The New Zealand dollar attempted to rally today following a surprisingly positive employment report that showed that New Zealand unexpectedly added jobs last quarter. The currency has retreated against some of its rivals by now but managed to keep gains versus others. Statistics New Zealand reported that the number of employed New Zealanders increased by 0.7% in the March quarter, seasonally adjusted, versus expectations of a 0.2% decline. Year-on-year, … “NZ Dollar Attempts to Rise After Surprise Growth of Employment”

Month: May 2020

Australian Dollar Edges Higher After Positive Retail Sales

The Australian dollar rose a bit today following the release of a better-than-expected retail sales report. Gains were limited, though, as the market sentiment was mixed, failing to help the currency in finding direction. The Australian Bureau of Statistics reported that retail sales climbed by 8.5% in March on a seasonally adjusted basis. Market participants were expecting an increase at the same 8.2% rate as in the preliminary report. The sales were up 0.6% in the prior month. Yesterday, the Reserve … “Australian Dollar Edges Higher After Positive Retail Sales”

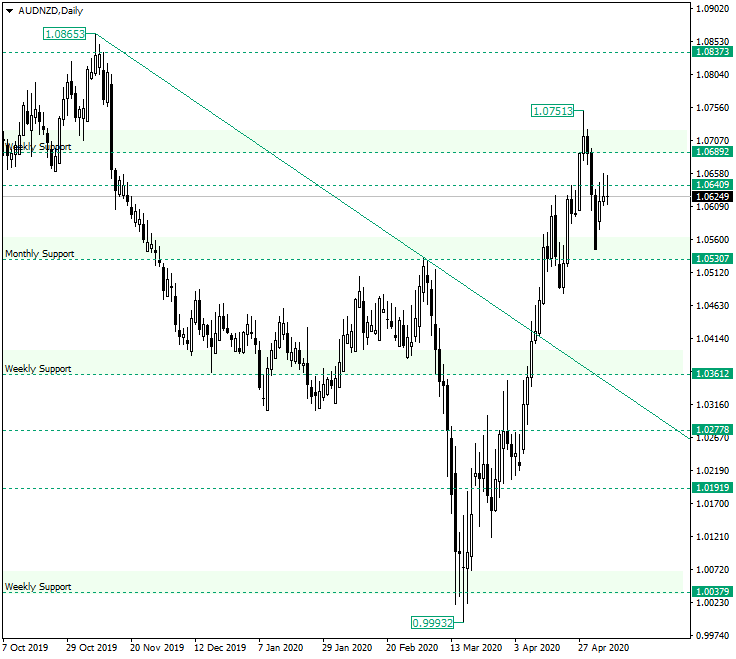

AUD/NZD at the 1.0640 Resistance

The Australian dollar versus the New Zealand dollar currency pair might be under bearish pressure. Long-term perspective The rally that started from the 0.9993 low after the weekly support level of 1.0037 was confirmed, extended until the high of 1.0751. But while approaching the old monthly and weekly supports of 1.0530 and 1.0689, respectively, the bulls began to lose momentum. This can be seen in the middle of April when the price oscillated … “AUD/NZD at the 1.0640 Resistance”

Swiss Franc Weakens As Manufacturing Slumps, Capped by SNB Intervention

The Swiss franc is weakening on Tuesday as the latest manufacturing figures highlighted an industry that is in a sharp decline. The franc’s slide was exacerbated by the central bankâs foreign exchange interventions to prevent currency appreciation. With Switzerland reopening in the aftermath of the coronavirus pandemic, could the economy rebound in the second half of 2020 and elevate the franc even more? The procure.ch manufacturing purchasing managersâ index (PMI) declined to 40.7 in April, … “Swiss Franc Weakens As Manufacturing Slumps, Capped by SNB Intervention”

US Dollar Weakens As Treasury to Borrow Record $3 Trillion in Q2

The US dollar is weakening against some of its G10 currency counterparts on Tuesday as the federal government announced that it would borrow $3 trillion in the second quarter. The US government has been going on a spending spree to contain the coronavirus pandemicâs economic fallout, making Washington poised for a $3.8 trillion deficit for the fiscal year 2020. The greenback is also getting a hit on disappointing economic data that continues to highlight the outbreakâs … “US Dollar Weakens As Treasury to Borrow Record $3 Trillion in Q2”

