USDCHF: Although the pair retains its broader uptrend in the medium, it also faces the risk of a correction which we saw on Friday (daily chart). On the upside, resistance resides at the 1.1216 level where a break will aim at the 1.0250 level. Further out, resistance resides at the 1.0300 level. A breather may … “USDCHF: Bullish But Faces Pullback Threats”

Month: January 2015

Dollar Ends First Full Trading Week of 2015 Mixed

It looked like the first full trading week of 2015 would be another positive one for the US dollar, yet the greenback stumbled by the weekend, finishing trading mixed. The dollar started the week on a strong note, and it looked like nothing could stop its march upward. Yet the rally halted on Friday despite very positive non-farm payrolls. The long-term outlook for the US currency remains bullish, yet those who hoped … “Dollar Ends First Full Trading Week of 2015 Mixed”

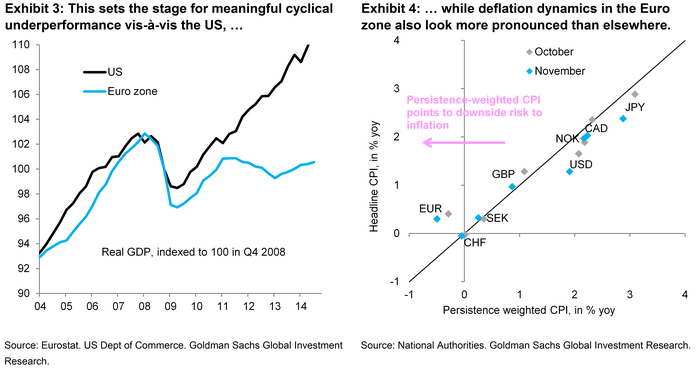

EUR/USD at 0.90 by end 2017 – Goldman Sachs updated

While EUR/USD managed to bottom out after the mixed Non-Farm Payrolls report, this is not necessarily a long lasting bounce. Euro/dollar parity is no longer ruled out in the longer term, and the bank provides targets for the shorter term as well as explanations for the downgrade of forecasts: Here is their view, courtesy of eFXnews: The … “EUR/USD at 0.90 by end 2017 – Goldman Sachs updated”

CAD Drops to Lowest Since May 2009 vs. USD

Macroeconomic reports from Canada were universally bad today, driving the Canadian dollar lower against most of major peers. The currency reached the lowest level since May 2009 against the US dollar. While the US employment reports had some negative parts in it, Canadian employment data was simply bad as the number of jobs fell by 4,300 in December. The reading was not as bad as the November drop by 10,700 but also … “CAD Drops to Lowest Since May 2009 vs. USD”

Has EUR/USD bottomed out? This pattern looks familiar

EUR/USD is trading at 1.1830: these are very low levels when looking back just one week and especially if we look back at the pre-holiday levels, but it has already seen lower levels this week. Looking at NFP reactions from October, November and December, we see a significant bounce of the pair. So, has EUR/USD reached a low … “Has EUR/USD bottomed out? This pattern looks familiar”

Dollar Drops After Stellar NFP; What’s the Reason?

The US dollar dipped against its major peers today even though US non-farm payrolls came out even better than optimistic expectations. Can the weird behavior be explained? So happens, market analysts have a theory that justifies the poor performance of the US currency. US non-farm employment grew by 252,000 in December, more that analysts have forecast (241,000). On top of that, the previous month’s reading received … “Dollar Drops After Stellar NFP; What’s the Reason?”

3 reasons why US wages are set for a big

The US enjoyed another strong month of job gains in December, but a big disappointment came from the drop in wages: 0.2% m/m and a slide to a gain of only 1.7% y/y. This casts a lot of doubts whether the Federal Reserve will be able to raise rates in 2015. However, here are 3 reasons to expect a … “3 reasons why US wages are set for a big”

GBPUSD: Turns Higher On Recovery

GBPUSD: Despite retaining its broader downside bias, GBP has triggered a recovery higher on correction. On the downside, support lies at the 1.5050 level where a break will aim at the 1.5000 level. A break of here will turn attention to the 1.4950 level. Further down, support lies at the 1.4900 level. Its daily RSI … “GBPUSD: Turns Higher On Recovery”

EUR/USD crash explained, FOMC minutes rundown, US jobs and

EUR/USD had a spectacular crash in the wake of 2015. We explain what’s behind it, what is already priced in and what isn’t. The Fed is seems to be smooth sailing towards hiking, but there are bumps on the road and data dependency: yes the NFP. And, we examine another effect of falling oil: the Caribbean country of … “EUR/USD crash explained, FOMC minutes rundown, US jobs and”

EUR/USD: Trading the US NFP Jan 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls +252K, unemployment, unemployment 5.6% Published on Friday … “EUR/USD: Trading the US NFP Jan 2015”