Euro continues to lose ground against the dollar and the pound as expectations of a bond purchase program become stronger. Many expect more quantitative easing from the European Central Bank, and that is weighing on the 19-nation currency. The eurozone economy remains on the brink of recession, and policymakers are trying to do whatever they can to combat deflation. As a result, the euro keeps heading lower. The next move from the ECB is likely to be a bond purchase … “Euro drops on ECB bond purchase expectations”

Month: January 2015

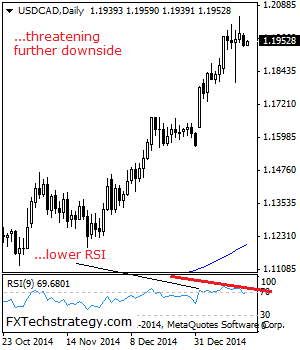

USD/CAD Faces Corrective Pullback Threats

USDCAD: With the pair triggering a corrective pullback, further decline is envisaged. On the upside, resistance is seen at the 1.2050 level followed by the 1.2100 level. Further out, resistance comes in at the 1.2150 level where a turn lower may occur. But if further recovery is triggered resistance comes in at the 1.2200 level. … “USD/CAD Faces Corrective Pullback Threats”

New Zealand Dollar Falls Despite Supportive Domestic Data

The New Zealand dollar went down today even though domestic macroeconomic data was positive for the currency. It was the third consecutive daily decline against the US dollar. New Zealand Institute of Economic Research reported that its business confidence index rose from 19 in the third quarter of 2014 to 23 in the fourth quarter. Unlike the Australian dollar, the New Zealand currency was unable to benefit from positive data. … “New Zealand Dollar Falls Despite Supportive Domestic Data”

Aussie Bounces with Help of Data from China

The Australian dollar fell against its US counterpart earlier today but bounced later with the help of positive economic data from China. The Aussie also rallied versus the Japanese yen. The National Bureau of Statistics of China reported that gross domestic product expanded 7.3 percent in the fourth quarter of 2014 from a year ago, at the same rate as in the previous three months. While some analysts considered the result disappointing, it … “Aussie Bounces with Help of Data from China”

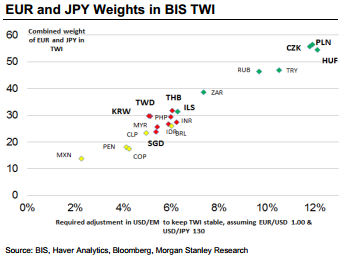

Trading The ECB – Morgan Stanley

What type of QE will the ECB announce? Will it actually delay the decision to March? What is and what isn’t priced in? The team at Morgan Stanley provide a guide map to trading the ECB decision on Thursday: Here is their view, courtesy of eFXnews: While the precipitous decline in crude prices has continued to capture … “Trading The ECB – Morgan Stanley”

Alpari UK enters administration after no buyers found

Reports are emerging that talks have failed regarding a buyer for Alpari and KPMG will administer it. The company now applied insolvency. Around $98.5 million of funds are segregated. The special administrators are Richard Heis, Samantha Bewick and Mark Firmin Richard Heis said: Following the announcement by the SNB last week, Alpari (UK) Ltd sustained substantial losses … “Alpari UK enters administration after no buyers found”

Swissie Backs Off After Huge Rally, Retains Most of Gains

The Swiss franc fell today, declining for the second consecutive session, as the market digests last week’s shocking decision of the Swiss National Bank to drop the cap on the currency. The currency is still far above the levels at which it was trading before the decision. The SNB made a huge surprise for traders last week, dropping its cap of 1.20 francs per euro. Nobody saw this coming as even on the day before the announcement central … “Swissie Backs Off After Huge Rally, Retains Most of Gains”

Forecast: US Dollar in 2015

The US dollar demonstrated exceptional performance in 2014. Can the greenback maintain its amazing rally in 2015 or correction is in order? Fundamentally, the dollar has a strong bullish case in the form of expected monetary tightening from the Federal Reserve. Consequently, it leaves the US currency vulnerable to any changes of the Fedâs stance. Still, the monetary policy outlook should drive the greenback higher though some might argue that the factor is already … “Forecast: US Dollar in 2015”

Alpari UK: Will Australia’s Pepperstone acquire the troubled firm?

The story of Alpari UK continues. The troubled forex broker still says that it has not entered a formal insolvency process and that a sale is on the cards. After FXCM was reported to be a potential buyer and this was denied, there may be another buyer. Pepperstone, an Australian broker, is showing interest. Update, Monday 16:30 GMT: Alpari … “Alpari UK: Will Australia’s Pepperstone acquire the troubled firm?”

Stay Short EUR/USD, EUR/GBP – Barclays Trade Of The Week

Towards the ECB meeting on January 22nd, there could be more room for the euro to the downside against both the dollar and the pound. The team at Barclays explains the rationale and levels on the charts: Here is their view, courtesy of eFXnews: Currency investors should consider starting short EUR/USD and EUR/GBP into this … “Stay Short EUR/USD, EUR/GBP – Barclays Trade Of The Week”