As discussed in our last analysis on gold from January 5, a bearish AB=CD pattern was forming with a 100% D leg completion at 1,273.9. That price target was reached last Friday as gold hit a high of 1,282.11 for the week. Although not assured, a pullback is now possible. In addition to the ABCD … “Gold reaches first target – potential short term pull”

Month: January 2015

Pound Drops as BoE Minutes Show Unanimous Vote

The Great Britain pound sank today after the Bank of England released minutes of its latest policy meeting, revealing that voting for stable interest rates was unanimous. The BoE minutes demonstrated that all of the Monetary Policy Committee members were voting in favor of keeping monetary policy unchanged. It was considered to be bad news, as previously two of the MPC members were voting for raising interest rates. With those … “Pound Drops as BoE Minutes Show Unanimous Vote”

Perceptions of ECB independence hang in the balance

This Thursday’s ECB press conference will be a show stopper for the forex markets and could deliver another market moving shocker following closely on the Swiss National Bank’s surprise decision to unpeg CHF from the EUR last week. The ECB is widely expected to announce the launch of a long waited and much anticipated quantitative … “Perceptions of ECB independence hang in the balance”

Yen Climbs as BoJ Doesn’t Act

The Japanese yen climbed today after the Bank of Japan refrained from adding monetary stimulus during today’s policy meeting. The currency rose for the first time in four days against the US dollar, jumping as much as 1.2 percent. The yen also climbed 1.4 percent against the Great Britain pound. The BoJ announced today that it will keep its bond purchase program at ¥80 trillion. While such decision was … “Yen Climbs as BoJ Doesn’t Act”

Staying Bearish EUR/USD Outright: Levels & Targets – Credit

The sentiment in the markets is still bearish on EUR/USD despite teh recent falls and ahead of the expected decision on QE from the ECB. What levels should be watched? The team at Credit Suisse answers and provides a chart: Here is their view, courtesy of eFXnews: EUR/USD still trading in retreat hovering around a … “Staying Bearish EUR/USD Outright: Levels & Targets – Credit”

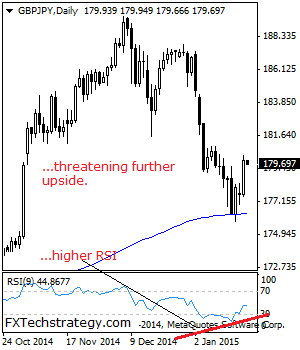

GBPJPY: Eyes Further Correction

GBPJPY: With the cross triggering a recovery higher, more strength is expected. On the downside, support comes in at the 178.00 level where a violation will aim at the 177.00 level. A break below here will target the 176.00 level followed by the 175.00 level. Further down, support lies at the 174.00 level. On the … “GBPJPY: Eyes Further Correction”

7 Scenarios for the ECB decision

An announcement on QE in the euro-zone seems imminent in the euro-zone. The shocking move by the SNB with its accompanying hints and recent comments from ECB officials have paved the way for a very significant announcement. The reaction for EUR/USD depends on the size of the program. But, Draghi and co. will not necessarily … “7 Scenarios for the ECB decision”

New Zealand Dollar Fragile After Disappointing CPI

The New Zealand dollar managed to eke out some gains against its US counterpart and the euro today following yesterday’s big drop. The currency remained extremely fragile, though, and continued to fall against the Japanese yen. New Zealand’s Consumer Price Index dropped 0.2 percent in the fourth quarter of 2014 even though forecasters promised no change. The reading was also noticeably worse the the previous quarter’s increase by 0.3 percent. … “New Zealand Dollar Fragile After Disappointing CPI”

Dollar Retains Support as Safe Haven

The US dollar backed off a little today following yesterday’s gains. The currency remains strong as signs of slower global growth support demand for the greenback in its role of a safe haven. There were plenty of reasons for investors to seek safety. One of them was the downward revision of the global growth forecast by the International Monetary Fund. Another was the lackluster growth of the Chinese economy. While the quarterly data was not terrible, China’s economic … “Dollar Retains Support as Safe Haven”

All brokers should forgive negative balances

Swiss based forex broker Dukascopy took an exceptional step to clear negative client balances. Dukascopy joins OANDA which made a already made a similar announcement in the immediate aftermath. Shouldn’t all forex brokers follow? The recent news Due to the extreme moves that resulted from the removal of the SNB floor under EUR/CHF, the lack of … “All brokers should forgive negative balances”