The US dollar weakened against the Canadian dollar during Monday’s trading session following a rally in oil prices. Global oil prices rose significantly following the announcement that the meeting between Organization of the Petroleum Exporting Countries and non-OPEC countries was successful. The non-OPEC countries, led by Russia, agreed to reduce their oil production in light of the global oversupply that had led to depressed oil prices. The USD/CAD tested new lows as it … “US Dollar Weakens Against Canadian Dollar Backed by Higher Oil Prices”

Month: December 2016

US Dollar Soars Against Japanese Yen Ahead of Fed Policy Decision

The dollar moved higher against the Japanese yen on Monday, as investors expected that a possible interest rate hike from the Federal Reserve on Wednesday will boost the US currency. Anticipation for higher inflation under President-elect Donald Trumpâs administration further lifted the dollar. The greenback, which traded within a tight range against the euro today, soared to its highest level against the Japanese yen since February 8. Marketsâ focus is … “US Dollar Soars Against Japanese Yen Ahead of Fed Policy Decision”

Japanese Yen Stays Soft During Monday’s Trading

The Japanese yen remained soft against most major currencies on Monday, though it managed to pare losses versus the US dollar by now, but not before reaching the lowest level since February. Economic data released from Japan today was a bit mixed, failing to provide reasons for the currency to change its bearish trend. Core machinery orders rose in October from the previous month, while the Index for Tertiary Industry … “Japanese Yen Stays Soft During Monday’s Trading”

Norwegian Krone Rallies After Non-OPEC Producers Join Output Cuts

The Norwegian krone joined the rally against the US dollar together with other currencies of oil-producing countries after the meeting between OPEC and non-OPEC producers on the weekend. The Organization of Petroleum Exporting Countries met with representatives from several countries not belonging to the organization on the weekend. It was attempting to convince them to join oil production cuts that the OPEC had announced earlier. The news about success of this endeavor boosted oil … “Norwegian Krone Rallies After Non-OPEC Producers Join Output Cuts”

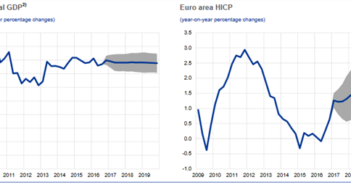

Euro falls on ECB’s QE extension, but declines are

The European Central Bank’s monthly monetary policy meeting which concluded on Thursday, November 8, showed that the central bank had extended its bond purchases from March 2017 to the end of 2017. The decision to extend QE takes the central bank’s total size of QE purchases above EUR 2.2 trillion. The central bank chief, Mario … “Euro falls on ECB’s QE extension, but declines are”

EUR/USD: Trading the German ZEW Economic Sentiment

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 10:00 GMT. Indicator Background … “EUR/USD: Trading the German ZEW Economic Sentiment”

The Counterintuitive EUR Reaction; The Market Is Wrong –

The euro sold off after Draghi presented his dovishness. Is this justified? Here is their view, courtesy of eFXnews: Whatever it takes” seems to be trumped by politics now Since 2011 Mario Draghi had brought iron-clad consistency to the ECB: it would err on the side of caution, would go as far as possible to … “The Counterintuitive EUR Reaction; The Market Is Wrong –”

Euro Soft During Week of ECB, Still Outperforms Pound & Yen

The euro was among the weakest currencies during the past trading week (though it still managed to outperform the Great Britain pound and the Japanese yen) after the European Central Bank surprised markets, expanding its stimulus program. Things were not in favor of the euro from the very start of the week as the outcome of the Italian referendum sent markets into panic (though it was rather short-lived). Yet the main event of the week was … “Euro Soft During Week of ECB, Still Outperforms Pound & Yen”

EUR/USD: Risk-Reward To The Downside Post-ECB; Sell Rallies –

More responses come after the ECB’s big QE extension move. What’s next? Here is their view, courtesy of eFXnews: The ECB extended its QE purchases by nine months to December 2017, but reduced the monthly purchases to EUR60bn from EUR80bn. The lower pace of purchases followed, according to the ECB, as the risk of deflation has … “EUR/USD: Risk-Reward To The Downside Post-ECB; Sell Rallies –”

Euro Extends Decline for Another Session

The euro extended its decline for the second day during the Friday’s trading session following Thursday’s policy meeting of the European Central Bank. The currency still managed to beat the very soft Japanese yen but fell against other most-traded rivals. Yesterday, the ECB announced that it reduces the size of asset purchases but postpones the planned end of the asset-purchase program from March 2017 to December 2017. Markets considered the net result … “Euro Extends Decline for Another Session”