The days are shorter and the data is worsening – yet the Bank of Canada may see the glass half full and potentially boost the loonie with reasons to be cheerful ahead of Christmas. Economists broadly expect the Ottawa-based institution to leave its interest rate unchanged at the December 9 meeting, yet the statement may move markets.

The most recent data points have been downbeat. Gross Domestic Product rose by 40.5% annualized in the third quarter – a historic leap, but below estimates for a bounce of 47.6%. The recovery from the worst of the coronavirus crisis has been slower than anticipated in the three months ending in September, ahead of the winter wave.

However, the BOC may point out several encouraging factors.

Five reasons for optimism

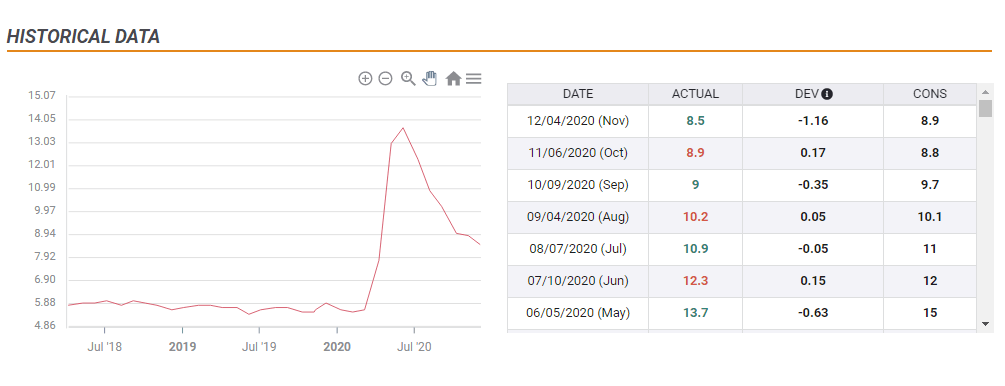

1) Falling unemployment: Canada’s labor market has bounced back, with November’s reading showing a jobless rate of 8.5%, better than expected, and a substantial climb down from the peak of 13.7% in May. Job creation, buoyed by the government, has been robust.

Source: FXStreet

2( Covid under control

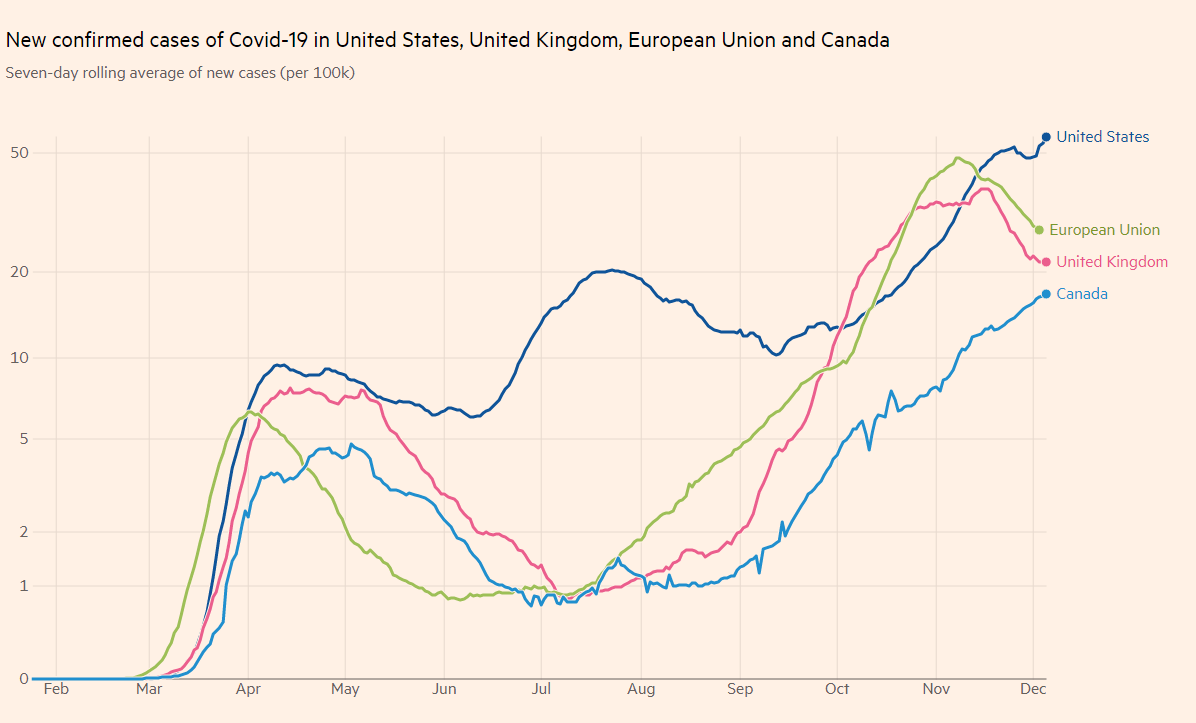

Canadian COVID-19 statistics are rising like in other northern hemisphere countries, but the nation is doing better than many, especially the US. While demand from its southern neighbor is critical for Canada, the relative reining-in of the disease may convince the BOC that internal demand remains robust.

