Australian GDP is the primary gauge of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity. A reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at … “AUD/USD: Trading the Australian GDP Mar 2015”

Category: Opinions

USD/CAD: Trading the Canadian GDP Mar 2015

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity and a reading which is better than the market forecast is bullish for the Canadian dollar. Update: Canadian GDP rises 0.3% – USD/CAD falls Here are all the details, and 5 possible outcomes … “USD/CAD: Trading the Canadian GDP Mar 2015”

RBA set to move on rates tomorrow

The pressure is on for the Australian dollar tomorrow as analysts are dived over whether the Reserve Bank of Australia will cut interest rates again following on from the rate cut in February. The market is now pricing in around a 55% chance that he central bank will reduce rates tomorrow, up from around 38% … “RBA set to move on rates tomorrow”

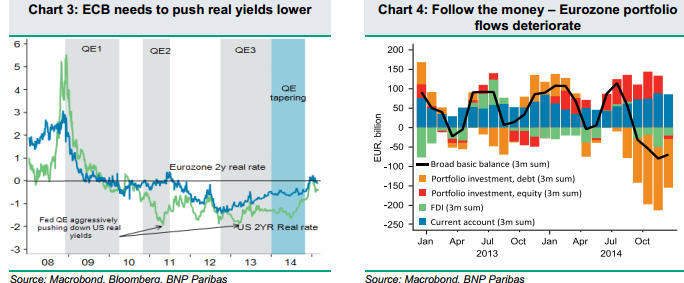

ECB QE: Go With The Flow & Sell The EUR – BNPP

The ECB is about to commence with its massive QE program. Is it already priced in or has the euro more room to run down? Vassili Serebriakov from BNP Paribas explains why the pair could further fall: Here is their view, courtesy of eFXnews: “As the ECB prepares to launch its full-scale QE programme next … “ECB QE: Go With The Flow & Sell The EUR – BNPP”

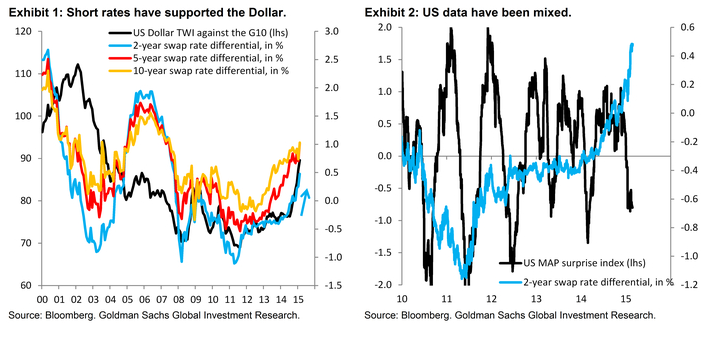

The Case For Cutting Our EUR/USD Forecasts – Goldman

EUR/USD has been stuck in range for quite a while, and fails to choose a new direction. How long will this last? The team at Goldman Sachs still sees a downwards move and goes further to cut forecasts to lower ground for the next 3,6 and 12 months. Here is their rationale and the chart: Here … “The Case For Cutting Our EUR/USD Forecasts – Goldman”

EUR/USD: Trading the Preliminary US GDP

US Preliminary GDP (also referred to as Second Release GDP) measures the growth of the economy. Analysts consider GDP one the most important indicators so the Preliminary GDP report can have a significant impact on the movement of EUR/USD. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and … “EUR/USD: Trading the Preliminary US GDP”

Yellen gave some food for USD bulls – June hike

The second part of Fed Chair Yellen’s testimony focused on regulatory questions, but there was an interesting monetary policy comment: Yellen sees inflation as falling lower before rising higher. This has implications on the rate hike. Here’s why. This comment reflects confidence that the fall in oil prices will only have a temporary effect on wider prices. More … “Yellen gave some food for USD bulls – June hike”

CNY devaluation would hit other Asian currencies hard

Could China’s CNY be the next domino to fall in the increasingly aggressive efforts by central banks to devalue their currencies? The People’s Bank of China holds considerable sway in the forex market and if it were to follow other Asian central banks an all out regional currency war could swiftly follow. The Eurozone, Japan … “CNY devaluation would hit other Asian currencies hard”

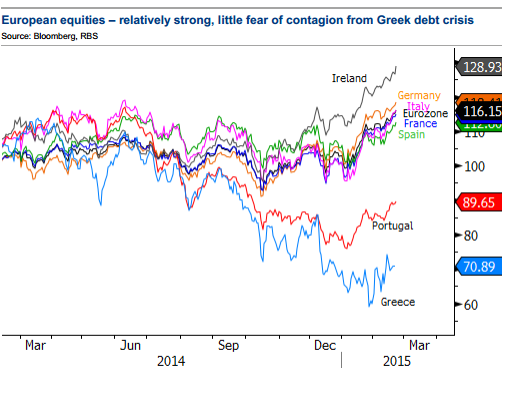

EUR Looking Heavy With General Bearish Price Action –

The euro is looking to recover on some positive news regarding Greece. However, this happiness may not last too long, says the team at RBS. Here is their rationale: Here is their view, courtesy of eFXnews: “Traders may have been reluctant to chase traditional growth currencies since they can see rate rises coming in the … “EUR Looking Heavy With General Bearish Price Action –”

AUD/USD: Trading the HSBC Chinese Flash PMI Feb 2015

The HSBC Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and … “AUD/USD: Trading the HSBC Chinese Flash PMI Feb 2015”