The Chinese yuan is extending its losses to jumpstart the holiday-shortened trading week. The currency is falling against its rivals on Monday after the White House threatened to slap sanctions on China over the governmentâs proposed implementation of national security laws on Hong Kong that reportedly threaten its autonomy. The heightened tensions come as the worldâs two largest economies escalate their war of words over trade. Whether this is a new … “Chinese Yuan Slips as US Threatens Sanctions on China Over Hong Kong”

Month: May 2020

AUD/USD depends on relations with China

AUD/USD has hit new highs over vaccine hopes but lost ground amid geopolitical concerns. Sino-American relations, China’s rate decision, the RBA’s minutes, and coronavirus statistics stand out. Late May’s daily chart is painting a mildly bullish picture for the pair. The FX Poll is pointing to the downside. Worsening relations between China with both the … “AUD/USD depends on relations with China”

AUD/USD Slipped Under the 0.6600 Mark

The Australian dollar versus the US dollar currency pair seems to have failed to profit from the fact the price went above the 0.6600 psychological level. Do the bulls still have a chance? Long-term perspective The rise that followed the confirmation of 0.5516 as support recovered a big part of the depreciation that started from the 0.7034 high. In doing so, the price consolidated the support area inscribed by the 0.6386 level and the descending trendline that originates from … “AUD/USD Slipped Under the 0.6600 Mark”

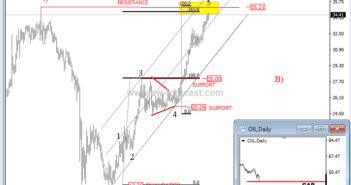

Crude Oil on the Way Towards March 09 Gap – Elliott wave analysis

Hello traders, Crude oil is bullish since the end of April and is currently trading very strongly towards $35 per barrel. This can be now a temporary resistance, ideally for wave 5 of A), therefore traders should be aware of a potential wave B setback, before the trend resumes even higher. This pullback is anticipated … “Crude Oil on the Way Towards March 09 Gap – Elliott wave analysis”

What is DMA Direct Market Access?

Direct Market Access (DMA) gives traders direct access to the global stock exchanges that speed up your transactions and reduces your costs. With DMA, you place your order online and it immediately undergoes a direct execution in the market. This means that your broker is essentially facilitating access directly to the market liquidity providers. Take … “What is DMA Direct Market Access?”

Chinese Yuan Weakens As Government Abandons 2020 GDP Target

The Chinese yuan is weakening against its major currency competitors to end the trading week, driven by officials announcing that they are abandoning their gross domestic product (GDP) target for 2020. The yuan is also coming under pressure on US-China tensions regarding trade and Hong Kong. While the worldâs second-largest economy has hit the reboot button, outside factors may pause its reopening. For the first time, China … “Chinese Yuan Weakens As Government Abandons 2020 GDP Target”

Pound Falls on Weak UK Retail Sales Data and Risk-Off Sentiment

The Sterling pound today fell against the US dollar following the release of disappointing UK retail sales data in the early London session. The GBP/USD currency pair’s decline was further fueled by the risk-off market sentiment as investors priced-in various global risks. The GBP/USD currency pair today fell from a high of 1.2233 in the Asian session to a low of … “Pound Falls on Weak UK Retail Sales Data and Risk-Off Sentiment”

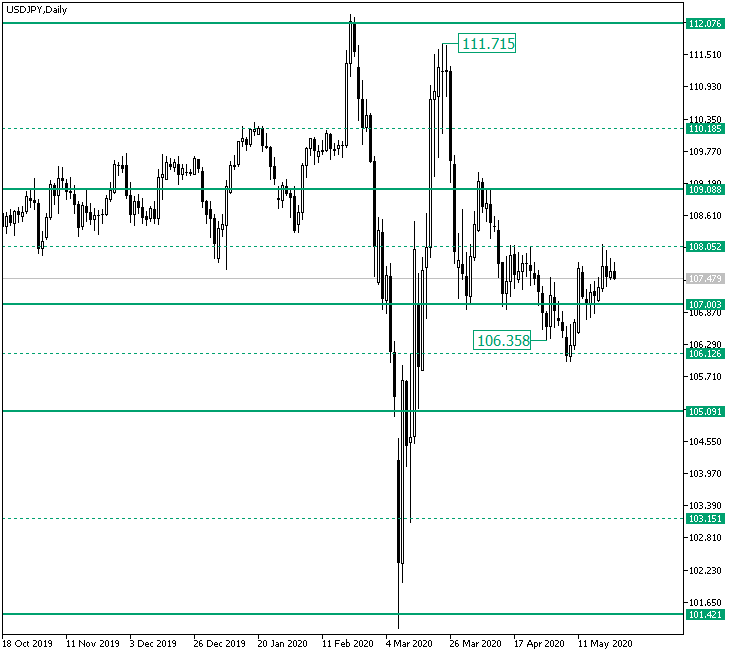

USD/JPY Bounces off the 108 Psychological Level

The US dollar versus the Japanese yen currency pair is still to decide about the overall direction. Long-term perspective The fall from 111.71 found support in the stable 107.00 level, but even so, the bulls slowly lost their determination, culminating with the confirmation of 108.05 as resistance. This lead to the price breaking the 107.00 support, extending until the low of 106.35, making a throwback, and departing again from the 107.00 level. However, this … “USD/JPY Bounces off the 108 Psychological Level”

Euro Rallies on Upbeat Euro Area PMIs, Falls on Strong US PMIs

The euro today rallied higher against the US dollar earlier today lifted by positive PMI reports from across the euro area released by Markit Economics. The EUR/USD currency pair later fell after the release of positive PMI data from the US amid rising Sino-US tensions. The EUR/USD currency pair today rallied to a high of 1.1008 in the mid-European session … “Euro Rallies on Upbeat Euro Area PMIs, Falls on Strong US PMIs”

US Dollar Flat As Initial Jobless Claims Show Steady Decline

The US dollar is trading flat on Thursday as the number of Americans filing for unemployment benefits continues its downward pattern, suggesting the job-loss trend peaked at the end of March. US financial markets were flat across the board, so there was not a huge push into the traditional safe-haven asset toward the end of the trading week. According to the Department of Labor, the initial jobless claims hit 2.438 million for the week ending May 16, … “US Dollar Flat As Initial Jobless Claims Show Steady Decline”