Source: FT

3) Vaccine optimism: Similar to other policymakers, Bank of Canada Tiff Mckelm and his colleagues will likely see through the current hardship and toward the upcoming deployment of vaccines in the upcoming weeks and months. The statement will likely reflect his “light at the end fo the tunnel.”

4) Oil prices rising: Back to Canada-specific development, oil prices are on the rise, hitting their highest since early March. Crude recently climbed in response to the extension of production cuts by OPEC+ members, making Alberta’s output more profitable. That could also encourage policymakers.

5) Fiscal policy remains expansionary: Prime Minister Justin Trudeau’s government continues stimulating the economy, paying no heed to deficits. Chrystia Freeland, Canada’s Finance Minister said that the plans to boost the economy will include jobs targets. Contrary to the US, the central bank is not the only game in town.

All in all, there are good reasons for the BOC to convey an upbeat message about the economy moving forward rather than focusing on the negatives in the present.

USD/CAD reaction

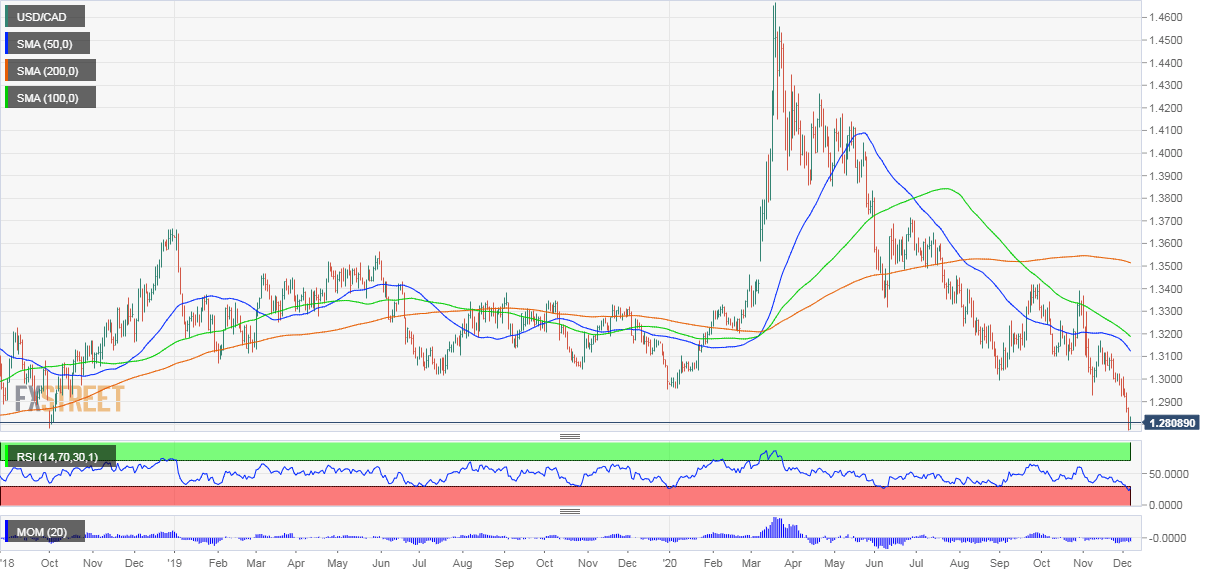

If Macklem indeed opts for a glass-half-full, the Canadian dollar may surge and USD/CAD could extend its decline from the highs. The currency pair’s moves have US dollar declines across the board.

Conversely, a more cautious approach could trigger a short-squeeze in Dollar/CAD, allowing for an upside correction before another probable move lower.

At the time of writing, USD/CAD has already bounced after a quick decline, but the Relative Strength Index on the daily chart is still around the 30 level – the limit separating normal and oversold conditions.

Conclusion

All in all, the BOC is set to leave rates unchanged and is more likely than not to project optimism in its last meeting of the year, triggering another drop in USD/CAD.

Get the 5 most predictable currency pairs

Why the BOC could send CAD higher, despite downbeat data