The euro plunged against the majority of most-traded currencies this week after the European Central Bank expanded its monetary stimulus. There was another currency that suffered from its central bank’s policy decision — the Canadian dollar, which was even weaker than the euro. Forex market participants were speculating about additional stimulus from the ECB for a long time. Often, when traders anticipate an event, it turns … “Week of ECB — Week of Suffering for Euro”

Month: January 2015

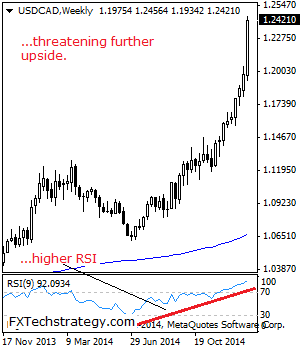

USD/CAD: Extends Bullish Offensive

USDCAD: With price extension seen the past week, USDCAD faces further bullishness in the new week. However, a corrective pullback may develop following its recent upside run. On the upside, resistance is seen at the 1.2500 level followed by the 1.2550 level. Further out, resistance comes in at the 1.2600 level where a turn lower … “USD/CAD: Extends Bullish Offensive”

Alpari UK: 5 brokers already reportedly showed interest

Following the SNBomb, Alpari UK got into deep trouble and went into administration. Since the initial news broke, there were various reports of bidders for the troubled broker. The number of parties interested has already reached 5. Some are still active and some probably aren’t. The initial attempt to find a buyer for the company over … “Alpari UK: 5 brokers already reportedly showed interest”

Brazilian Real Heads to Weekly Gains Despite Daily Losses

The Brazilian real fell today but was still heading to a weekly gain. The currency rallied after the nation’s central bank bolstered its interest rates, making the currency more attractive for investors, particularly carry traders. Brazil is the largest economy in Latin America, and this makes it appealing for traders. The high interest rates mean that carry traders should be particularly interested in the Brazilian market due to its high … “Brazilian Real Heads to Weekly Gains Despite Daily Losses”

GBP Highest Since 2008 vs. EUR, Weakest Since 2013 vs. USD

The euro jumped to the highest level since February 2008 against the euro today with the help of surprisingly good retail sales in the United Kingdom as well as yesterday’s monetary policy announcement from the European Central Bank. At the same time, the sterling dropped to the lowest level since July 2013 versus the US dollar. UK retail sales rose 0.4 percent in December, month-on-month, following the 1.6 percent increase in the previous reporting period. It … “GBP Highest Since 2008 vs. EUR, Weakest Since 2013 vs. USD”

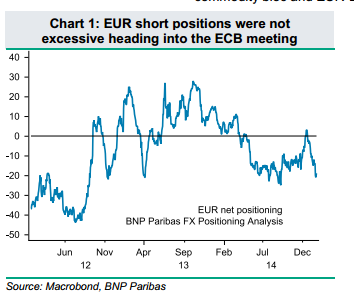

EUR/USD: After ECB And Ahead Of FOMC – room for

Draghi delivered a massive QE program and sent the euro sinking across the board. Before we have too much time to rest, the central bank on the other side of the Atlantic makes its decision. What will Yellen do? The team at BNP Paribas analyzes EUR/USD and reaches a conclusion: Here is their view, courtesy … “EUR/USD: After ECB And Ahead Of FOMC – room for”

Loonie Remains Down Against Greenback

Loonie continues to fall against the greenback, even though oil is a little bit higher today. The Canadian dollar is doing better against European currencies, though. Canadian dollar continues to struggle in Forex trading as oil prices fight to stabilize. Saudi Arabia’s King Abdullah recently passed away, with the succession moving to his half brother, King Salman. The new king, and the new crown prince, are 79 and 69, respectively. … “Loonie Remains Down Against Greenback”

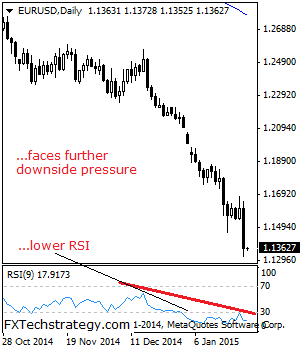

EURUSD: Resumes Weakness

EURUSD: With the pair declining on Thursday, it now faces further downside pressure. Support is seen at 1.1300 level with a cut through here opening the door for more downside towards the 1.1450 level. Further down, support lies at the 1.1400 level where a break will expose the 1.1350 level. Below here will pave the … “EURUSD: Resumes Weakness”

Dollar Gains to Highest Since 2003 vs. Euro

The US dollar climbed to the highest level since 2003 against the euro today after the European Central Bank made a move, announcing an expansion of its asset purchase program. The currency also gained against other major counterparts. While initially it looked like the gains of US currency against the euro might be limited, the rally accelerated and the greenback jumped as much as 2.1 percent against the currency of the eurozone and touched the strongest rate … “Dollar Gains to Highest Since 2003 vs. Euro”

NZ Dollar Extends Decline for Third Session

The New Zealand dollar dipped to the lowest level since June 2012 against its US peer today despite positive domestic macroeconomic data. While the currency bounced against the greenback, it retained losses versus the Japanese yen. BusinessNZ Performance of Manufacturing Index climbed from 55.6 in November to 57.7 in December, demonstrating healthy growth of the sector by the end of the year. The data was not able to support the New Zealand dollar that … “NZ Dollar Extends Decline for Third Session”