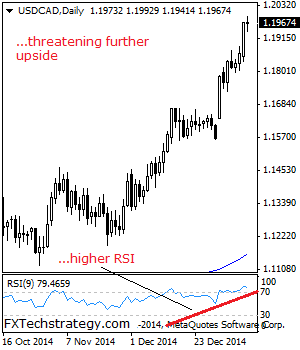

USDCAD: USDCAD continues to build up more upside pressure extending its strength on Monday and threatening further upside. However, a pullback may be seen. On the upside, resistance is seen at the 1.2000 level followed by the 1.2050 level. Further out, resistance comes in at the 1.2100 level where a turn lower may occur. But … “USDCAD: Targeting Further Upside With Warning”

Month: January 2015

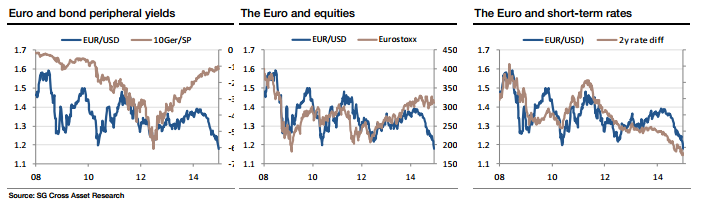

Why EUR Sell-Off Is Set To Extend Even If ECB

Some market analysts have cast doubts if the ECB will indeed push through with QE already at the January 22nd meeting. And if a 500 billion euro program is already priced it, the euro could bounce back up, right? Well, the team at HSBC offers a different view: seeing the euro fall even if Draghi doesn’t … “Why EUR Sell-Off Is Set To Extend Even If ECB”

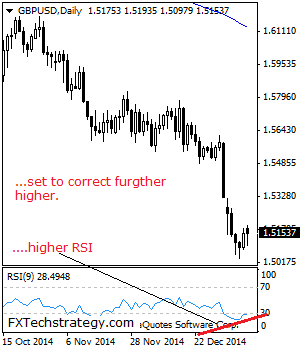

Inflation Figures Send Pound Lower

Disappointing inflation figures are causing some trouble for the pound today. Sterling is lower against the dollar, and, while recovering against the euro and yen, is still trading somewhat choppily against other currencies. Inflation figures are in for the United Kingdom, and they are worse than expected. Analysts had expected CPI to come in at 0.7 per cent for the month of December, but it came in at 0.5 per cent. PPI … “Inflation Figures Send Pound Lower”

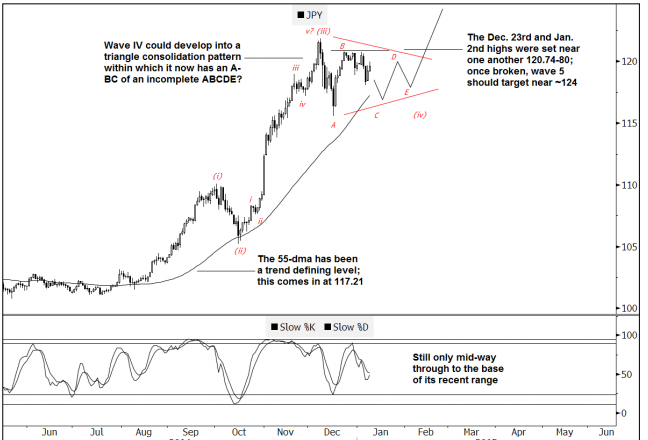

USD/JPY: ABCDE Pattern; 55d AVG Key – Goldman Sachs

USD/JPY has been stuck in some kind of range of late, after a long period of gains. What do the technical levels say? The team at Goldman Sachs offers an in-depth technical analysis for the pair: Here is their view, courtesy of eFXnews: USD/JPY seems to be consolidating into the 4th wave of a sequence which … “USD/JPY: ABCDE Pattern; 55d AVG Key – Goldman Sachs”

GBPUSD: Risk Points Higher On Correction

GBPUSD: GBP may be biased to the downside in the medium term but faces immediate corrective recovery in the new week. On the downside, support lies at the 1.5033 level where a break will aim at the 1.4950 level. A break of here will turn attention to the 1.4900 level. Further down, support lies at … “GBPUSD: Risk Points Higher On Correction”

QE Speculation Weighs on Euro

Euro is once again struggling, thanks in large part to speculation that policymakers are moving toward full scale quantitative easing. The announcement could come later this month, and many Forex traders are anticipating it. On January 22, policymakers at the European Central Bank will meet to discuss further moves for propping up the eurozone’s flagging economy. One of those moves might be all-out quantitative easing. There … “QE Speculation Weighs on Euro”

GBP/USD: Trading the British CPI Jan 2015

British CPI, released each month, is the primary gauge of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK inflation plunges to 0.5% – GBP/USD follows Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background Analysts consider CPI one … “GBP/USD: Trading the British CPI Jan 2015”

Tough times ahead for the Australian economy

The Australian economy took a hit last week as retail sales came in well below expectations fuelling speculation again that the Reserve Bank of Australia will need to lower interest rates in order to kick start the economy. Retail sales in Australia rose by 0.1% in November lower than analyst’s expectations of a 0.2% rise … “Tough times ahead for the Australian economy”

What is behind the strength of the NZD?

If you look at the NZD daily charts against any of the 7 major forex currencies, you will see that NZD is making a very strong progress against all of them. How is this possible for a commodity currency when most commodity prices have recently been falling? Here are 4 reasons which help to explain … “What is behind the strength of the NZD?”

EUR/USD: Is Market Ahead Of Itself? – SocGen

The fall of EUR/USD has been quite spectacular in the last days of 2014 and the early days of 2015 – falls which sent the pair to the lowest levels since 2006. Is this all too soon? Did the market get ahead of itself? Kit Juckes of Societe Generale answers: Here is their view, courtesy of eFXnews: … “EUR/USD: Is Market Ahead Of Itself? – SocGen”