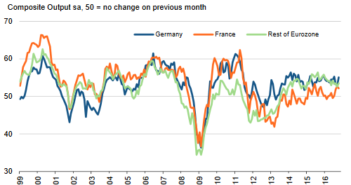

Flash PMI data released last week from IHS Markit suggested that economic recovery in the euro area strengthened in October, largely due to the increase in the manufacturing sector. The Purchase Managers Index (PMI) released by IHS Markit showed the composite output index rising to 52.7 in October, marking a 10-month high and follows up … “German growth leads Eurozone expansion; manufacturing outperforms services”

Category: Opinions

USD/CAD: Trading the Canadian GDP

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Tuesday at 12:30 … “USD/CAD: Trading the Canadian GDP”

USD: How Much Is A Fed Repricing Worth? How To

The US dollar took a hit on the FBI Effect but seems to recover. What’s next? With the Fed set to hike again at the December meeting, we look at the impact a repricing of the rates curve would have on the broad USD. Our estimates suggest that if the market prices in a pace of … “USD: How Much Is A Fed Repricing Worth? How To”

EUR: 3 Things To Expect From The ECB On 8

Draghi decided to keep us in suspense towards the December decision. What can we expect from the high stakes event? Here is the view from Goldman Sachs: Here is their view, courtesy of eFXnews: What we expect from the ECB to announce on 8 December? 1- The ‘stock effect’: QE extended by 9 months, from March … “EUR: 3 Things To Expect From The ECB On 8”

GBP: Pause For A Breath Warranted; Where To Target? –

The pressure on the pound continued for another week, but maybe we could have a pause now. BOE Governor Mark Carney is set to stay in his post and there are also other reasons for a sterling stabilization. Here is the view from ANZ: Here is their view, courtesy of eFXnews: On a trade weighted basis, … “GBP: Pause For A Breath Warranted; Where To Target? –”

EUR/USD: Staying Short: 4 Macro Reasons Plus Technicals –

EUR/USD managed to stabilize itself on higher ground after mixed data but the pressure persists. Here is the view from Credit Suisse: Here is their view, courtesy of eFXnews: We lower our 3m EURUSD forecast to 1.05 from 1.10. Rationale: 1. Relative monetary policy: The 20 October ECB meeting was interpreted as leaving open room for continued … “EUR/USD: Staying Short: 4 Macro Reasons Plus Technicals –”

EUR/USD: Trading the US Advance GDP

US Advance GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and publication of Advance GDP could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Here … “EUR/USD: Trading the US Advance GDP”

How Would A Trump Presidency Affect USDCNY?

Much has been made of the potential impact of the US elections on currencies such as MXN and CAD. However, the US elections have the potential to also be a major driver for CNY in the context of broader US -China trade relations. Should Democratic candidate Clinton win the Presidency, this is likely to maintain … “How Would A Trump Presidency Affect USDCNY?”

GDP Preview: A return to the New Normal or a

Growth has been poor, hovering just above 1% in recent quarters. Expectations are for a return to the new normal of around 2.5%. The USD has the necessary momentum to absorb also 2%, but any number under this level could push back a rate hike. Also, it could serve as ammunition for Trump, adding to … “GDP Preview: A return to the New Normal or a”

EUR/USD set to target 1.0615 – Credit Suisse

While EUR/USD continues recovering above 1.09, hopes are not so high. The team at Credit Suisse sees lower ground ahead: Here is their view, courtesy of eFXnews: EURUSD paused to catch its breath holding near the recent lows. This leaves the trend still directly lower to test price support next at 1.0826/22 ahead of the … “EUR/USD set to target 1.0615 – Credit Suisse”