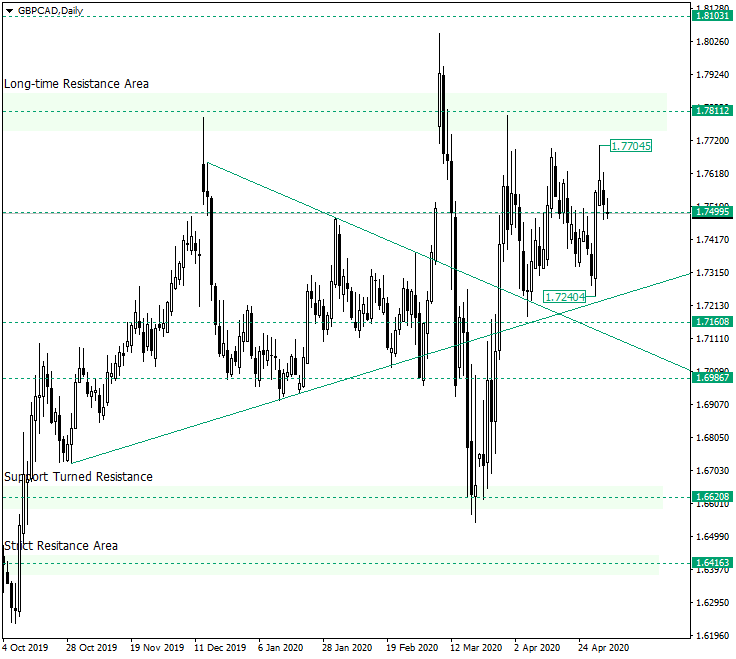

GBP/CAD, Retesting the 1.7500 Level?

The Great Britain pound versus the Canadian dollar seems to be a little undecided. Long-term perspective After confirming the important 1.6620 level, the price extended until the long-time resistance area of 1.7811. In doing so, it also pierced the intermediary level of 1.7499. But when meeting the resistance of 1.7811, the price retreated, falling around the triple support area defined by the two trendlines and the 1.7160 level. From the triple support, the bulls attempted, yet … “GBP/CAD, Retesting the 1.7500 Level?”

Euro Falls Against Strong Dollar Amid Rising Global Tensions

The euro today fell against the much stronger US dollar as tensions between China and the US skyrocketed, causing investors to seek refuge in safe-haven assets. The EUR/USD currency pair due to the prevailing risk-off market sentiment in the financial markets that saw European equity markets close lower for the day. The EUR/USD currency pair … “Euro Falls Against Strong Dollar Amid Rising Global Tensions”

Japanese Yen Holds Steady As Abe Extends State of Emergency

The Japanese yen is holding steady against its most traded currency rivals to start the week. After disappointing economic data and expanded monetary stimulus announcements last week, the yen is being largely driven by the governmentâs decision to extend the state of emergency for the rest of May. While Tokyo is bracing for a severe downturn, the tsunami of coronavirus cases has yet to occur. On Monday, Prime Minister Shinzo Abe extended the nationwide state … “Japanese Yen Holds Steady As Abe Extends State of Emergency”

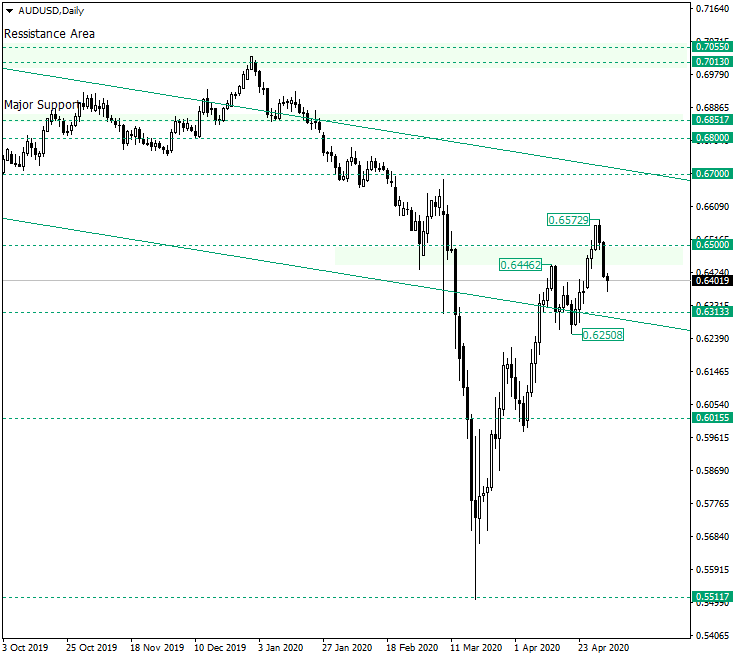

AUD/USD Has to Decide from 0.6500

The Australian dollar versus the US dollar currency pair is in a moment in which it has to decide where to go. Long-term perspective The appreciation from the 0.5517 support peaked at the 0.6572 high. By doing so, the swing that starts from 0.6250 extended and oscillated above the 0.6500 psychological level. However, the price quickly ebbed under the 0.6500 level. By doing so, the bears are sending the message that they are willing to join … “AUD/USD Has to Decide from 0.6500”

Chinese Yuan Slides to One-Month Low on Manufacturing, Trump Trade Threats

The Chinese yuan fell to a one-month low against the US dollar to close out the trading week, driven mostly by sluggish manufacturing and renewed trade threats by the White House. Now that China has hit the reboot button on the economy, could Beijing contend with another trade spat with the US? Chinaâs manufacturing industry has been the hardest hit in the domestic market due to slowing export demand. Despite factories resuming production … “Chinese Yuan Slides to One-Month Low on Manufacturing, Trump Trade Threats”