The Australian dollar demonstrated mixed performance today as economic data from Australia matched analysts’ predictions. The Aussie was flat against the US dollar, rose versus the euro and fell against the Japanese yen. Australia’s Producer Price Index and private sector credit were in line with expectations, giving no edge to the Australian currency. The Reserve Bank of Australia will hold a policy meeting next week, and there are plenty of speculations … “Aussie Mixed as Data Matches Expectations”

Month: January 2015

USD Down vs. JPY After Disappointing GDP, Strong vs. Other Majors

The US dollar went down against the Japanese yen today after a disappointing report about US economic growth. The currency was still able to gain on the euro and the Great Britain pound. The US economy grew just 2.6 percent in the fourth quarter of 2014 from a year ago, trailing the consensus analysts’ forecast of 3 percent. The growth was also slower than in the previous three months (5 percent). Not all news … “USD Down vs. JPY After Disappointing GDP, Strong vs. Other Majors”

New Lows for Canadian Dollar

The Canadian dollar sank to new multi-year lows against its US counterpart today due to negative economic data from Canada. While analysts expected poor performance from the Canadian economy, it fared even worse than forecasts. Canada’s gross domestic product fell 0.2 percent in November. The actual reading was even worse than the pessimistic forecast of a 0.1 percent decline. The report said that the economic slowdown … “New Lows for Canadian Dollar”

Bank of Russia Makes Surprise Interest Rate Cut, Ruble Sinks

The Russian ruble plunged today after the Bank of Russia made a surprise decision to cut its key interest rate. The cut was rather significant though not as big as the interest rate hike in December. The Russian central bank announced a reduction of its main interest rate from 17 percent to 15 percent. The bank explained its decision by “the shift in the balance of risks of accelerated consumer price growth and cooling economy”. The decision followed … “Bank of Russia Makes Surprise Interest Rate Cut, Ruble Sinks”

Fed rundown, GDP outlook, Greek elections analysis and AUD

The US returns to the limelight with the Fed decision and the first release of US GDP. What are the implications for the dollar? Before diving into this, we analyze the impact of the Greek elections for the euro in the short and long terms. And AUD is also on the agenda with a possible rate cut … “Fed rundown, GDP outlook, Greek elections analysis and AUD”

GBP/USD Declines Further, Remains Vulnerable

GBPUSD: With GBP extending its weakness on Thursday, further downside pressure is likely. On the downside, support lies at the 1.4950 level where a break if seen will aim at the 1.4900 level. A break of here will turn attention to the 1.4850 level. Further down, support lies at the 1.4800 level. Its daily RSI … “GBP/USD Declines Further, Remains Vulnerable”

Yen Stable Despite Poor Economic Data from Japan

The Japanese yen was stable at the early Friday’s trading even though macroeconomic reports from Japan were far from being good for the most part. The currency demonstrated losses against other majors during the previous trading session. The majority of Japan’s economic indicators were bad including the falling household spending and the slowing inflation. While industrial production expanded, the growth was smaller than economists predicted. The only really good … “Yen Stable Despite Poor Economic Data from Japan”

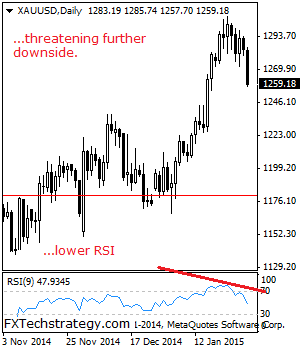

GOLD: Declines On Price Sell Off

GOLD: With GOLD selling off sharply during Thursday trading session, further downside pressure is expected in the days ahead. On the downside, support comes in at the 1,250.00 level where a break will aim at the 1,230.00 level. Below here if seen could trigger further downside towards the 1,200.00 level where a break will aim … “GOLD: Declines On Price Sell Off”

Reasons for Decline of Canadian Dollar to Fresh Lows

The Canadian dollar dropped to the fresh lows against its US peer during the Thursday’s session and also fell against some other majors including the euro. The currency has plenty of reasons for its weakness, both domestic and global. The major reason for the loonie’s weakness is the strength of the greenback after yesterday’s monetary policy announcement from the Federal Reserve. While US policy makers still talked about patience in approach to monetary tightening, … “Reasons for Decline of Canadian Dollar to Fresh Lows”

Did the Fed hint about a strong GDP report?

Recent indicators about the US economy were not too good. Most recently, durable goods orders for December badly disappointed and included downwards revisions for November. However, the FOMC statement did see a solid economy and even a strong jobs market. No word about falling wages – a figure combining both the Fed’s mandates for jobs and inflation. … “Did the Fed hint about a strong GDP report?”