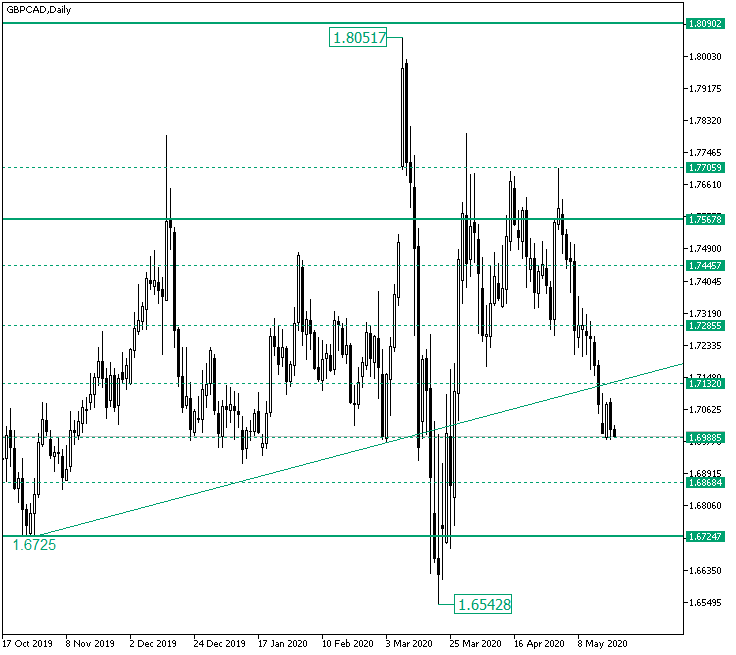

The Great Britain pound versus the Canadian dollar currency pair is at the 1.7000 psychological level. Is there a chance for the bulls to stop the bears in their tracks? Long-term perspective The rally that started from the 1.6542 low, after the price stalled from the 1.8051 peak, ended as a consolidative phase limited by the 1.7705 resistance and the 1.7285 support. But after the attempts to conquer the 1.7567 level failed altogether, as the bullish efforts were hindered by the 1.7705 … “Price Sent by the Bears at 1.7000 on GBP/CAD”

Month: May 2020

Euro Rallies on Bullish Sentiment, Mixed Eurozone Inflation Data

The euro today rallied higher against the US dollar driven by positive investor sentiment even as the greenback registered losses across the board. The EUR/USD currency pair rallied higher ignoring the weak eurozone inflation data released earlier today as investors bid up riskier assets. The EUR/USD currency pair today rallied from an opening low of … “Euro Rallies on Bullish Sentiment, Mixed Eurozone Inflation Data”

Canadian Dollar Rallies on High Oil Prices and Mixed Macro Data

The Canadian dollar today rallied higher against its US peer driven by high crude oil prices before the release of multiple fundamental reports from the Canadian docket. The USD/CAD currency pair today fell as the loonie rallied higher against the much weaker greenback amid a risk-on market environment as investors remain hopeful about the future. The USD/CAD currency pair today fell from a high of … “Canadian Dollar Rallies on High Oil Prices and Mixed Macro Data”

British Pound Mixed on Sliding Inflation, First-Ever Negative-Yielding Bond

The British pound is trading mixed against its G10 currency competitors midweek as investors comb through the influx of April inflation data. For the first time in the nationâs history, the United Kingdom sold a negative-yielding bond, meaning that the government is being paid to borrow. In the post-Coronavirus economy, this might be the new norm for a myriad of nations around the world. According to the Office for National Statistics (ONS), the consumer price index (CPI) tumbled … “British Pound Mixed on Sliding Inflation, First-Ever Negative-Yielding Bond”

AUD/NZD at the Important Support of 1.0707

The Australian dollar versus the New Zealand dollar currency pair is about to test the major support of 1.0707. Is there any way to grasp the direction? Long-term perspective The rally that began from the low of 1.0476, after the market confirmed the pivotal 1.0013 support, extended all the way to the 1.0830 high. However, reaching the 1.0830 level involved passing the 1.0707 mark. As a consequence, the bulls could have felt confident that they … “AUD/NZD at the Important Support of 1.0707”

