The ECB announced QE. Buying sovereign bonds in a Quantitative Easing program finally happened, and it happened big time. Draghi seemed determined and rightfully so. The initial market reaction was somewhat hesitant but the euro began it’s slide. Is that all? Probably not. Here are 5 points about why the move is huge and why … “5 points on why Draghi more than delivered and EUR/USD”

Month: January 2015

Brazilian Real Climbs as Central Bank Continues Monetary Tightening

Brazil’s central bank increased its key Selic rate at today’s monetary policy meeting. The decision was not unexpected by market participants, but the Brazilian real still demonstrated a rather big rally after the announcement. The Central Bank of Brazil announced an increase of its main interest rate by 50 basis points to 12.25 percent. It was the third straight interest rate hike. Analysts believe that the central bank may … “Brazilian Real Climbs as Central Bank Continues Monetary Tightening”

Euro Down After ECB Announces Expansion of QE

The euro dipped today after the European Central Bank announced an expansion of its asset purchase program. The size of the expansion was a bit bigger than market participants have anticipated. As was expected, the ECB left interest rates unchanged at today’s policy meeting. Regarding quantitative easing, ECB President Mario Draghi announced the following decision of the Governing Council: It decided to launch an expanded asset purchase programme, encompassing the existing purchase … “Euro Down After ECB Announces Expansion of QE”

Forex traders should not lose more than they deposit

Following the SNBomb and the subsequent leap of the Swiss franc, the lack of liquidity not only liquidated some traders’ accounts, but also put them into negative equity territory. This means that in theory, they need to pay more money to the broker only to cover the debt, before being able to trade again. Quite a few … “Forex traders should not lose more than they deposit”

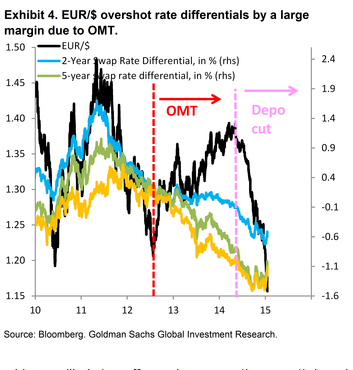

ECB Meeting A Catalyst For EUR/USD Lower – Goldman Sachs

Will the size of the ECB’s QE be big big enough to push the euro even lower? It does not have to be that extreme: Draghi could find a way to surprise the markets and weigh on the common currency. The team at Goldman Sachs explains: Here is their view, courtesy of eFXnews: Goldman Sachs … “ECB Meeting A Catalyst For EUR/USD Lower – Goldman Sachs”

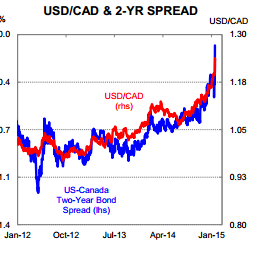

USD/CAD: Running Away; Buy Dips targeting 1.30 – CBA

The Bank of Canada shocked markets with the first rate move in over 4 years, and it was to the downside: the cut of the rate to 0.75% sent the Canadian dollar down. Is this a first move out of many or just a one-off event? And what will happen to the Canadian dollar? The team … “USD/CAD: Running Away; Buy Dips targeting 1.30 – CBA”

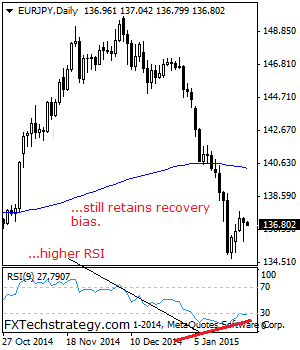

EUR/JPY Retains Recovery Bias

EURJPY- With the cross taking back most of its intra day losses to close slightly lower on Wednesday, it continues to hold on to its recovery risk. On the upside, resistance resides at the 137.50 level where a break if seen will threaten further upside towards the 138.50. Further out, resistance resides at the 139.00 … “EUR/JPY Retains Recovery Bias”

AUD/USD: Trading the HSBC Chinese Flash PMI Jan 2015

The HSBC Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and … “AUD/USD: Trading the HSBC Chinese Flash PMI Jan 2015”

Bank of Canada Shocks Market Cutting Main Interest Rate, CAD Sinks

It looks like central banks decided to rock the market continuously. Last week it was the Swiss Nation Bank that shocked traders, today it was the Bank of Canada that made an unexpected move by cutting its benchmark overnight rate. Needless to say, the Canadian dollar suffered as a result of such decision. The BoC reduced its key interest rate by 25 basis points to 0.75 percent today. The central bank … “Bank of Canada Shocks Market Cutting Main Interest Rate, CAD Sinks”

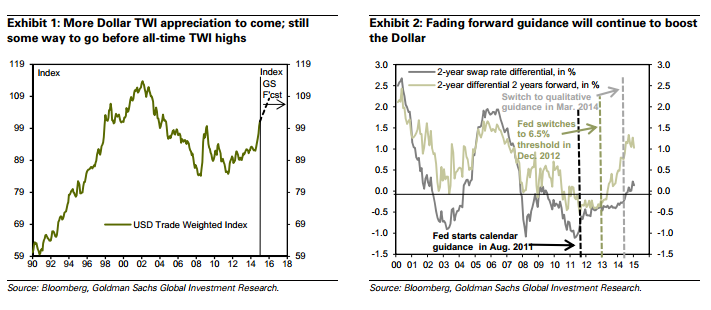

Dollar Strength To Continue With Shift In Drivers –

The US dollar gained quite a lot in late 2014 and in the early days of 2015. Can this strength continue? There is potential, and the move could come from other sources. Fiona Lake, Robin Brooks and Michael Cahill from Goldman Sachs explain: Here is their view, courtesy of eFXnews: “We expect USD strength across … “Dollar Strength To Continue With Shift In Drivers –”