Australian CPI (Consumer Price Index), which is released each quarter, is an inflation index which measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published … “AUD/USD: Trading the Australian CPI Jan 2015”

Month: January 2015

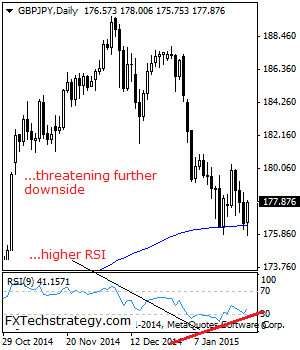

GBPJPY: Halts Weakness, Triggers Correction

GBPJPY: With the cross reversing its early intraday losses to strengthen on Monday, it faces further corrective recovery threats in the days ahead. On the downside, support comes in at the 177.00 level where a violation will aim at the 176.00 level. A break below here will target the 175.00 level followed by the 174.00 … “GBPJPY: Halts Weakness, Triggers Correction”

Ruble Drops as Conflict in Ukraine Escalates

The Russian ruble slumped today as escalation of the conflict in Ukraine led to the threat of additional sanctions against Russia, making it very risky for traders to buy Russian asses. The battle in the eastern region of Ukraine took lives of more than 5,000 people. The United States and the European Union, blaming Russia for the escalation of conflict, threaten to impose additional sanctions. As a result, speculators were fleeing from the ruble, which took another hit to its value. … “Ruble Drops as Conflict in Ukraine Escalates”

Brazilian Real Drops as Growth Outlook Worsens

The Brazilian real fell today as the worsening outlook for nation’s economic growth made the currency less attractive for market participants. The Central Bank of Brazil revised the growth outlook for this year negatively in its weekly forecast. The expected increase of gross domestic product stands at 0.13 percent now compared to 0.38 percent in the previous week’s estimate. Still, many market analysts believe that the real should be attractive to speculators, particularly carry … “Brazilian Real Drops as Growth Outlook Worsens”

Fxstreetoption.com is NOT related to FXStreet – Update: site

A website called FXstreetoption has nothing to do with FXStreet.com. Evidence is mounting regarding the malpractices of the firm and the abuse of FXStreet’s reputation, Update February 5th: And it seems we have a happy end: the site has been removed from the web. More details here. Here is more information from FXStreet’s publication: A website called … “Fxstreetoption.com is NOT related to FXStreet – Update: site”

GBP/USD: Trading the British Preliminary GDP Jan 2015

British Preliminary Gross Domestic Product (GDP) is a key release and is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. Preliminary GDP is the first version of the indicator and tends to have the most impact. A reading which is … “GBP/USD: Trading the British Preliminary GDP Jan 2015”

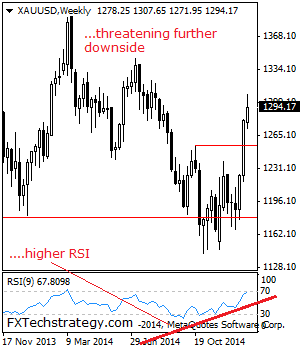

GOLD: Looks To Trigger Correction

GOLD: With a marginal close seen the past week, corrective pullback is envisaged. Resistance resides at the 1,315 level where a break will aim at the 1,330.00 level. A break of here will turn attention to the 1,350.00 level followed by the 1,380.00 level. A cut through here will extend gains towards the 1,400.00 level. … “GOLD: Looks To Trigger Correction”

ECB QE rundown, SNBomb effect on brokers, surprise cut

ECB QE is here and it’s big: we run down the event and the impact before circling back to the big hint we received for this one week before from the SNB, focusing on the impact on brokers. The moves are of course correlated to the price of oil and we analyze the surprising Canadian cut and also … “ECB QE rundown, SNBomb effect on brokers, surprise cut”

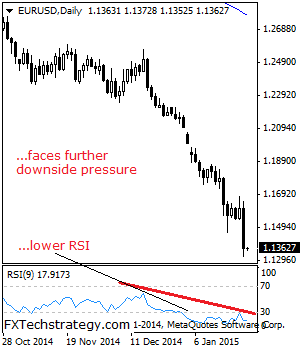

EURUSD: Maintains Its medium Term Weakness

EURUSD: With EUR declining strongly further the past week, further downside is likely in the days ahead..Support is seen at 1.1150 level with a cut through here opening the door for more downside towards the 1.1110 level. Further down, support lies at the 1.1050 level where a break will expose the 1.1000 level. On the … “EURUSD: Maintains Its medium Term Weakness”

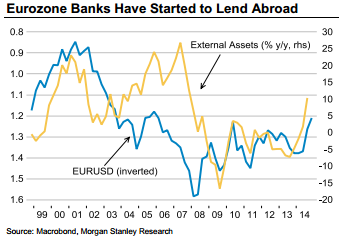

EUR/USD: Selling the rebounds – Morgan Stanley

EUR/USD fell quite a lot after the announcement of massive Quantitative Easing by Mario Draghi, but after the pair reached a trough of 1.113 it made a huge rebound before sliding back down. Forex trading is never a one way street.How can euro/dollar be traded? Morgan Stanley suggests a strategy: Here is their view, courtesy … “EUR/USD: Selling the rebounds – Morgan Stanley”