The retail FX industry has been dominated by MetaTrader 4 (MT4) brokers. This goes without any doubt. Even though there are brokers that offer their trading software, many of them still add MT4 as a fallback option. In this article, I am going to focus on the main disadvantage of MT4 and will consider two of the best alternatives for brokers.

What’s wrong with MT4?

It is evident that MetaTrader became a synonym of online currency trading. It is way easier to integrate with a third-party software provider than develop your platform from scratch. However, MT4 comes with a few obvious weak points.

Lack of focus

The developer of MT4, MetaQuotes (MQ), released its newer platform, MetaTrader 5 (MT5) already six years ago. Since then MQ has been trying to accomplish two things in the same time: 1) make brokers adopt MT5 and 2) extend the scope of MT4 features. Can a company focus on developing two similar products at the same time? I hardly doubt it.

Lack of support

Retail FX market today is entirely different from what it used to be a decade ago. A broker has to cater for traders that have much higher expectations regarding software. Until 2015 MT4 was only available to Windows users. There was no web-based platform. Hence all of the OSX and Linux users had to struggle with the installation of MT4 or use a brokerage that provides a more convenient way to trade. Even today, when a web trading version MT4 os available, it is still much more inferior to its desktop alternative and can hardly be used for any serious trading. On top for that, there is still no native support for OSX.

Lack of new features

Repetitive activities, sometimes, can become quite annoying. This is why many companies that offer a purely online experience often come up with different updates. New features make the users more entertained and engaged. If you take a look at poker rooms, for example, new types of tournaments and additional features are released nearly on a weekly basis. However, MT4 receives updates very rarely.

Close-minded Policy

In the modern times, the platform is firmly separated from the useful features. Is that Microsoft or Apple that makes your laptop useful? Most probably not. In the past, the apps that you can install over your operating systems used to provide the biggest benefit. In the modern times, millions of web pages and web services make your hardware useful. Your operating system is designed to perform a supportive function. Unlike Apple and Microsoft, MQ seems to have a challenge with figuring this out. A few years ago there were third-party web trading platforms, copy-trading services, enhanced 1-click trading terminals and more. However, MQ has either banned or restrained them.

Now imagine, your brokerage invests dozens of thousands into the development of new features for a popular, yet not so useful, platform. And then your brokerage is required to remove the features from its MT4 distributive or not allowed to use the features at all.

Lack of independence

What is more to this? Well, If MQ is the only software supplier of your brokerage, there is absolutely no negotiation power left. If, one day, MQ decides to implement an additional charge for an active user – there is nothing you can do. Even if a broker is one of the largest, MQ can easily harm its business without losing any meaningful share of the profits. This is another reason why you no longer see top10 largest brokers offering MT4 as its primary platform.

What are the alternatives?

If your brokerage looks into offering a superior way to trade, there are two potential alternatives to MT4: cTrader and Protrader. Let’s take a look at both of the options and see which one is a better fit.

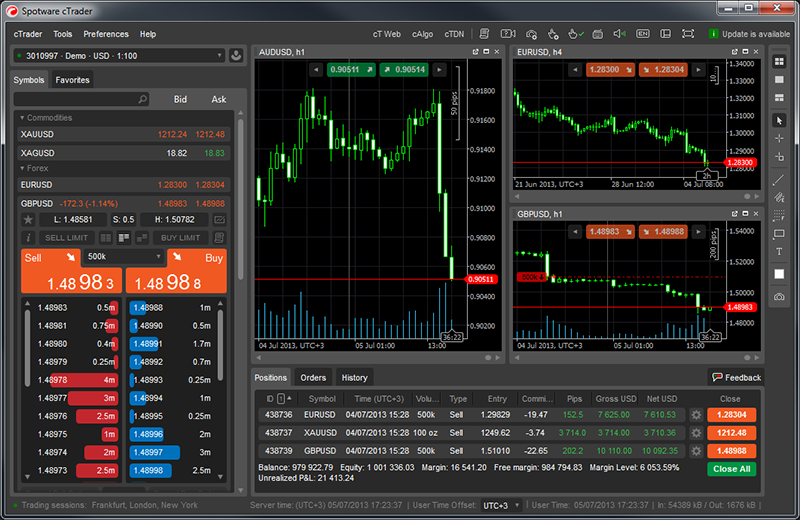

cTrader

Most of smaller FX brokers rely on MT4 as their main (and typically the only) trading platform. And most of such brokers will find cTrader as a handy substitution. Not only it offers a web trading platform that is identical to the desktop application, but it also comes with a full scope of features.

cTrader provides a superior trading experience for FX and CFD products, and the platform’s look & feel is just incomparable to MT4. Next to this, it is also a great platform for start-up brokerage companies as it can be easily connected to TopFX liquidity.

