The Canadian dollar was mixed at the early trading on Friday. While the currency attempted to extend its rally versus the Japanese yen, it was trading virtually flat against the euro and the US dollar. The Canadian dollar was rising for two days against the yen and is now attempting to extend its rally for a third session. The currency also gained for two sessions versus the euro but halted its advances as of now. As for the loonie’s performance … “Canadian Dollar Mixed During Early Friday’s Trading”

Month: January 2015

No Stop for Dollar’s Rally

The US dollar continued its unstoppable rise for yet another session today. Economic reports, especially employment data, fueled optimism about the US economy and speculations about a close interest rate hike from the Federal Reserve. The dollar retained its strength, rallying to new highs against the euro and the Great Britain pound, as analysts predict that tomorrow’s non-farm payrolls will show substantial growth. Other employment reports supported … “No Stop for Dollar’s Rally”

Pound Rallies After HPI Report & BoE Meeting

The Great Britain pound rallied today following a positive report about house prices and the monetary policy decision made by the Bank of England. The currency dropped to the lowest level since July 2013 against the US dollar intraday but bounced to the opening level as of now. The BoE decided to keep its monetary policy unchanged at today’s meeting. The central bank announced: The Bank of Englandâs Monetary Policy Committee at its meeting today voted to maintain … “Pound Rallies After HPI Report & BoE Meeting”

Australian Dollar Jumps, Supported by Economic Data

The Australian dollar jumped today as economic reports from Australia as well as from the United States were positive, improving the market sentiment and encouraging traders to take more risk. Australian building approvals rose 7.5 percent in November from October following the 11.5 percent growth in the previous reporting period. The actual reading was much better than forecasts that promised a 2.7 percent decrease. The Aussie rallied with the help of the data … “Australian Dollar Jumps, Supported by Economic Data”

2015 Preview for currencies & commodities: the Fed hike,

An exciting 2014 has ended and we have a packed show previewing the currencies and commodities in 2015: when will the Fed hike and how will the dollar react? How low can the euro go? Can it bounce back? And the same question goes for oil? For the pound, politics play a particularly important part, and for … “2015 Preview for currencies & commodities: the Fed hike,”

USD/JPY Turns Higher, Strengthens

USDJPY: With the pair halting its weakness to close higher on Wednesday and following through higher during Thursday trading session, further bullishness is now envisaged. On the upside, resistance resides at the 120.00 level followed by the 120.50 level where a break will target the 121.00 level. Further out, resistance comes in at the 121.50 … “USD/JPY Turns Higher, Strengthens”

Euro Continues to Drop on Future Expectations

Euro continues its downward slide against major currencies as future expectations weigh on the 19-nation currency. Concerns about the economy are paramount, and many expect the ECB to announce another round of easing at its next meeting. Forex traders are already preparing for another round of easing from the ECB policymakers. The next meeting is expected to bring more asset purchases in an attempt to bolster the flagging economy. German industrial orders fell … “Euro Continues to Drop on Future Expectations”

GBP/USD: Selling Overdone; Buy On Further Dips – ANZ

The British pound is on the back foot against the greenback, trading at the 1.50 handle. Can it break lower, or is it set for a rebound? The team at ANZ sees the recent moves as overdone, and explains: Here is their view, courtesy of eFXnews: Cable’s plunge in early 2015 looks overdone as the … “GBP/USD: Selling Overdone; Buy On Further Dips – ANZ”

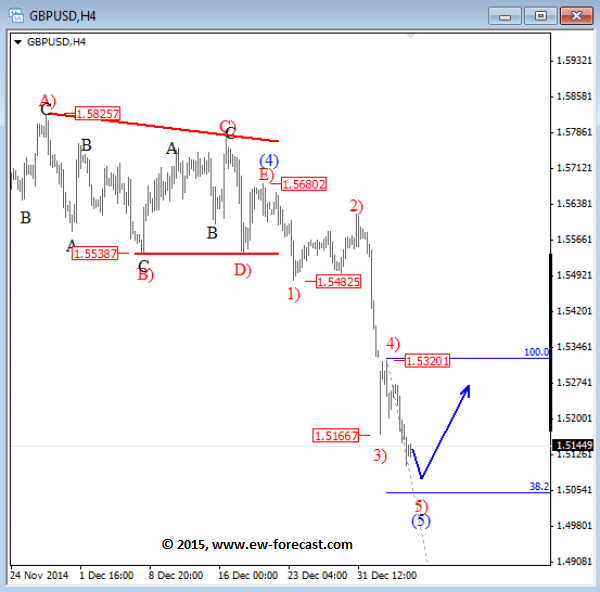

EUR/USD support seen at 1.1750, GBP/USD at 1.5000 –

EURUSD is already at the lows, which means that wave 4) is probably done near 1.1970 so wave 5) is now in play for lower levels. We are looking for a potential weakness to 1.1750 where the market could be looking for some support, especially as we see the price in late stages of an … “EUR/USD support seen at 1.1750, GBP/USD at 1.5000 –”

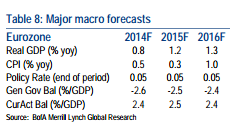

How Far QE Will Go?; Forecasts & Risks for EUR/USD

Quantitative Easing in the euro-zone is probably on the way. How much of it is already priced in? Did the markets get ahead of themselves? The analysts at Bank of America Merrill Lynch weigh in: Here is their view, courtesy of eFXnews: By the end of 2014, the ECB provided strong signals that sovereign QE … “How Far QE Will Go?; Forecasts & Risks for EUR/USD”