Pound Rallies Higher on Mixed Jobs Data and Upbeat Investor Sentiment

The British pound today rallied higher against the US dollar extending yesterday’s gains driven by positive investor sentiment and the mixed UK jobs data. The GBP/USD currency pair today posted gains after the release of the latest jobs data showing a better than expected unemployment rate. The GBP/USD currency pair today rallied from a daily low of 1.2184 in the Asian session to a … “Pound Rallies Higher on Mixed Jobs Data and Upbeat Investor Sentiment”

Turkish Lira Strengthens Ahead of Interest Rate Decision

The Turkish lira is strengthening against several major currency competitors on Tuesday as investors anticipate the central bank to cut interest rates. Forex markets are also optimistic that Ankara can establish swap lines with foreign central banks to mitigate its currency crisis. The lira has been rebounding since it crashed to a record low against the US dollar earlier this month. According to a Reuters poll of economists, … “Turkish Lira Strengthens Ahead of Interest Rate Decision”

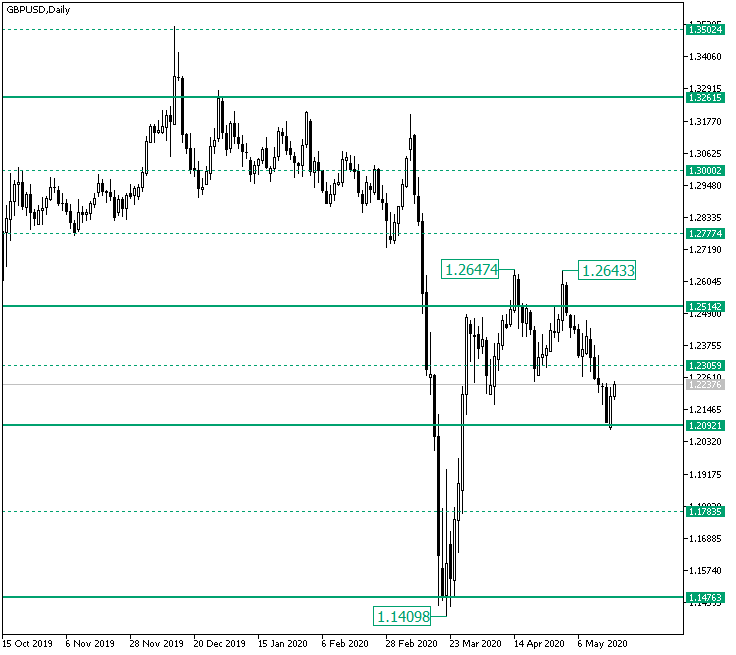

GBP/USD Bounced from 1.2092

The Great Britain pound versus the US dollar currency pair corrected from the 1.2100 area. Is this a simple correction of the downwards movement, or is it a bullish comeback? Long-term perspective The rally that commenced from the low of 1.1409, after the significant support level of 1.1476 was validated, lost its steam just under the 1.2514 mark. From there, a consolidative phase took shape, one that was limited by the 1.2514 … “GBP/USD Bounced from 1.2092”

Chinese Yuan Weakens on PBoC Expansion, Poor Data

The Chinese yuan is weakening against its primary currency competitors to start the trading week. Trading patterns appear to reveal that investors are uncertain regarding the yuanâs near-term performance due to weak economic data and expansionary monetary policy. With 100 million people under a renewed lockdown over a potential second wave of the coronavirus pandemic, is the economic restart in jeopardy? Over the last three months, the Peopleâs Bank of China … “Chinese Yuan Weakens on PBoC Expansion, Poor Data”

Could AUD/USD Be in Bearish Hands from 0.6400?

The Australian dollar versus the US dollar seems not to be profiting from the appreciation opportunities. Is this a sign that the bears are preparing the next movement? Long-term perspective The rally that started from the 0.5701 low, after the confirmation of 0.5516 as support, pierced the descending trendline that starts from 0.7034, and extended all the way to 0.6616. Subsequently, the price entered a consolidative phase, limited by the important level of 0.6386 and the intermediary level … “Could AUD/USD Be in Bearish Hands from 0.6400?”