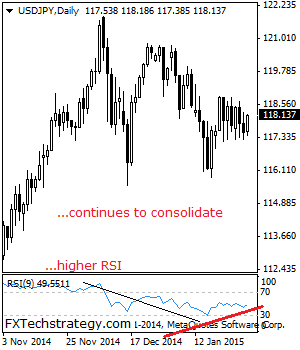

USDJPY: With USDJPY still facing consolidation price action, a directional move is now on hold. On the downside, support comes in at the 117.00 level where a break will target the 116.50 level. Below here if seen will aim at the 116.00 level followed by the 115.00 and then the 114.00. On the upside, resistance … “USD/JPY Faces Price Consolidation”

Month: January 2015

EUR/USD: Trading the Advance US GDP

US Advance GDP is a measurement of the production and growth of the economy. Analysts consider GDP one of the most important indicators of economic activity. So, the Advance GDP release could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Update: US … “EUR/USD: Trading the Advance US GDP”

Pound Mixed After Thursday’s Data

The Great Britain pound was mixed after today’s economic data from the United Kingdom. The currency was stable against the US dollar, fell versus the euro and rose versus the Japanese yen. The Nationwide House Price Index rose 0.3 percent in January, in line with expectations. The Confederation of British Industry released its Distributive Trades Survey, showing a balance of realized sales at +39 percent, above predictions. All in all, data … “Pound Mixed After Thursday’s Data”

Aussie Falls to Lowest since 2009 vs. US Dollar

The Australian dollar fell today, sinking to the lowest level since July 2009 against its US counterpart and reaching the lowest since March 17, 2014, versus the Japanese yen. The currency declined due to Australia’s economic data that was not particularly good. Australia’s import prices grew 0.9 percent in the December quarter of the last year from the previous three months. While the reading was not as bad as the preceding quarter’s … “Aussie Falls to Lowest since 2009 vs. US Dollar”

Oil plunge leaves USD & CHF as the only strong

SGD is the latest currency to register a sharp unexpected drop following action from the Monetary Authority of Singapore to ease monetary policy, which is fast leaving the US and Switzerland as the only two countries not trying to devalue their currencies. The question is – how long will that last for? Many of the … “Oil plunge leaves USD & CHF as the only strong”

Euro Regains Upper Hand in Currency Trading

Euro is getting some help in forex trading today, heading higher against its major counterparts in something of a correction. However, it’s uncertain how long the current good news will last. For now, the euro seems to be enjoying something of a relief rally. It looks as though, even though Syriza won the Greek elections, there won’t be an exit for the embattled country from the eurozone. Additionally, it also appears … “Euro Regains Upper Hand in Currency Trading”

Dovish RBNZ Statement Sends NZ Dollar Down

The New Zealand dollar crashed today after the Reserve Bank of New Zealand announced its monetary policy decision. While the central bank did not change interest rates, the statement sounded rather dovish. The RBNZ decided to keep its main interest rate at 3.5 percent during today’s policy meeting. Yet the statement sounded rather negative for the NZ dollar as Governor Graeme Wheeler was unhappy about the strength of the currency, … “Dovish RBNZ Statement Sends NZ Dollar Down”

Dollar Rises Even as Fed Talks About Patience

The US dollar rallied against the majority of its most-traded peers today after the Federal Reserve released statement of its first monetary policy meeting this year. The biggest loser was the Canadian dollar, while the Japanese yen was able to hold ground against the greenback and demonstrated an upward bias. The US currency managed to rally even as the Fed reiterated that it “can be patient in beginning to normalize the stance of monetary policy”. … “Dollar Rises Even as Fed Talks About Patience”

Fed Preview: USD buy opportunity on “business as usual”?

The US dollar has been on the back foot after the disappointing durable goods orders, that joined other underwhelming figures. There is a growing notion in the markets that a rate hike will not come before September and many already see the Fed refraining from a rate hike this year. But is the Fed really going … “Fed Preview: USD buy opportunity on “business as usual”?”

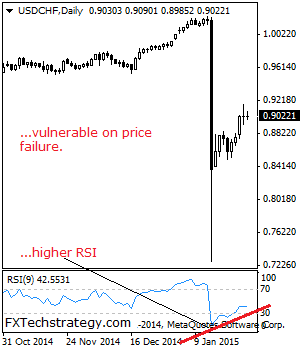

USDCHF: Halts Recovery, Vulnerable

USDCHF: The pair continues to hold on to its upside pressure but now faces price hesitation. On the downside, support lies at the 0.8950 level with a break targeting the 1.8900 level and then the 0.8850 level. Further down, support comes in at the 0.9000 level. On the upside, resistance resides at the 0.9050 level … “USDCHF: Halts Recovery, Vulnerable”