Many things have changed in 2020 – but talking directly about the exchange rate tends to have an adverse effect on it. Will European Central Bank President Christine Lagarde complain about the euro’s recent strength? That is an open question heading into the Frankfurt-based institution’s last decision of the year.

EUR/USD longs may have gone too far for Lagarde

Euro/dollar has changed from a tightly-traded currency pair to a boasting a big breakout, hitting the highest levels seen in 32 months. While this development excites traders, it undermines the ECB’s efforts to reach its sole target of 2% or close to 2% annual inflation per year. A dearer euro pushes prices of imported goods lower and also weakens the currency bloc’s economies by making exports less competitive.

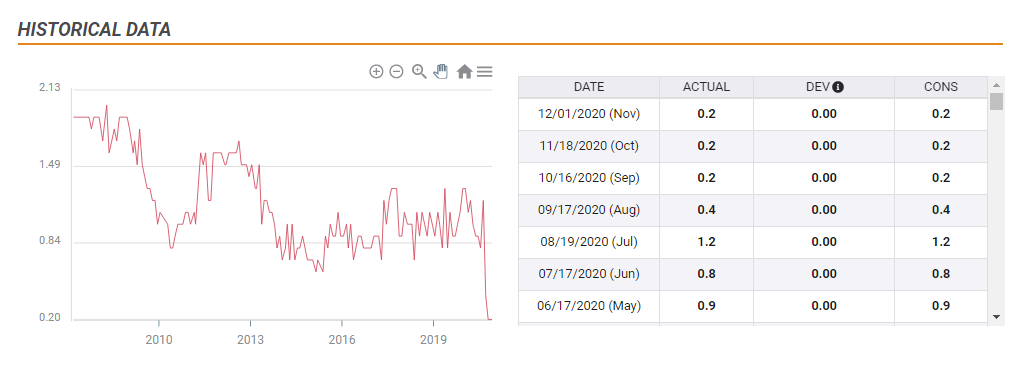

The Core Consumer Price Index has dropped to near-zero, showing that the pandemic depressed demand, and not only for volatile items such as energy.

Source: FXStreet

Lagarde may say something along the lines of “we are closely monitoring the exchange rate” to express the Governing Council’s dissatisfaction with the recent rise. While the ECB sticks to its message of not targeting the euro’s value, any hint would indicate policy may take the currency into account.

The bank may take one step further and open the door to further rate cuts. Its deposit rate already stands at -0.50%, deep in negative territory, and it may hint at pushing it further down to -0.60% if needed. While setting sub-zero borrowing costs has arguably done little to boost the eurozone economy, it played a major role in depressing the euro.

More QE is euro-positive but priced in

One thing that coronavirus undoubtedly changed is the reaction to bond-buying schemes. With the exception of the dollar, currencies responded positively to central banks’ money-printing – contrary to pre-pandemic logic. Instead of seeing creating money out of thin air as an act of devaluation, markets cheered governments’ lower borrowing costs and the ability to further boost their economies.

The expected expansion of the ECB’s Pandemic Emergency Purchase Program (PEPP) was supposed to be the focus of the December 10 meeting – until the recent rise in the exchange rate. This scheme consists of looser rules regarding bond purchases, allowing for more flexibility, and currently stands at around €1.35 trillion.

Expectations stand at an additional €500 billion and an extension of PEPP beyond June 2021. The bank is also likely to expand its Targeted Long-Term Refinancing Operation (TLTRO) programs, which facilitate bank lending, and usually have little effect on markets.

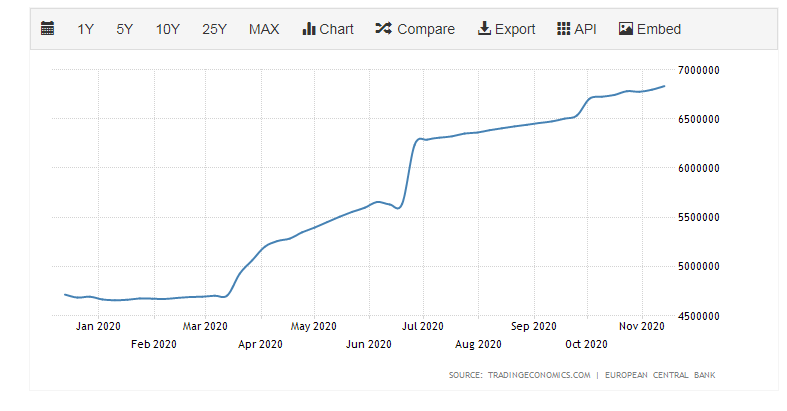

The ECB has substantially enlarged its balance sheet in 2020:

Source: Trading Economics

Apart from the recent jump in EUR/USD, the impact of an additional €500 billion is mostly priced in. It would probably take Lagarde and her colleagues to announce €700 billion or more in additional bond buys to excite investors. With the prospects of an upcoming vaccine, the hawks in Frankfurt may object to a generous outpour of money.

Conclusion

The ECB is set to add more stimulus via an expansion of some €500 billion in its bond-buying scheme but that is already priced in. For the euro to rise, the move would probably need to be larger. EUR/USD has room to fall if Lagarde warns about the exchange rate and especially if she hints at cutting rates.

More EUR/USD Forecast: Three reasons for the massive breakout and big levels to watch

Get the 5 most predictable currency pairs

ECB Preview: More money but no honey, Lagarde may lower the euro if she wants to