As many others and we have been calling for long days, FXCM joins the list of brokers forgiving negative balances following the SNBomb. While it is not forgiving all traders and not in all jurisdictions , the 10% of the remainder belongs to the institutional, high net worth and experienced traders according to the firm. Perhaps FXCM understood … “FXCM to forgive most clients with negative balances –”

Month: January 2015

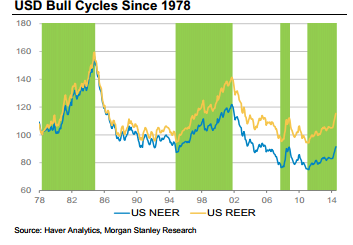

USD Pullback An Attractive Long-Term Buy – Credit Suisse

The recent setback for the US dollar may be temporary, and just an opportunity to pile up on more USD longs. What do you think? The team at Credit Suisse do not see the Fed making a big enough change to change the course of the greenback: Here is their view, courtesy of eFXnews: “…From a … “USD Pullback An Attractive Long-Term Buy – Credit Suisse”

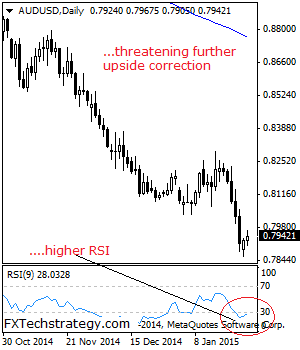

AUDUSD: Maintains Corrective Bias

AUDUSD: With AUDUSD turning higher on Monday and following through higher on Tuesday, it now faces the risk of further upside in the days ahead. On the downside, support resides at the 0.7850 level where a breach will aim at the 0.7800 level. Below that level will set the stage for a run at the … “AUDUSD: Maintains Corrective Bias”

USD Super Cycle Intact; Sell EUR/USD Rebounds targeting 1.09

The US dollar took a hit on the weak durable goods orders numbers, and could not recover on strong numbers from new home sales and consumer confidence. However, the team at Morgan Stanley sees the super cycle of the strengthening dollar intact, and suggests selling rebounds on EUR/USD: Here is their view, courtesy of eFXnews: Past USD … “USD Super Cycle Intact; Sell EUR/USD Rebounds targeting 1.09”

Attend the Traders Expo New York

Forex Crunch invites you to attend the only event that gives retail traders hands-on access to the very same tools, technology, and ideas as the best and brightest traders in the world—The Traders Expo New York! More than 30 hours of firsthand mentoring direct from 70+ elite traders is just a slice of what’s happening February … “Attend the Traders Expo New York”

Pound Drops After GDP Disappoints, Resilient vs. Dollar

The Great Britain pound fell against some of its major counterparts today as economic growth of the United Kingdom disappointed market participants. Surprisingly enough, the sterling was able to gain on the US dollar. The Office for National Statistics reported that UK gross domestic product rose 0.5 percent in the fourth quarter of 2014 from the previous three months. The growth was below the market expectations of 0.6 percent and previous quarter’s expansion by 0.7 … “Pound Drops After GDP Disappoints, Resilient vs. Dollar”

Swiss Franc Rebounds After Drop on Intervention Speculations

The Swiss franc dipped earlier today on speculations that the Swiss National Bank will intervene to bring the exchange rate down. The currency bounced later and trades above the opening level against the US dollar as of now. There were rumors that the SNB may intervene to lower the value of the Swissie, though there were no confirmation from central bank’s officials. The franc jumped sharply after the SNB shocked the market by unexpectedly dropping … “Swiss Franc Rebounds After Drop on Intervention Speculations”

Greenback Continues to Pull Back

Greenback is pulling back against its major counterparts today, heading lower with some correction in the market. Also sending the dollar lower are expectations that the recent dollar bubble might burst. US dollar has been strong for quite some time, and, in reality, the dollar is still fairly strong. However, the greenback is losing some ground against its major counterparts today. Dollar is … “Greenback Continues to Pull Back”

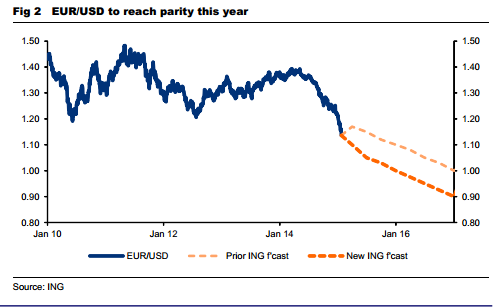

EUR/USD set for parity at year end, 0.90 at end

Euro/dollar enjoyed some stabilization after the big falls. Was the fall exaggerated or is it set to continue? The team at ING explain why the fall is justified and set new targets for the each of the following quarters: Here is their view, courtesy of eFXnews: EUR/USD is currently suffering a discrete adjustment on the larger-than-expected … “EUR/USD set for parity at year end, 0.90 at end”

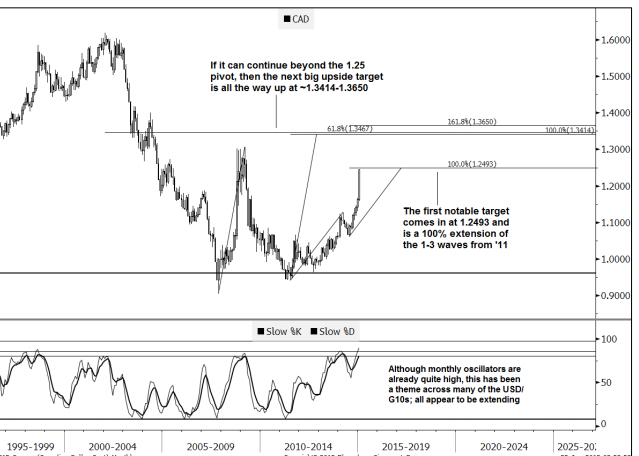

EUR/USD: Momentum Loss?; USD/CAD: 1.25 Breakout? – Goldman Sachs

EUR/USD dropped quite a lot and already reached a first major target. Can it continue lower? It faces significant support. Also the Canadian dollar lost a lot of ground against the greenback. 1.25 could be the floodgate line to the next higher levels on USD/CAD. Here is their view, courtesy of eFXnews: EUR/USD has now … “EUR/USD: Momentum Loss?; USD/CAD: 1.25 Breakout? – Goldman Sachs”