The pressure on the pound continued for another week, but maybe we could have a pause now. BOE Governor Mark Carney is set to stay in his post and there are also other reasons for a sterling stabilization. Here is the view from ANZ:

Here is their view, courtesy of eFXnews:

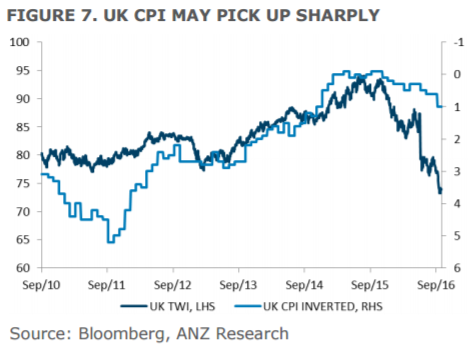

On a trade weighted basis, sterling has fallen 8% since parliament returned on 5 September after its summer recess. The resumed fall reflected the clear rhetoric from Westminster that Brexit will proceed; Article 50 will be triggered before the end of March next year – and the UK will regain control over immigration. The UK’s position on immigration is at odds with the EU’s principle of free movement of people. Consequently, expectations of a hard Brexit rose and weighed heavily on sterling.

However, for the moment that expectation seems to be discounted and until new political dimensions emerge, sterling may consolidate. What shouldn’t be overlooked is that the economy is performing quite well for the time being. The housing market has perked up, the 3m/3m trend in retail sales shows upward momentum in consumption (September +1.8%), the labour market is holding up well, and inflation is showing signs of accelerating.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The rule of thumb is that every 10% drop in the exchange rate raises CPI inflation by around 1.75% over two years. Our expectation is that the BoE will probably upgrade its assessment of growth and inflation in the November inflation report. Meanwhile, the autumn statement on fiscal policy is likely to be expansionary and push out the timing of when a balanced budget will be achieved whilst also providing some current fiscal stimulus.

While it is impossible to quantify the appropriate risk premium for sterling and major questions overhang longer-run growth, in the short run sterling may have adjusted sufficiently.

ANZ targets GBP/USD at 1.22 and EUR/GBP at 0.88 by year-end.