The US dollar is mixed against its G10 currency rivals on Thursday after new labor data suggests the pace of the historic layoffs in the aftermath of the coronavirus pandemic appear to have slowed down. All eyes will be on the Thursday jobs report, and analysts are anticipating 21 million lost jobs. Have investors already priced in a devastating reading into the broader financial markets? According to the Department of Labor, initial jobless claims … “US Dollar Mixed As Pace of Historic Layoffs Slows Down”

Month: May 2020

Australian Dollar Strongest After Australian & Chinese Trade Data

The Australian dollar rallied against all other most-traded currencies today after positive trade data released in China, Australia’s biggest trading partner, and Australia itself. Reports about the services sector were rather bad in both Australia and China but that did not prevent the Aussie from logging substantial gains. The Australian Industry Group Australian Performance of Services Index sank from 38.7 in March to 27.1 in April, seasonally … “Australian Dollar Strongest After Australian & Chinese Trade Data”

Euro Trades Sideways on Weak German Data, EU Differences

The euro today traded sideways against the US dollar amid weak macro reports from Germany and France as investors await crucial US jobs data. The EUR/USD currency pair today traded within a tight range following three daily pullbacks as divisions among EU nations persist. The EUR/USD currency pair today traded in a range marked by … “Euro Trades Sideways on Weak German Data, EU Differences”

Pound Spikes Higher on BoE Rate Decision, Retreats on Dovishness

The Sterling pound today spiked to new daily highs after the Bank of England announced its monetary policy decisions early in the London session. The GBP/USD currency pair later gave up most of its gains as investors digested the BoE’s seemingly dovish stance on the economy amid calls for more stimulus. The GBP/USD currency pair … “Pound Spikes Higher on BoE Rate Decision, Retreats on Dovishness”

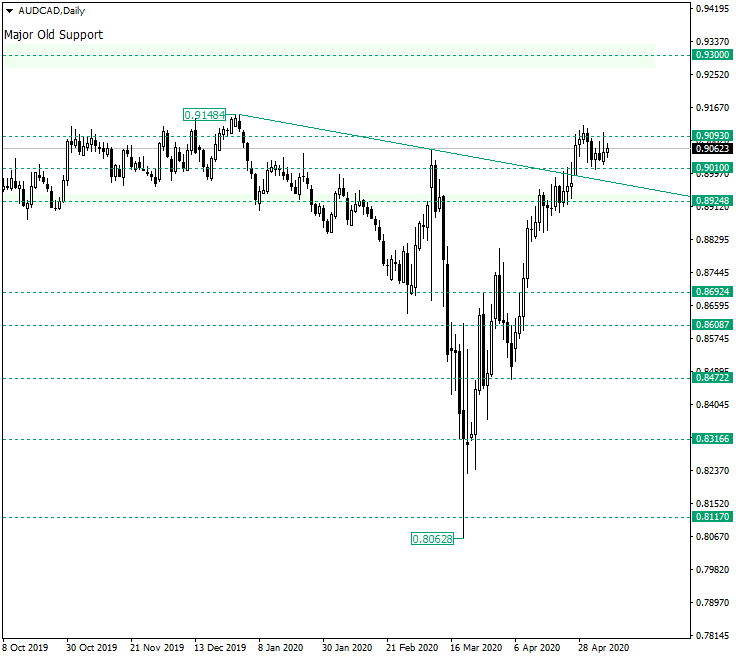

AUD/CAD Between 0.9093 and 0.9010

The Australian dollar versus the Canadian dollar currency is in a position from where it could go either up or down. Is there any hint on the direction? Long-term perspective The appreciation that started from the low of 0.8062, after the level of 0.8117 was confirmed as support, continued until it reached the double resistance area made possible by the level of 0.8924 and, more importantly, the trendline that starts from 0.9148. Once … “AUD/CAD Between 0.9093 and 0.9010”

Japanese Yen Rallies Against US Dollar on Safe Haven Flows

The Japanese yen today rallied against the US dollar driven by the risk-off market sentiment, which saw the yen benefit from safe-haven flows. The USD/JPY currency pair fell to new multi-week lows as the yen kept making gains against the greenback despite the DXY’s gains. The USD/JPY currency pair today fell from an opening high … “Japanese Yen Rallies Against US Dollar on Safe Haven Flows”

Chinese Yuan Slips on Reports US Considering Canceling Debt Owed to China

The Chinese yuan is weakening against its major currency competitors midweek on reports that the US administration is considering canceling all or part of the roughly $1.1 trillion debt owed to China. According to local reports, Beijing is now mulling over a plan that would reduce its holdings of Treasurys as part of overall efforts to diversify the nationâs foreign exchange reserves. The White House has blamed China for its mishandling … “Chinese Yuan Slips on Reports US Considering Canceling Debt Owed to China”

US Dollar Remains Strong Despite Worst Employment Drop in History

The US labor market lost the biggest amount of jobs in history last month. But the US dollar was hardly fazed by the disastrous data, remaining one of the strongest currencies on the Forex market during Wednesday’s trading. Automatic Data Processing released an employment report that showed an unprecedented drop of 20,236,000 from March to April on a seasonally adjusted basis. While the actual value was slightly better than the markets’ pessimistic expectations, it … “US Dollar Remains Strong Despite Worst Employment Drop in History”

Sterling Weakest After UK Construction PMI Sinks to Record Low

The Great Britain pound was the weakest currency on the Forex market during Wednesday’s trading. Initially, the euro was the second weakest but currently, the Canadian dollar replaced it, falling versus the shared European currency and trading about flat against the sterling. The drop of the UK construction index to the record low was among possible reasons for the slump of Britain’s currency. The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index … “Sterling Weakest After UK Construction PMI Sinks to Record Low”

Euro Among Weakest After Dire Macroeconomic Data

The euro was among the weakest currencies on the Forex market today after the release of a bunch of extremely poor macroeconomic reports and a very pessimistic economic forecast. While the currency has trimmed its losses by now, it is still trading lower against the vast majority of the most-traded currencies. The one exception was the Great Britain pound, which was even weaker than the euro. Eurostat reported that retail sales sank by 11.2% … “Euro Among Weakest After Dire Macroeconomic Data”