. These are the more predictable currency pairs. However, not all currency pairs enjoy this kind of technical … “5 Most Predictable Currency Pairs- Q1 2015”

Month: January 2015

SNB Action Hints At A Steady EUR/USD Drop From Here

The comments regarding the shock SNB move to remove the cap continue flowing. And yet again, this certainly has implications for the euro and the ECB decision next week. The team at Danske explains why the SNB move could hint at the next moves down for EUR/USD: Here is their view, courtesy of eFXnews: The … “SNB Action Hints At A Steady EUR/USD Drop From Here”

Greenback Mostly Lower on Disappointing Data

The US dollar is mostly lower today, with the dollar index dropping, as Forex traders consider the recent data release. Lackluster data has many rethinking the idea that the Federal Reserve will raise rates in the immediate future. Instead, it looks as though there will be a little more wait and see happening. Recent retail sales figures for the United States showed that they fell 0.9 per cent. … “Greenback Mostly Lower on Disappointing Data”

What does the SNB know about ECB QE?

Nobody expects the Spanish Inquisition or the Swiss National Bank. The removal of the 1.20 floor under EUR/CHF was a huge shock that sent EUR/USD temporarily below 1.16, the franc surging across the bonds and even sent Swiss crosses off brokers’ systems. We are one week away from the all-important ECB decision that will probably … “What does the SNB know about ECB QE?”

EUR/USD: Wave-5 underway; USD/JPY: Bull Triangle? – Nomura

Both EUR/USD and USD/JPY are experiencing interesting patterns on their charts. Taking a technical look at both major pairs, the team at Nomura see more potential for the US dollar. Here is their view, courtesy of eFXnews: The down channel in EUR/USD is still in force from 1.26 and now there is strong resistance at 1.1864, notes … “EUR/USD: Wave-5 underway; USD/JPY: Bull Triangle? – Nomura”

6 reasons why AUD/USD long is the top trade for

The Australian dollar remains pressured in 2015 but has managed to avoid the 0.80 level so far. With a local and Chinese slowdown, bears seem to be in control. However, the team at Nordea has a different opinion and explains why the fate of AUD/USD could be very positive in 2015: Here is their view, courtesy … “6 reasons why AUD/USD long is the top trade for”

Oil Prices Continue Drag on Canadian Dollar

Oil prices continue to pull on the Canadian dollar today, bringing it down against the US dollar to a level not seen since 2009. Loonie is likely to continue to fall further, as long as the oil slide is in effect. For the Canadian dollar, almost the entire story right now is oil. Oil prices continue to slide, with crude dropping to less than $46 a barrel. The drop is bad for the Canadian economy, which … “Oil Prices Continue Drag on Canadian Dollar”

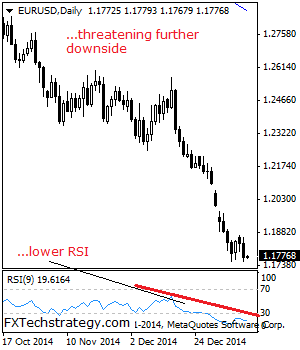

EURUSD: Looks To Resume Broader Weakness

EURUSD: With EUR continuing to maintain its downside pressure, more weakness is envisaged. Support is seen at 1.1700 level with a cut through here opening the door for more downside towards the 1.1650 level. Further down, support lies at the 1.1600 level where a break will expose the 1.1550 level. Below here will pave the … “EURUSD: Looks To Resume Broader Weakness”

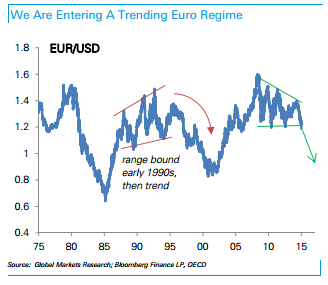

3 reasons to sell EUR/USD targeting 1.10 – Deutsche Bank

EUR/USD hit a double bottom and is holding on for now, but this may be only temporary. The specter of QE could push the single currency lower and make it “Draghed and Beaten”, says the team at Deutsche Bank, but this is certainly not the only reasons. Here are three reasons for a further downfall … “3 reasons to sell EUR/USD targeting 1.10 – Deutsche Bank”

AUD/USD: Trading the Australian jobs Jan 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Jan 2015”