The Japanese yen dropped today, falling for the second day, as the market sentiment improved a bit due to positive economic data from the United States as well as because of the rally of stocks and crude oil. US inventories of crude oil shrank unexpectedly, leading to a rally of prices for the commodity. This, in turn, alleviated tensions among traders, driving equities higher. On top of that, US macroeconomic reports improved the market sentiment further. All in all, it … “Yen Drops for Second Session as Market Sentiment Improves”

Month: January 2015

Dollar Continues March Up

The US dollar continued its march higher today. The currency gained for the fifth straight session against the Great Britain pound and for the sixth against the euro. Wednesday’s economic data from the United States were very good. Growing employment and falling trade deficit fueled speculations that the Federal Reserve will tighten its monetary policy in the near future. Talking about monetary policy, the Fed released minutes of its December policy … “Dollar Continues March Up”

Brazilian Real Gains on Optimism About New Economic Team

The Brazilian real gained today on hopes that the new economic team appointed by President Dilma Rousseff will succeed in revitalizing economic growth in the South American country. Finance Minister Joaquim Levy, a member of the team, said that he may increase tax revenue to help in rebalancing the budget. The market show great confidence in the new team, improving the outlook for Brazil’s economy and bolstering the nation’s currency. Previously, the real was falling on concerns … “Brazilian Real Gains on Optimism About New Economic Team”

EUR/USD: A QE program worth over €500 billion could

Chances for an announcement of QE in the euro-zone seems more than imminent after the zone slipped into deflation. Is the move already priced in? The focus now moves to the size of the program. The team at BTMU explains the critical number for the ECB and EUR/USD and provides price targets: Here is their view, courtesy … “EUR/USD: A QE program worth over €500 billion could”

Deflationary Pressure Makes Czech Koruna Weaker

The Czech koruna sank today due to concerns that deflationary pressure may lead to additional monetary easing from the nation’s central bank. The currency fell more than 1 percent against the US dollar. Vladimir Tomsik, Vice Governor of the Czech National Bank, talked about “strong deflationary pressures”, which “may have a negative impact on domestic real demand”. It looks like economic problems of the eurozone spilled over … “Deflationary Pressure Makes Czech Koruna Weaker”

There is No Point in Setting Trading Goals Unless You

We all have a certain return we want to achieve from our trading for the year. A good way to get started on securing that return is to set it as a goal. But setting a return goal on its own is not enough. To be successful, you need to focus on the process behind … “There is No Point in Setting Trading Goals Unless You”

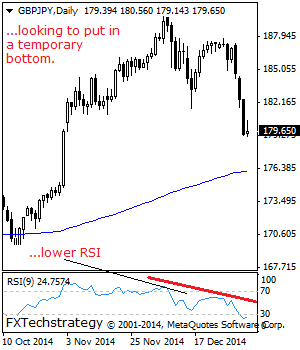

GBPJPY: Vulnerable But With Caution

GBPJPY: With continued decline occurring on Tuesday, further weakness is expected. Though we may see a corrective recovery higher. On the upside, resistance lies at the 181.00 level followed by the 182.00 level where a break will aim at the 183.50 level. A cut through here will aim at the 184.50 level. On the downside, … “GBPJPY: Vulnerable But With Caution”

US Dollar Continues to Strengthen

It’s all about the US dollar these days. The greenback continues to strengthen against major counterparts, and see gains as commodities drop and as expectations for the US economy continue to improve. Right now, the US dollar is up pretty much across the board against its major counterparts. There is very little to hinder dollar strength as the US economy is seen as picking up, and the Federal Reserve is expected to boost interest … “US Dollar Continues to Strengthen”

Australian Dollar Mixed During Asian Trading

The Australian dollar was mixed during the Wednesday’s Asian trading session. The currency fell a little versus its US counterpart, was flat against the euro and jumped versus the Japanese yen. Economic data from Australia was mildly upbeat today. The seasonally adjusted Australian Industry Group Australian Performance of Services Index climbed from 43.8 in November to 47.5 in December. The reading below 50.0 still indicates contraction of the sector, but … “Australian Dollar Mixed During Asian Trading”

Yen Retreats, Retains Support from Safe-Haven Demand

The Japanese yen retreated a bit today following yesterday’s rally. The currency remains relatively strong though thanks to wide-spread demand for safe currencies among Forex market participants. Safe-haven demand was driving the yen up previously and still remains a supportive factor for the currency. While it is usually news from Europe that make traders worried, yesterday’s economic data from the United States was not good as well, … “Yen Retreats, Retains Support from Safe-Haven Demand”