The US dollar has wiped out all its losses from earlier in the midweek trading session after the Federal Reserve dismissed it would be introducing negative interest rates. Fed Chair Jerome Powellâs grim assessment of the US economy could prompt investors to pour into the greenback as a safe-haven asset since financial markets tumbled throughout his press conference. On Wednesday, the head of the central bank delivered prepared remarks … “US Dollar Recovers As Federal Reserve Dismisses Negative Interest Rates”

Month: May 2020

Australian Dollar Strongest on Economic Data, Market Sentiment

The Australian dollar rallied today, turning out to be the strongest currency on the Forex market during Wednesday’s trading. The possible reasons for the rally were good domestic macroeconomic data and optimism about an exit from the lockdown in Australia as well as other countries around the world. The Australian Bureau of Statistics reported that the Wage Price Index rose 0.5% in the March quarter from the previous three months. The rate of increase was stable, unchanged from … “Australian Dollar Strongest on Economic Data, Market Sentiment”

NZ Dollar Weakest After RBNZ Expands QE Program, Talks About Negative Interest Rates

The New Zealand dollar was the weakest currency on the Forex market today, sinking after the monetary policy announcement from the Reserve Bank of New Zealand. While the central bank kept its benchmark Official Cash Rate (OCR) unchanged, it almost doubled the scale of the quantitative easing program. The RBNZ left its key interest rate unchanged at 0.25% — a move that was widely expected by markets. At the same time, the bank increased … “NZ Dollar Weakest After RBNZ Expands QE Program, Talks About Negative Interest Rates”

Pound Spikes Higher as UK GDP Beats Estimates Despite COVID-19

The Sterling pound today spiked higher against the US dollar after the release of multiple positive UK fundamental reports including positive GDP data earlier today. The GBP/USD currency pair rallied higher as investors reacted to the positive reports, which indicated that the British economy fared surprisingly better than expected during Q1 2020. The GBP/USD currency pair today spiked from an opening low of 1.2251 to a high of 1.2301 after … “Pound Spikes Higher as UK GDP Beats Estimates Despite COVID-19”

AUD/CAD on the Grey Line at 0.9093

The Australian dollar versus the Canadian dollar currency pair seems to be willing to still think where to go next. But does the market offer some guides? Long-term perspective After stamping the low of 0.8062, the surge that took place from the 0.8117 level brought the price above the double resistance area created by the 0.8924 level and the trendline. Once here, the bears tried to put pressure to send the price back, just as it … “AUD/CAD on the Grey Line at 0.9093”

Euro Rallies on Investor Sentiment Amid European Reopening Efforts

The euro today rallied higher against the US dollar driven by positive investor sentiment as European countries cautiously move forward with the reopening of their economies. The EUR/USD currency pair today benefitted from the greenback’s overall weakness recouping yesterday’s losses and printing new weekly highs. The EUR/USD currency pair today rallied from a low of 1.0784 to a high of 1.0885 in a 100 pip move before giving up some of its gains … “Euro Rallies on Investor Sentiment Amid European Reopening Efforts”

NZ Dollar Strong Ahead of RBNZ Monetary Policy Decision

The New Zealand dollar was among the strongest currencies today amid the mildly positive market sentiment. The currency waits for tomorrow’s monetary policy decision from the Reserve Bank of New Zealand. No economic reports were released in New Zealand today while yesterday’s data was not bad but not particularly good either. The RBNZ will announce its decision on monetary policy at 2:00 GMT tomorrow. While the vast … “NZ Dollar Strong Ahead of RBNZ Monetary Policy Decision”

US Dollar Mixed As Fed Triggers Corporate Bond-Buying

The US dollar is trading mixed against multiple G10 currencies on Tuesday as the Federal Reserve begins its historic corporate bond-buying initiative. Investors were also concentrating on core consumer prices sliding and economies reopening across the country. On Tuesday, the US central bank will start purchasing corporate bond exchange-traded funds (ETFs) as part of its new $2.3 trillion Main Street Lending Facility. The New York Fed Bank … “US Dollar Mixed As Fed Triggers Corporate Bond-Buying”

Aussie Rebounds After Falling on Tensions Between China & Australia

The Australian dollar fell intraday but has rebounded by now. The drop was a result of growing political tensions between China and Australia as well as poor macroeconomic data in both Australia and China. China banned imports of red meat from four Australian abattoirs. Analysts speculated that the move was a response to Australia’s demands of inquiry into the handling of the coronavirus pandemic by China. With China being the major destination of Australian exports, the conflict … “Aussie Rebounds After Falling on Tensions Between China & Australia”

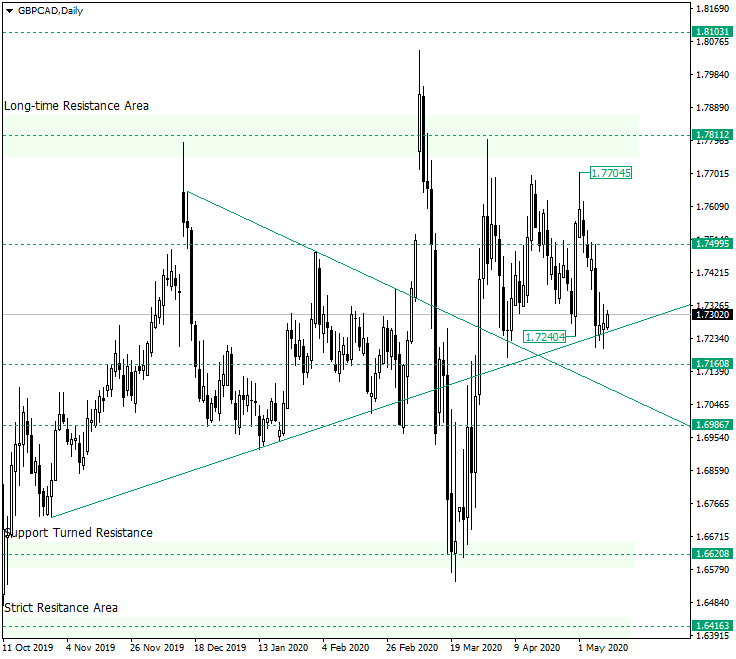

Bears Joining Forces on GBP/CAD to Send Price Under 1.7200?

The Great Britain pound versus the Canadian dollar currency pair is back at the ascending trendline. Could the bears spell further movement to the downside? Long-term perspective After the appreciation that started from 1.6620, the bulls met the long-time resistance area of 0.7811. The price retraced drastically from this area, ingraining a high that would serve as a reference point for the next — at least for now — two confirmations, and that matches to the 0.7700 psychological level — … “Bears Joining Forces on GBP/CAD to Send Price Under 1.7200?”