The Chinese yuan gained today amid speculations that China’s government is going to bolster the nation’s economy. Economic data from the Asian country was also helpful to the currency. According to rumors, China is going to spend as much as 7 trillion yuans on infrastructure projects. Investors hope that increasing spending will revitalize economic growth that is losing momentum currently. The HSBC China Services PMI rose from … “Yuan Gains on Hopes for Economic Stimulus”

Month: January 2015

GBP/USD Drops to New Low on Services PMI

The Great Britain pound dropped today, reaching a new low versus the US dollar, as the UK services sector demonstrated weakest growth in more than a year and a half. The Markit/CIPS UK Services PMI sank from 58.6 in November to 55.8 in December instead of rising to 58.9 as was predicted by analysts. The reading was the lowest in 19 months. The sterling fell after the report, reaching the lowest level since August 2013 against the US dollar. … “GBP/USD Drops to New Low on Services PMI”

AUD/USD: Trading the Australian Building Jan 2015

Australian Buildings Approvals measures the change in the number of new building approvals issued. It is one of the most important indicators of the construction sector. A reading that is higher than the market prediction is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Thursday at … “AUD/USD: Trading the Australian Building Jan 2015”

Euro Continues to Struggle

Euro continues to struggle today, although it is off recent lows. Concerns about the eurozone, as well as continued low oil prices are weighing on the 19-nation currency region. The euro has gained some ground since it collapsed below the $1.19 level against the US dollar yesterday, reaching a low not seen for nine years. The euro is still lower today than its open, although it is … “Euro Continues to Struggle”

Trading 3 Major Support Zones on the Weekly Chart

Many traders make the mistake of entering trades without looking at the long-term charts. This mistake can influence the outcome of the trade as the daily chart might not show a major support or resistance zone which can only be seen on the weekly or monthly charts. We will look into 3 setups based on … “Trading 3 Major Support Zones on the Weekly Chart”

Yen Profits from Demand for Safety

The Japanese yen rallied today as the decline of prices for crude oil and the subsequent drop of stocks prompted investors to seek out safe alternatives. The yen, being considered a safe currency, was a logical choice. The decline of prices for crude continues to make traders nervous. While prices rebounded a little today, the bounce was not big enough to ease worries. As a result, the MSCI Asia Pacific Index of equities dropped 1.3 percent. There were … “Yen Profits from Demand for Safety”

Australian Dollar Gains on Trade Balance & China’s Data

The Australian dollar gained today as the nation’s trade balance came out better than analysts have predicted. Macroeconomic data from China was helpful too. The Australian trade balance demonstrated a deficit of A$925 million in November. While it was an increase from the October’s A$877 million, it was still smaller than the predicted value of A$1,590 million. The HSBC Services Purchasing Managersâ Index rose from 53.0 in November … “Australian Dollar Gains on Trade Balance & China’s Data”

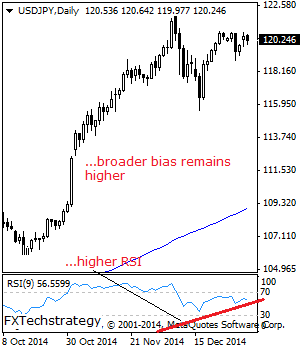

USDJPY: Risk Continues To Point Higher

USDJPY: Although it closed marginally lower the past week (see weekly chart), further upside is likely in the new week. On the upside, resistance resides at the 120.82 level followed by the 121.50 level where a break will target the 122.50 level. Further out, resistance comes in at the 123.50 level where a violation will … “USDJPY: Risk Continues To Point Higher”

Forex Crunch Key Metrics December 2014 and 2014 Roundup

2014 was a tale of two parts: the first 8 months which saw low volatility and consequently low traffic, and the last four months which saw new records. How will 2015 shape up? Hopefully this volatility is here to stay. All in all, 2014 saw stronger numbers than 2013. Here are the numbers: Website – … “Forex Crunch Key Metrics December 2014 and 2014 Roundup”

Doom and gloom for the Australian economy

The Australian dollar has had a horror start to the year falling to its lowest level in in over 5 years with no bottom in sight as weak iron ore prices, a resurgent US economy and a slowdown in China take its toll on the currency and the overall economy. In early trade on Monday … “Doom and gloom for the Australian economy”