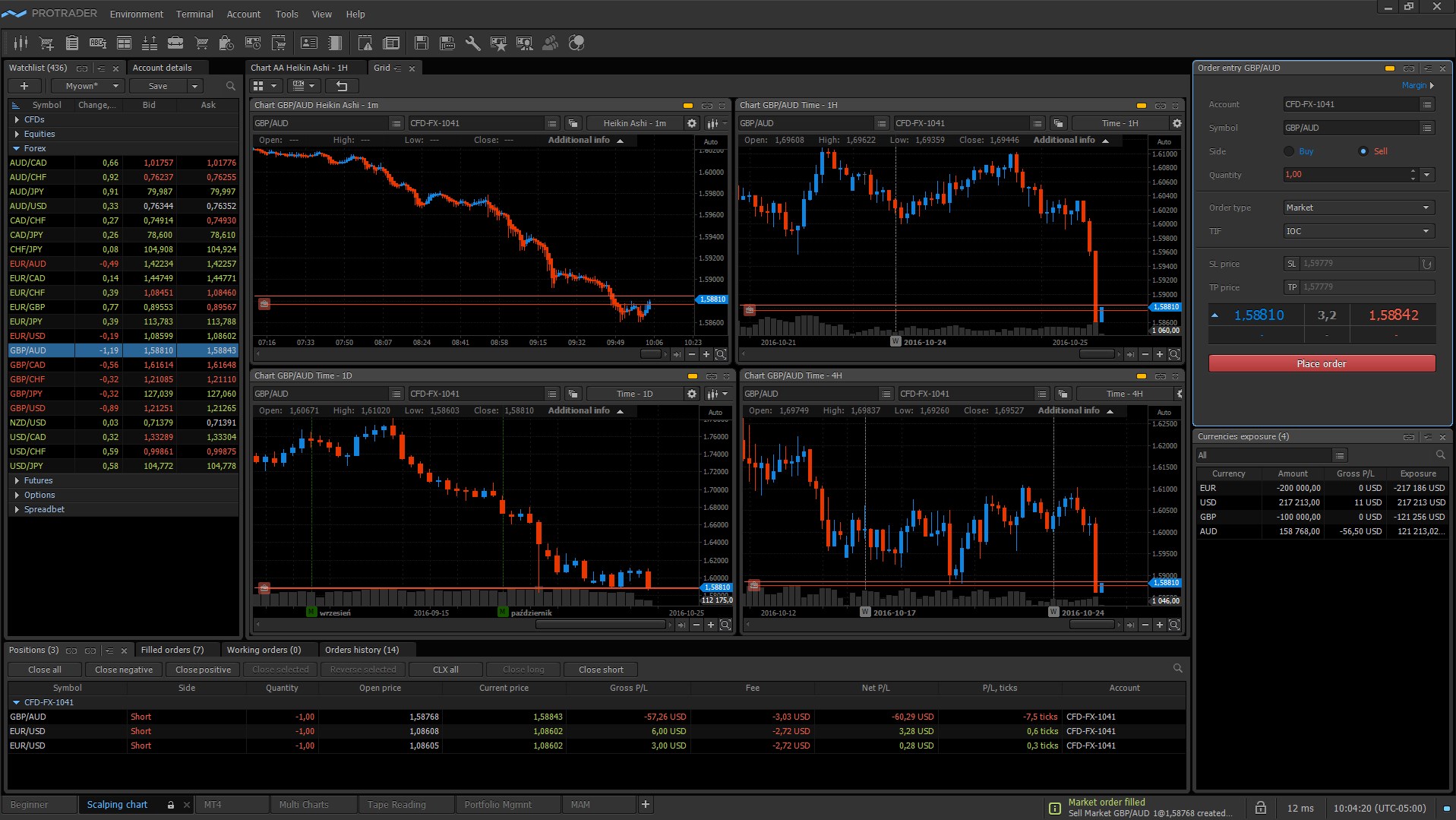

Protrader

So far this software was predominantly employed by multi-asset brokers and banking institutions. While cTrader is an excellent choice for smaller-size FX/CFDs brokers, Protrader is a superior choice for large brokers that mostly or only rely on MT4. It is a liquidity neutral trading platform, which means that a large broker can integrate its current liquidity pools. Hence, moving clients from MT4 to Protrader will be quite a smooth process. This software comes as a standalone platform, iOS, Android mobile platforms, and as a web trading application with a similar scope of features.

One of the main distinction of Protrader is that it is a multi-asset platform. This is especially handy for large brokers that are looking to extend the scope of its products. In addition to this, considering the recent changes in the European regulations, brokers may be required to introduce new products to maintain their trading volumes. With such software as Protrader, it is possible to offer not only Forex (spot) and CFDs but also Equities, Futures, Options (vanilla) and Spread Betting within the same trading platform.

Finally, Protrader comes with extensive options for customization, both to cater to clients’ needs and various brokers’ operational requirements. Moreover, Protrader comes with such unique functions that can only become available in MT4 with the help of third party plugins.

Conclusion

It is evident that MT4 is quite behind most of the modern trading technologies, both regarding design and functionality. Even though a significant share of traders still chooses MT4, the largest FX brokers have moved most, or even all of its clients, to other trading platforms. While smaller retail FX brokers should be much better off integrating with cTrader, larger MT4 brokers are recommended to go for Protrader.

Why brokers shouldn’t choose MT4 and what are the