German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 10:00 GMT. Indicator Background … “EUR/USD: Trading the German ZEW Jan 2015”

Month: January 2015

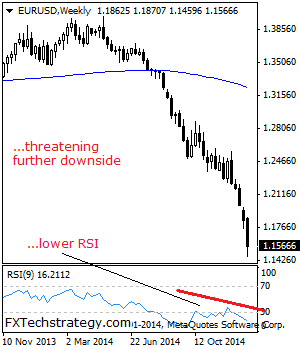

EUR/USD Faces Continued Bearishness

EURUSD: With further decline occurring the past week, additional downside pressure is likely in the week. Support is seen at 1.1500 level with a cut through here opening the door for more downside towards the 1.1450 level. Further down, support lies at the 1.1400 level where a break will expose the 1.1350 level. Below here … “EUR/USD Faces Continued Bearishness”

Orbex not negatively affected by Swiss Franc moves

Cyrpus based forex broker Orbex reports business as usual: it did not experience any negative effects and continues serving clients. Here is the press release: Limassol, Cyprus, 16th January 2015 Following extreme volatility on the Forex market due to the Swiss Franc’s 30% price climb, Orbex is pleased to announce that their operations have not been negatively … “Orbex not negatively affected by Swiss Franc moves”

ECB QE could theoretically surpass €2 trillion according to

In the past week, we have received quite a few fat hints from Draghi and his colleagues.Also the SNB’s shock move included 3 ECB QE hints. And if fat hints weren’t enough, Dutch ECB member Klaas Knot spills the beans on QE, or if you wish, ties the knot. Here are the recent details emerging from the ECB, calculations … “ECB QE could theoretically surpass €2 trillion according to”

EUR/USD: Staying Bearish With A Wide Range Into ECB –

Is the ECB QE priced in or not priced in? That remains an open question in markets, also after the shocking SNB decision to remove the EUR/CHF peg. The team at BTMU explain their positioning, taking the SNB move into consideration, and offer a bearish bias: Here is their view, courtesy of eFXnews: The following … “EUR/USD: Staying Bearish With A Wide Range Into ECB –”

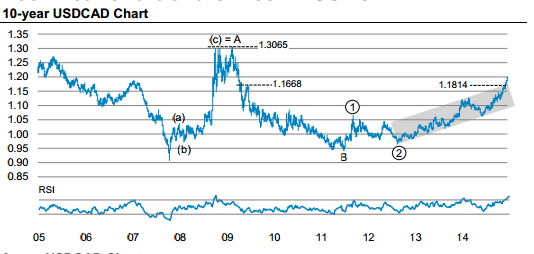

Buying USD/CAD – Morgan Stanley Chart Of The Week

The Canadian dollar had quite a few volatile days, with ranges of over 200 pips. What’s next for the loonie? The team at Morgan Stanley selects Dollar/CAD on 3 technical charts and points to the upside: Here is their view, courtesy of eFXnews: Morgan Stanley picks USD/CAD as its technical FX chart of the week, where … “Buying USD/CAD – Morgan Stanley Chart Of The Week”

Alpari: UK unit scrambling for sale (could be to FXCM);

Alpari’s story continues to fascinate: Alpari UK initially announced they have entered insolvency, then changed its position stating it has NOT entered a formal insolvency and is checking out the options, including a sale. And now there is more news from both the UK unit and the Japanese one: Forex Magnates now reports that Alpari UK is … “Alpari: UK unit scrambling for sale (could be to FXCM);”

Alpari UK sale possible: FXCM, Pepperstone potential buyer

Alpari UK has an updated statement up on its website saying it is not formally entered an insolvency process. A sale is considered. This is different than the previous decision. The story develops. Here is the statement: The recent move on the Swiss franc caused by the Swiss National Bank’s unexpected policy reversal of capping … “Alpari UK sale possible: FXCM, Pepperstone potential buyer”

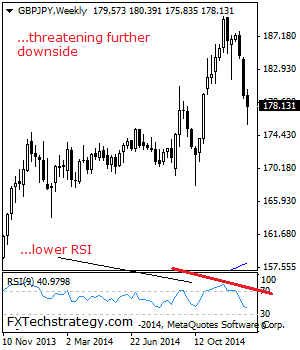

GBPJPY: Bearish, Extends Weakness

GBPJPY: With the cross extending its weakness the past week, further decline is envisaged in the new week. However, following the mentioned weakness it should trigger a corrective recovery in the new week. On the downside, support comes in at the 175.83 level where a violation will aim at the 175.00 level. A break below … “GBPJPY: Bearish, Extends Weakness”

ECB QE Base Scenario: €500-€750 billion – Credit Suisse

An announcement on Quantitative Easing by the ECB seems imminent after recent comments from the Bank’s chiefs, including Draghi, and after the removal of the Swiss peg. The team at Credit Suisse provides an in-depth analysis and various scenarios for the big event on January 22nd: Here is their view, courtesy of eFXnews: In the run-up … “ECB QE Base Scenario: €500-€750 billion – Credit Suisse”